The house is nick-named “Casa Sombrero” because of its big sheltering roof.

It is on a corner lot in the Corazon de Jesus neighborhood, just north of downtown Puerto Armuelles. The house sits about 100 meters from the beach. While not as windy as a beachfront lot, there is still a good breeze when the onshore winds blow on warm afternoons.

The original footprint of this humble concrete block house was 30'x 22' with two notches removed. Total floor area was about 600 square feet. It had 2 bedrooms, 1 bath, kitchen, and dining/living area.

As you can see by the photos of the original house, it was very basic house indeed. Just a concrete block cottage, with a tin roof, and very few, small window openings that were filled with ventilated cement blocks. Not surprisingly, the original house was hot and stuffy.

Our redesign, in collaboration with a local Panamanian architect, maintains the 2 bedroom, 1 bath of the original small house, but adds an additional 1500 square feet of breezy covered porch space, enclosed by ornamental ironwork.

The open plan is intended to permit the ample porch areas of the house to serve as the primary day use areas. So that most of the events of daytime domestic life can take place within earshot of the sounds of ocean waves and the songbirds of Panama.

The original spaces have solid concrete block walls and large window openings.

This entire original area could be used as an “air conditioned zone.” Or, a smaller area, say just the bedrooms or bedroom, office and bathroom could be air conditioned by a single air conditioner.

The large outdoor porch/living area makes the house much more integrated into the outdoor environment. It is quite comfortable and dramatically reduces the energy requirement of running lots of air conditioning units. If the house had been redesigned as a typical northern home, extensive air conditionally would be required for most expats.

In the first phase of remodeling, we cut numerous new window openings, and enlarged the existing openings.

We also demolished a wall that had divided the kitchen and the dining area into 2 separate spaces.

Since the spaces were so tight, we thought that one big open plan for kitchen/dining /living was better than several smaller spaces. We added ironwork to the window openings, both for security and to give a sense of “completion” and enclosure.

Next, we asked our contractor to build a colonnade around the perimeter of the existing structure. This created wide porches on all sides of the house.

At its widest the porch is nearly 13 feet, and its narrowest about 7 feet. On top of these columns, spaced 9 feet apart, the contractor poured a concrete beam with gently radiused connections at the tops of the columns.

This is a look that we find quite pleasant, and which is quite common in Puerto Armuelles. Bluntly put, it is sort of a “poor man’s Spanish colonial”. It has the old world arches, but lacks the two-foot thick stone walls of Old Spain.

The house was rented to a Panamanian man in this Phase 1 condition for a couple of years. The man lived in the house, rent free, in exchange for maintaining the garden.

The truth is that up until a couple of years ago the real estate market in Puerto Armuelles was not as fast as the rest of Panama. Now our market has definitely begun to pick up. In fact, there were 2 families who were interested in buying Casa Sombrero at the same moment. We ended up selling it to a couple from British Columbia and their four young children.

The new owners appear to be very comfortable building their own homes, which they have done before in British Columbia, including a home on the Queen Charlotte islands.

They hired our general contractor to raise the walls of the existing structure, pour a floor, and to install a new roof. From here, the client is going to take over as his own contractor, and supervise all of the ongoing finishes.

While this Canadian family works on their new home, they are staying in our house in Las Palmas. Since they have young

children, we offered them our house, so that they would have a “gentle landing” into their new life in the tropics. They are apparently quite capable, bilingual, and it appears that they are enjoying a successful remodel.

As you can see from the photos, the roof is on. The owner is working on site every day alongside the Panamanian contractor, and the project is advancing well. The new owner says that he hopes his family can move into their new home by Christmas.

Of course, not all of our clients are interested in, or capable of, being their own building contractor.

For this reason, we offer the option of having one of our Living In Panama House built for them, using the services of one of our licensed Panamanian contractors. We always oversee all our remodeling or Living In Panama House projects.

If have built or remodeled a home in Panama, please share your experiences in the comments below.

Recently, we have talked with a number of people who are interested in building tiny homes in Panama. If you have experience with tiny homes or if you would like to share any techniques for building in the tropics, please add them in comments.

Thank you.

We were all hanging out in hammocks and chairs under the large rancho at our hotel in Pedasi.

They spoke flawless English with the perfect American accent all the Panamanian elites seem to speak with.

We immediately hailed the man pushing the La Italiana ice cream cart. He served ice cream on a stick (paletas in Spanish).

They were right, La Italiana ice cream is excellent. Far superior to any other cart vendor we had tried. Remember, we were traveling with a 5 year old so we had been trying all the ice cream vendors we saw.

In the Chiriqui province, most of the La Italiana ice cream peddlers are Ngobe Bugle indians. I am not sure why, but given the prejudice against Indians here, I imagine it is because it is not a high paying gig.

At the time (about 10 years ago), you could only get La Italiana ice cream from one of these hand carts. You will still see them being pushed down streets all over Panama. But not often enough.

Thankfully, there is at least one La Italiana ice cream store now. It is in David next to El Campion. El Campion is just a few blocks from David's parque central. Luckily, El Campion is very big and recognizable so you can easily spy it. At the La Italiana store you can not only get their usual paletas, but scoops of ice cream as well.

I'm not sure La Italiana is the best ice cream in Panama anymore. Its competition grows steadily.

A month before we had our first paleta from La Italiana, we enjoyed a scoop from what I think was Panama's first gelato ice cream store. It was in the Casco Antiguo neighborhood of Panama City. Now there are gelato stores popping up all over the place: Boquete, Paso Canoas and more.

However, I think that La Italiana is still the best ice cream on a stick in Panama.

Our favorites are the chocolate (think fudgicles) and strawberry paletas.

What are your favorite La Italiana flavors?

Please comment below.

[leadplayer_vid id="582B4F5476ACD"]

Click to get more details about this Puerto Armuelles beach front house for sale.

We are always happy to answer any questions you may have, just shoot us an email, or give us a call.

You can read what I said in the video below.

Video Transcription

Hi, I’m Betsy from Living In Panama

I want to let you know about a very affordable beach front house we have for sale

It is only $87,500.

It is on a beautiful beach

The lot is ample at 6100 sq. feet.

The house is 1350 sq. feet. It has 2 bedrooms, 1 bath

It needs some remodeling, although you can move in as is.

All utilities are set up and functioning.

The metal roof does need some immediate repair.

It is in the charming beach town of Puerto Armuelles.

Which is located right on the Pacific Ocean in the popular Chiriqui Province.

It really is an ample lot, with a nice house, on a beautiful beach for a very affordable price.

If you have any questions, please click the link below to find out more and to contact us by phone or email.

Thanks for watching

I'm not saying that internet in Panama will not be without its frustrations. It may stop for no apparent reason, you may pull your hair out while talking to, or trying to talk to, customer service, and then of course, the internet may be working fine, but you wouldn't know it because the electricity it out.

However, as you'd imagine, I use the internet all the time in Panama. Overall, while it is not lightening fast, it is more than adequate.

If you are in or near a city or town, it will be fairly easy to get internet. The more remote your location the harder it will be.

In the more developed parts of the country, like Panama City area, Colon and David, you will find high speed (for Panama) broadband cable internet and DSL.

In undeveloped, or older areas, then most likely you will be left with DSL as your fastest option. DSL can be fast, but its speed can fluctuate. In remote areas, the only option is satellite internet. Satellite internet can be very fast, but is more expensive.

At one time, the only Internet provider was Cable & Wireless. But since 2003 when the government opened up telecommunications to competition there have been a growing number of providers.

I asked a friend of ours to share her experiences with various internet companies in Panama. Specifically, in Puerto Armuelles, Panama. She has tried a few providers, while I have only used Cable & Wireless.

Our friend prefers to stay anonymous. I have edited her words slightly for clarity and added sub-headers.

Here is her experience with Internet in Panama.

I have used several Internet providers during my time in Puerto Armuelles.

Internet Activo

Currently I have Internet Activo and have been very satisfied with them and their service.

The only down side is they currently do not offer automatic deduction from a credit card for payment. So, I pay them every three months when I go to David. The other option would be to pay at one of the two banks where they offer a payment service of making the deposit and then providing proof of deposit.(Both banks are in Bugaba. But if I drive that far, I don’t see any sense in not just making a David run of it)

Planet Telecom

Planet Telecom was a personal nightmare for me on so many levels. They promised installation and equipment in a week – it took a month. I was at Andrea’s (an Internet place in downtown Puerto) for hours every day. (They knew not to set the timer on my computer!!) That was a pain because at the time I did not have my truck here.

When I was building my house, I wanted Plant Telecome to pre-wire my house. They sent someone out, finally, to do the pre-wiring. Because I had made an inquiry about the possibility of TV, as well as internet, they just assumed I wanted TV and installed that wiring as well.

I was charged for both the internet wiring and the TV wiring, as well as the travel and time to do the installation. The reality was that they were doing such a poor job that my worker, Jonathan, actually ran the wires! That is when I decided I would no longer do business with Planet Telecom!

Fidanque

I moved into my house and initially had Internet a company that is now called Fidanque. They were very good until they weren’t. I did like that they would automatically deduct the payment from the credit card I provided.

When they started the road expansion project, my Internet service was completely disrupted. I believe it was from interference from all the communications systems the road workers were using. At any rate they never could get the whole signal thing worked out so I had to move on.

Internet Activo (again)

Enter Internet Activo. They had no qualms about putting up an antenna that was high enough to block out the interference from the lower level interference. They are courteous, prompt, speak English and understand my payment schedule. I have been asking them to open a small account at Banco National, but so far no luck. I will ask them again when I go make the next 3 month payment. For some reason they believe that there is a $10,000.00 fee to set up automatic deductions from credit cards. There very well may be; I simply have no expertise in that area.

Cable Onda

Cable Onda has an excellent product and I had them for about a minute. (I still have their equipment on my roof).

The guy who signed me up spoke English. The guys who installed did not. After about a week, when I ran into a signal issue, I was dead in the water. No one anywhere in the company could speak English.

Right now, I am waiting for Cable Onda to finish laying all their fiber optic cable and will then I will switch over to them for phone and internet. They do have the best price – about $23.00 for 3meg of internet. Don’t know what it will be with telephone, but don’t think it will be that much more. They started marking their presence with a “deal” on satellite TV (all the blue dishes) so they would have some sort of customer base when they get the fiber optics done.

Cable & Wireless

Cable and Wireless has recently been bought out by someone else. They are unable to deliver 3 meg to Corazon de Jesus even though they say they can when they sign you up (enough theys for ya). Alexandra has them at her house – phone and internet – and the service is reasonably reliable. When there is an issue the repair guy is fairly prompt. They do have English speakers in their call center now so that does help with problems.

Internet Sticks or Dongle

I even tried one of those dongles and it was OK for checking email, but only while I was in the rental house. It never did work once I moved into my house.

(Note: you can buy these internet sticks, or traveling hotspots, from most internet and cell phone providers such as Claro and Movistar. They cost about $15 and the speed is slow. They can be useful for checking email and such in places without any internet.)

That is my Internet saga.

In another post, I (Betsy) will share my Cable & Wireless saga.

In May 2016, Cable & Wireless was purchased by Liberty Global. Hopefully, it will improve. Liberty Global is an American company, is in 30 countries and is the world's largest international TV and broadband company.

Here are some things to think about before choosing an Internet provider.

I would take their answers to these questions with a grain of salt, but it could give you a good indication of what it will be like to deal with them.

Important: Remember to check your Internet speed to ensure you are not paying for more than you are getting. Immediately downgrade so that you are paying for the speed you are getting, not the speed they promise you will get.

Updated March 16, 2017

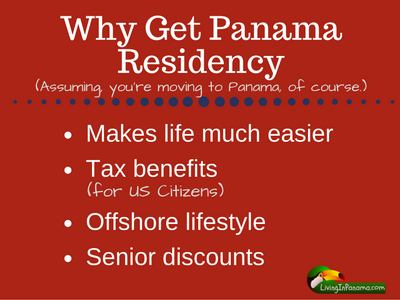

Americans may have more reasons to get a Panama residency than other foreigners, but every nationality benefits. (Scroll down for 3 American specific reasons)

As I said, a cedula is a Panama ID card. You can only apply for a cedula, after you become a Panama resident.

A cedula is forever. It is a document with a number specific to you. Like your social security number, it never changes.

Without a cedula, anything you do: getting a bank account, electricity, buying land, or even registering your car is done using your passport number. Unfortunately, every time you renew your passport you get a new passport number as well. Changing the passport number you have associated with almost everything in Panama is a nightmare and takes time.

More Cedula Perks

Get even more details about Panama cedulas in one of my older posts.

If you’re an American, you may have even more reasons to want be a Panama resident.

3 Reasons To Consider

Learn more about 4 types of Panama Residency Visas on my site.

March 2017 UPDATE: New Tourist visa rules make it impossible to be a Permanent Tourist in Panama. You must leave the country for at least 30 days before you can get another tourist visa.

Until March 6, 2017, many people lived in Panama as tourists for many years. But no longer!

You will need many documents to get residency: an FBI report, finger prints, birth certificates, medical examination reports, affidavits and more. It all must be certified, authenticated, notarized, stamped and gathered together and submitted, in person, in your presence. And some of those documents, like your FBI report, can expire and need to be done again if too much time passes before you are able to submit it.

There are 8 or 9 Panama residence visas. As I mention above, I have written about the 4 most common types of Panama residency visas.

You may want to hold off on getting your residency visa until you are sure you want to live in Panama on a long-term basis. The tourist visa gives you 180 days to check out Panama as you decide if it is a good fit.

Please let us know if we forgot to mention some of the benefits of having residency. Please comment below.

Given that, I was surprised that one of my favorite things to do as we traveled around Panama was to stop by construction sites and talk with other builders. I had fled the hustle and bustle of the building trade in Seattle only to discover, once again, how much I enjoy the fundamental beauty of human “dwellings” and how they are built. Apparently I made a good choice when I chose to become a designer/builder.

It doesn’t take long for one builder, chatting with another builder, in a new area, before the conversation winds its way around to the cost of materials, the cost of labor, the cost of land, to arrive at the potential profitability of being a builder in this new location.

Although I always prided myself on being more of an artisan design/builder than just a financially-motivated contractor, the profit potential in Panama is very seductive.

Early in our Panama travels we met a young builder and his girlfriend at Playa Cambutal. Playa Cambutal is out on the Azuero Peninsula, past Pedasi and Tonosi. They were both surfers and they loved this beautiful surf spot. The young man had borrowed $30,000 (as I recall) from his father who was a realtor somewhere in California. With this money, he and his girlfriend were able to buy a number of oceanfront farms, totaling over 2 miles of beachfront. Amazing!

We all know stories like this, and at first glance, one might say, “Wow! You guys are lucky. I guess we got here too late.” I remember my Dad telling stories about the farm he could have bought in Northern Virginia, a farm that later became Tyson’s Corner Mall.

There have always been great deals. And there will always be great deals. And we are all going to die some day. We still see amazing land deals in Panama.

About 10 years ago we spent some time investigating Pedasi and Tonosi, and other nearby locations. Yes, we discovered some amazing land deals. However, we decided that we were not interested in living so remotely, so far from services. And we had no interest in traveling to check in on any land we would buy in such a remote location.

This young couple (above) explained to us that they had to spend several hours, twice a week, driving to a small town, about 40 miles away, to do their basic shopping. For our own family, spending so many hours on the road, just sitting in the car, and burning gasoline, would not have fit our desired lifestyle. This was the in-the-car lifestyle we were trying to avoid by moving from Seattle. So we left the Azuero Peninsula and chose to live and invest in Puerto Armuelles. If you have read our site much, you will know we are very happy with our decision.

When I am asked if there are any “deals” left in Puerto Armuelles, I have to chuckle.

In truth, the big speculator class of investors arrived in Puerto 12 or 13 years ago. We got here 3 years after the miles of beachfront were sold to speculators from out of town. These same early investors continue to sit on some of the largest tracts of beachfront property in our area. I have no idea how they spend their days. But I am sure that they hardly ever think about our little beach town, unless they are looking at their investment portfolios.

A couple of these “big fish” are now offering schematic drawings of their future plans for these properties, but they haven't started to build yet. Or seemingly will in the near future. Meanwhile, a smaller class of builders, folks like us, is beginning to develop and build.

Yes, there are deals still to be had here. But you will not find the best deals advertised on the internet. You will find them by being here in Puerto.

You need to look around. Decide on your favorite locations and start talking with people. You will start to hear about some stellar deals.

For instance, if you shop, you can still pick up a house, a block from the water, for only $11,000 and a buildable lot for as low as 3 to $5,000.

Puerto Armuelles is a beach town of 25,000 residents, give or take.

It has many good properties and existing buildings, that with a skillful touch can still be resold for a substantial profit.

We want to encourage designers and builders to come check out Puerto Armuelles. To discover if there are any potential projects that suit them in our town. If so, not only will you have a great project, but you can step out of the stressful lifestyle of being a builder, contractor, or designer up north.

If you have experience in alternative energy housing, cooling, and transportation, even better. That is an untapped market here.

There is plenty of room for competitors in our market. Puerto Armuelles does have a few good builders, but we definitely need more motivated and skilled investor builders to provide housing for the growing influx of expat retirees. More good builders will just bring a greater diversity of expats and Panamanians to enjoy the lifestyle that Puerto has to offer.

Small-scale projects are definitely in demand. We recently sold a couple of our own projects. We did not make ten, or even five times our initial investment, but we have done well enough to carry us forward. Plus we have had a good family adventure and enjoyed our time doing it. And we have also slowly evolved our guiding design principles for building in our area. We are eager to continue to buy, to build and to sell.

We are excited by the uptick in the housing sales market. This enables us and others to design and build in a manner that inspires us, and that we think will be useful to new expat residents of Puerto Armuelles.

Our friend Victor describes life in Puerto Armuelles as being similar to that of Hawaii, or Southern California of 50 years ago.

You may find Puerto Armuelles is a more relaxed, and probably a more profitable building environment. And you won't have the stiff competition from other builders.

The broadest market niche by far available to expats in the construction field is that of “investor/builder”. You don't need a work permit to work on your own property, even if your intent is to sell it.

However, for the last few years, Panama has made getting a work permit much easier. This is especially true if you obtain the easy-to-get, Friendly Nations visa. That permanent resident visa was designed as a stepping stone to a work permit.

If you are a builder looking for a change in lifestyle, we invite you to check out our town.

For the builder who loves a beach town lifestyle, I would say that Puerto Armuelles is similar to Puerto Vallarta 50 years ago. It is a relaxed, maritime environment. And it probably won’t be like this forever.

Related Reading

You may be interested in reading my articles about building. I have given my 2 cents on

We have also written about these related items:

You have 30 days to return the course for a full refund.

The Pimsleur website offers their courses both digitally and on CDs. They offer 50 languages, including Spanish, of course.

On Amazon, Pimsleur has a rating of 4.5 stars. 209 reviews. So that sounds good.

You can see the Amazon reviews here.

In general, the reviews seem to say that the course is good, especially for those who want to listen while in the car. However, the consensus seems to be that Pimsleur Spanish is too formal and the vocabulary limited.

I have not used Pimsleur myself, so I cannot tell you what it is like. Some readers have asked me about it though. So when I got an email from them announcing the sale, I thought I'd pass the news along.

You can also find Pimsleur used CDs on Amazon as well.

I still enjoy the Rocket Language Spanish course. You can find out more by reading my review of Rocket Language.

Which Spanish language course is your favorite? Please comment below.

Note: if you buy a language course using my links, I will make a little money. It won't increase your cost at all. If you are thinking of buying a course, I'd love it if you'd do so using my links. Thanks.

This means I filed my 2015 taxes only a week ago. As I did them, it reminded me of how taxes are both the same and different for Americans abroad.

Taxes are something you should think about before you buy or sell international real estate, no matter what your home country. However, I can only speak to the impact on Americans.

If you are an American thinking about investing in Panama or other international real estate, you should know how it will impact your taxes "back home".

If you are a US citizen, the IRS requires you to pay taxes whenever you sell offshore real estate.

Actually, you are required to pay U.S. taxes on any and all of your worldwide income, which includes all passive and investment income. For Americans, income is taxable as earned, no matter where you reside.

Offshore real estate is taxed at the same tax rates, the same allowable deductions for expenses, and the same available credits. The only exception is in how depreciation is handled.

Keep in mind, active investors, real estate professionals, and those who buy using a retirement account are exceptions to this rule.

I will describe how various overseas transactions can impact your US taxes below. (For purposes of this post, I will assume a US long term capital gain rate of 20%.)

The only deduction available for passive income (such as real estate) is the foreign tax credit. The purpose of this deduction is to eliminate double taxation on investment income. Don't get too excited about this deduction, it in no way allows you to pay less in total taxes (US and foreign country taxes combined).

The IRS allows you to deduct or take a dollar-for-dollar credit for any taxes paid to a foreign country. In practice, this never works out perfectly, but it does eliminate most double taxes. How much you can deduct depends upon the tax rate of the country your land is located. Here are some examples.

Capital gains tax of 33% (Columbia)

Say you bought a property in Medellin, Colombia in 2005 for $100,000. In 2013, you received an offer you couldn’t refuse for $150,000, giving you a capital gain of $50,000. The capital gains tax rate in Colombia is 33%, so you pay $16,500 to Colombia.

Since Columbia's rate (33%) is so much higher than the US (20%), you wouldn't owe any tax to the US. In this case, you would report the sale on Schedule D of your US personal return and deduct or take a credit for the $16,500 you paid to Columbia on Form 1116. This would allow you to pay $0 to the IRS.

Capital gains tax of 10% (Panama)

Now let’s say you sell a property in Panama. Panama's capital gains are taxed at 10%. In this case, you will pay 10% to Panama and 10% to the United States, to arrive at the US's 20% rate for long term capital gains.

Capital gains tax of 0% (Costa Rica)

If you had this same transaction in Argentina, Ecuador or Costa Rica, where real estate sales are not taxed, you would pay the full 20% capital gains tax to the IRS.

Important Note: When deciding in which country to buy real estate, that country’s capital gains rate only comes in to play if it exceeds the US rate. If a country’s capital gains rate is 0% to 20%, you will pay 20% in total. If a country’s rate is more than 20%, then only the excess should be considered in your decision. For example, Columbia's higher tax rate of 33%, means you will pay more (13%) in capital gains tax than if that property was in Panama or Costa Rica.

Caution, while you may think you are saving money by buying and selling land in Costa Rica because they have no capital gains tax, it might not be the case. Costa Rica and other such countries have other taxes and duties to make up for their zero capital gains rate. Taxes which might not be deductible on your US return. In most cases, you are better off buying property in a country whose tax system is similar to the United States.

The Foreign Earned Income Exclusion (FEIE) does not affect your U.S. tax bracket, nor does it reduce your adjusted gross income amount, which is used in calculating your capital gains rate.

For example, a husband and wife who qualify for a FEIE with individual salaries of $100,800 in 2015 will pay $0 U.S. Federal Income tax on their salaries. However, their adjusted gross income for determining capital gains rates will be $217,200. This means that their long term capital gains will be taxed at the blended 18.8% rate.

This also means that every dollar earned in excess of the FEIE is taxed at the 28% or 33% tax rate. Keep in mind, your tax rate does not start from zero after taking the FEIE consideration. Also FEIE does not apply to retirement or other investment income.

Note: to qualify for the FEIE you must either pass the IRS's physical presence test or the residence test. The physical requires that you are out of the United States for 330 out of any 365 day period. The residence test is more complicated, but in general it requires your intent to move to another country and that you are in the US for no more than 3 to 4 months a year.

The exception to the same tax rate rule above is offshore real estate held in an IRA. By purchasing offshore real estate in your retirement account, you can defer or eliminate US tax on both rental profits and capital gains.

If the country where your property is located doesn’t tax the sale, then you just might avoid the tax man all together. If the country taxes you at a relatively low rate, such as Panama at 10%, this might be the only tax you pay (ie. the IRA cut your total tax bill by half with this exception).

Let me explain: If you move your IRA or other type of retirement account away from your current custodian and into an Offshore LLC, you can invest that account in foreign real estate. The LLC is owned by your retirement account and holds investments on behalf of that account. You buy the rental property in the name of the LLC, pay operating expenses from the LLC, and profits flow back in to the LLC and into your retirement account.

This only applies to investment rental real estate and not property you personally occupy. If you later decide to live in the property, the funds must first be distributed out of the retirement account and any applicable taxes paid.

If you wish to purchase offshore real estate with funds from your IRA and a non-recourse loan, or you are in the active business of real estate, you can add a specially structured offshore corporation to eliminate US tax.

If you buy real estate with an IRA in the United States, you get the joy of paying tax on the gain attributed to the money you borrow (the mortgage). If 50% of the purchase price comes from your 401-K and 50% from a loan, half of the rental profits and half of the gain is taxable, with the other half flowing in to your retirement account.

Take this same transaction offshore and no US tax is due. Tax free leverage in a retirement account is one of the great offshore loopholes. This is often called using a self-directed IRA.

Owners of rental real estate in the United States can use accelerated depreciation to deduct the value of property over 27.5 years. However, if the property is offshore, a straight-line depreciation must be used over 40 years. The straight-line method gives you less bang for your depreciation buck.

This means that on a $100,000 rental property, your annual depreciation deduction would be about $3,636 for a US property vs. $2,500 for a foreign property. So you would pay a premium of $1,136 on the overseas property.

It may sound like an issue, but it isn't necessarily. A straight-line depreciation can also save you money. Accelerated depreciation is great if you plan to hold the property for about 20 years. However, if you plan on buying, improving and selling over a short period (a few years), then accelerated depreciation will cost you money, not save you money.

This is because depreciation is “recaptured” when you sell the property. Every dollar you were allowed to deduct over the years must now be paid back. It is added to your basis, and taxed at 25% rather than 20%. So, as a rough example, if you have a gain of $50,000 and took depreciation of $20,000, you owe tax at 20% of $50,000 for $10,000 plus 25% of $20,000 for $5,000. Therefore, you total tax due is $15,000.

The more depreciation you take, the more you must repay. If you hold a property for many years, taking a deduction today, and paying it back in the distant future, is a benefit. If you will sell the property in 3 or 5 years, taking the deduction now, and paying an additional 5% in tax later, is of little to no benefit.

People can be shocked at the size of their tax bills from the sale of a rental property. They had planned for a 15% rate (the previous long term rate), and ended up at 20% + recapture. In States like California, where values property values have gone down, it is possible to sell a rental at a loss and still have a big time tax bill from recapture.

This might lead some to think a good strategy is to not take depreciation, especially on property you plan to flip ASAP. Well, the IRS has a surprise for you: The tax law requires depreciation recapture to be calculated on depreciation that was “allowed or allowable” (Internal Revenue Code section 1250(b)(3)). This means you will pay tax on depreciation whether you take it or not.

All of this is to say that not being allowed accelerated depreciation on offshore real estate might be a good thing.

As I said to begin this article, all of the same US tax rules apply to offshore real estate that apply to onshore properties. This holds true for the primary residence exclusion. If you qualify, you can exclude up to $250,000 single or $500,000 married filing joint, from the sale of your primary residence.

To qualify, you must own and occupy the home as your principal residence for at least two years before you sell it. Your “home” can be a house, apartment, condominium, stock-cooperative, or mobile home fixed to land anywhere in the world.

Tax Tip: You can take the $250,000/$500,000 exclusion any number of times. But you may not use it more than once every two years.

Have you owned and been renting out a property in Panama for a few years? You might consider kicking out those renters, moving to Panama, and occupying the property for two years before you sell.

Did you convert a home from your primary residence to a rental property? The rule is that you must have lived in the property for 2 of the last 5 years to qualify for the exclusion. Therefore, you can live in it for two years, rent it out for up to 3 years, and then sell and get the full exclusion.

To get the $500,000 exclusion, both a husband and wife must live in the home as their primary residence. It is possible for one spouse to qualify while the other does not. For example, husband is living in the United States and visiting his wife and family in Panama. On a joint return, only the wife may take the exclusion for $250,000 when they sell the home in Panama.

You don’t need to spend every minute in your home for it to be your principal residence. Short absences are permitted—for example, you can take a two month vacation and count that time as use. However, long absences are not permitted. For example, a professor who is away from home for a whole year while on sabbatical cannot count that year as use for purposes of the exclusion.

You can only have one principal residence at a time. If you have a home in California and a condo in Panama, the property you use the majority of the time during the year will be your principal residence for that year. So, it would be possible for Panama to be your primary resident for one year and California to be your primary residence the next. Before you sell, make sure you have spent at least 2 of the last 5 years in the property.

Because you get the “benefit” of all US tax rules when it comes to offshore real estate, you can use like-kind exchanges (also called a Section 1031 exchange) to defer US tax. The only caveat is that you can’t exchange US property for foreign property – it must be a foreign property for foreign property transfer.

In a like-kind exchange, you defer paying taxes by swapping your property for a similar property owned by someone else. The property you receive is treated as if it were a continuation of the property you gave up. The benefit is that you defer paying taxes on any profit you would have received.

You may only exchange property for other similar property, called like-kind property by the IRS. Like-kind properties must have the same nature or character, even if they differ in grade or quality. All real estate owned for investment or business use in the United States is considered to be like kind with all other such real estate in the United States, no matter the type or location. For example, an apartment building in New York is like-kind to an office building in California.

All real estate owned for investment or business use outside of the United States is considered to be like kind with all other such real estate outside of the United States. Therefore, you can exchange an office building in Panama City, Panama for an apartment building in Medellin, Colombia. You may not exchange a property in Panama with a property in New York.

Combo Deal: Yes, you can combine a 1031 exchange with the $250,000 primary residence exclusion. To qualify for both, you must hold the property for more than five years and live in it for at least two of those five years. Then, you can use the exclusion to reduce or eliminate the capital gains, including tax carry-over from a like-kind exchange.

Rental income and expense from offshore real estate is reported on your personal return, Schedule E, just as a US rental property would be. You must keep rental records, including all expenses from management, improvements, repairs, and taxes paid. You must follow all US tax rules for these deductions and expenses, such as depreciating improvements and deducting repairs.

The IRS has a right to audit your offshore real estate, so be ready. It may be common to pay your bills in cash in Colombia, but you will have a tough time deducting any expenses without a receipt and proof of payment (such as a cancelled check).

An area of emphasis in an audit of offshore real estate is travel and other expenses associated with visiting the property. If you are flying to Panama five times a year, hanging out for a week, and then expensing these trips against your one rental unit on Schedule E, the deduction will not survive an audit. On the other hand, you most likely can expense one trip a year, more if you have a large portfolio overseas.

When reporting your rental property, remember to take depreciation. As stated above, the only difference in offshore real estate is the allowed depreciation method. You must utilize straight-line depreciation over 40 years.

Your offshore real estate may come with a number of new US tax forms to file. It is important you file them or you may face substantial penalties if you are caught. These penalties are aimed at Americans hiding money offshore, but they could ensnare you as well.

FBAR

The most critical offshore tax form is the Report of Foreign Bank and Financial Accounts, Form TD F 90-22.1, referred to as the FBAR. Anyone who is a signor or beneficial owner of a foreign bank or brokerage account (or combination of accounts) with a value of more than $10,000 must disclose their account(s) to the U.S. Treasury.

On your tax return you will be asked if you have such an account. The question is answered with a simple yes or no. But that is not the end of it.

You must also remember to send in the separate FBAR form. But you don't send it to the IRS, you send it to the US Treasury Department. Oddly it is due, or was due, on June 30th. No extensions.

New FBAR Due Dates

However, for calendar year 2016 and beyond, the due date is April 15th, with an automatic extension of 2 months for US citizens living abroad. Also an extension is now available, which moves the FBAR due date to October 15th.

I can see myself taking that extension. It is so much easier to do all the forms at once, and not have staggered due dates.

Other Required IRS Forms

Other tax forms may be required if you hold your property in a foreign corporation, LLC, Panamanian foundation, or international trust.

Offshore Real Estate Professional Benefits & Definition

If you are living and working abroad and in the business of real estate, you can realize some great tax benefits. The following section is for those who spend a significant amount of time and effort working their offshore properties, and not those with only one or two apartment units.

The typical investor in offshore real estate may only deduct his losses against other passive income. If you do not have any other passive income, losses are carried forward until you can use them.

An exception to this rule applies to a) active participants and b) material participants in the management of offshore real estate.

As an active participant in offshore real estate, you can deduct up to $25,000 of passive losses against other income (like wages, self-employment, interest, and dividends) on your US tax return. This allowance is phased out on a 50% ratio if your adjusted gross income is $100,000 or more.

If you are a material participant in offshore real estate, you are much more involved and in control than an active participant. As a material participant (sometimes referred to as a real estate professional), you are in the active business of real estate and may deduct your expenses against any and all of your other income, without limitation or AGI phase-out.

It is relatively easy to qualify as an active participant. It is far more challenging to be classified as a material participant in offshore real estate. If you can meet the criterion, you will find that there are major international tax breaks and loopholes available to the real estate professional.

NOTE: The major benefit of being offshore and material participant / real estate professional is that you may draw a salary from an offshore corporation and qualify for the Foreign Earned Income Exclusion. This tax break is only available to offshore professionals and not those living or working in the United States.

In order to materially participate in offshore real estate, you should be living and working abroad. It would be near impossible to qualify as materially involved in properties in Colombia while living Texas. Therefore, you should also plan to qualify for the Foreign Earned Income Exclusion (FEIE). When the FEIE is combined with an eligible offshore real estate business, you can take out up to $108,600 (in 2015) in salary from that enterprise free of Federal income tax and make use of a number of other tax mitigation strategies.

In other words, a qualified offshore real estate professional can deduct his or her expenses against all other income, regardless of source and without limitation based on his or her AGI, and draw out up to$108,600 in profits free of Federal income tax. If a husband and wife both qualify as material participants and for the FEIE, they can each take out a salary of$108,600, for a total of $217,200 of tax free money.

Again, to qualify for the FEIE, you must be out of the US for 330 out of 365 days or a resident of another country. If you are a resident of another country, preferably where your properties are located, then you can spend up to 4 months in the US each year.

If, after reading this, you realize you have not been filing the required FBAR, not done your taxes correctly (or at all); no worries. Just make sure you file before you are caught. The IRS has an amnesty program with no penalties if you voluntarily correct your past errors or omissions. But you have to do it before the IRS calls you out.

For most Americans, filing your US taxes while living overseas is no more difficult than it is if you live in the USA. However, there are some loopholes, exclusions, tax accounting, and tax forms you should be aware of as an American living abroad, especially when it comes to offshore real estate.

NOTE: I don't know the ins and outs of US taxes as well as this post makes it sound. While I did draw on some of my own knowledge, the vast bulk of this tax information comes directly from posts found on premieroffshore.com and greenbacktaxservices.com. And mostly from Christian Reeves, of premieroffshore.com, he really knows his stuff.

If you need any help setting up your business structure or with your US taxes I would give premieroffshore.com a shout. He offers a free and confidential consultation. (I am in no way affiliated with this company.)

.

Updated Dec 13, 2019

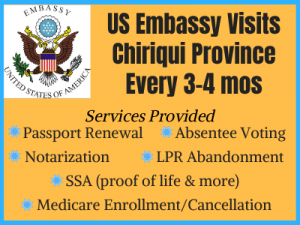

You can accomplish many tasks at one of these ACS travelling shows.

As I mentioned, the ACS visits David and/or Boquete every 3 to 4 months. If you are lucky, their visit will be in time to save you a trip to Panama City.

To find out when they will be in town, you can visit the embassy's website, email [email protected], or give them a call during their very limited phone-answering hours.

Unfortunately, the embassy doesn't set the date for ACS's visit to the Chiriqui province much in advance of it happening.

The ACS will only accept payment by local banker’s cashier check (known in Spanish as “Cheque Certificado”). That is, the check needs to be issued by a Panamanian bank. It must be made payable to “U.S. Embassy Panama” and have been issued within the past 5 months.

The ACS will NOT accept cash or credit card payments. The notarial fee is $50 per each signature of the Consular Officer.

Depending upon which ACS services you will be using, you will need to bring the following documents.

Passports: For adult passport renewals, in addition to the completed DS-82 application, provide one recent color photo with a white background that measures 5x5 cm (2X2 inches), your passport, and a photocopy of the photo page of your passport. The fee for an adult passport renewal is currently $110. If your previous passport was lost or stolen you will also need to bring a copy of the police report and the fee for the new passport is $135.

You will be happy to learn that you can complete adult passport renewals by mail (or Uno Express). You do not have to visit the embassy in person to renew.

For minor passport renewals, in addition to the completed DS-11 application, bring a copy of the photo page of the minor’s passport, a copy of both parents’ passports /cedulas, one recent color photo with a white background that measures 5x5 cm (2X2 inches) and a copy of the minor’s birth certificate, in addition to the original birth certificate and passport/ cedulas. The fee is currently $105.00 for a minor (under 16) passport renewal. The minor and both parents or guardians must appear in person. If only one parent is present in Panama, the “Statement of Consent from Absent Parent” Form DS-3053, notarized in the U.S., is required. Please note that the DS-3053 will not be accepted if notarized in Panama.

Notarizations: If you are requesting the notarization of your driver’s license, bring a photocopy of the front and back page of your license, as well as your license. If you are requesting notarization of benefits documents, bring the original and a copy of the document(s) showing the amount of benefits you receive monthly or annually. The notarial fee is $50.00 for each signature of the Consular Officer. Visit this US Embassy webpage to learn all the details regarding getting a document notarized there or at the visiting ACS unit.

Voting: You can submit your completed absentee ballot, no postage required, at the travelling ACS unit (or at the US Embassy in Panama City).

If you haven’t yet registered to vote or requested an absentee ballot, you can find out how to do those things by visiting the Federal Voting Assistance program's website. I also explain how US citizens can register and vote from Panama in this post: How To Vote in US Elections While In Panama.

LPR Abandonment: Bring completed form I-407 and a photocopy of your Permanent Resident Card, as well as your Permanent Resident Card. (Filling out this form means you decided to voluntarily abandon your status as a lawful permanent resident of the United States.)

The Embassy stresses that all your copies of the required documents, noted below, need to be legible.

SSA Proof of Life: If you are required to comply with this requirement, please bring your cedula or passport.

Medicare Enrollment/Cancellation: To enroll in Medicare, you should complete and sign form CMS 40B. To find out more about Medicare eligibility and how to cancel your participation, this US government Medicare page is a good place to start.

Social Security Replacement Card: Bring a copy of your valid U.S. passport and completed form SS-5FS.

Social Security Card for child under 12: Bring a copy of the U.S. passport for one of the parents, the child’s “copia integra” birth certificate, and the child’s U.S. passport (as well as copies) as well as completed form SS-5FS.

Change of Address for Social Security: Bring your current passport or cedula.

International Direct Deposit Enrollment: You should bring the necessary form and whatever other documents the form instructions requests. Before the ACS visit, e-mail the SSA Federal Benefits Unit ([email protected]) to request the enrollment form.

You can get more information on getting your Social Security checks directly deposited into your bank account (in the US or in Panama) on this US Embassy webpage.

If you live in Panama and have questions regarding Social Security, you must contact the SSA Federal Benefits Unit (FBU) located in Costa Rica. For more information on their services and how to contact them, please visit their webpage.

For comprehensive information on SSA’s services abroad, please visit SSA’s Service Around the World.

Also, I wrote a post about how to continue to receive SSA benefits while in Panama.