In Panama, most foreigners buy property with cash.

Of course, it isn’t usually a cold hard cash payment. Typically it is paid via a cashier’s check or a wire transfer from your bank account.

You don’t really want to pay with a suitcase full of cash, even if you could. It is always a good idea to have a paper trail of all payments made on a property.

There are two primary options for financing property in Panama.

I review those, and some less commonly used financing options, below

Some sellers (like us) offer to finance your purchase of their property. This way you can avoid dealing with a bank or mortgage company. It can be time-consuming for a foreigner to get a bank mortgage in Panama.

Seller financing is a good option for buyers who want to buy a home in Panama but need to sell their current home to pay for it.

In that case, a buyer may want to negotiate terms that include a small downpayment, payments until the house sells (say 3 years), and then a balloon payment at the end of the 3-year term. You can have your lawyer or agent help you with this if you would prefer.

This type of seller financing allows you to secure the property of your dreams and gives you plenty of time for the sale of your original home. If the original home sells earlier than expected, then you get to pay off the balance early. However, you need to ensure that the financing agreement includes a clause stating there is no penalty for early payoff.

For buyers, who have monthly income and some cash-on-hand, but not enough to pay for the property in full, they may ask to structure the financing to pay a larger downpayment of say 30 to 40%, then the remainder in monthly payments over 5 years or so.

Owner financing is a great option for potential buyers who know they want to purchase property in Panama but cannot pay for it fully upfront.

To discover our seller-financing terms, click here.

It is not an easy process to get a mortgage through a Panama bank. It is tedious. And it can take a long time, especially if you are an American.

If you plan to apply for a mortgage, allow for a good long wait before it is finalized and approved. You may get it quickly, although it isn’t likely. However, it will be a wonderful gift if it does happen fast.

The amount of documentation that is required will leave you flabbergasted. God forbid you forget to include a document when you submit your application. Your forgetfulness can bring the whole mortgage application process to a crawl.

Big Developments Can Be An Exception

The exception is if you are buying a property from a developer that already has a relationship with a bank.

These are usually large developments, especially the type that sell property in the pre-construction phase.

In those situations, your loan can be granted in a matter of days. But most property in Panama is not in that kind of development.

You do not have to be a resident to get a mortgage loan

But you do need to be under 75 years of age (see below for more).

In North America, qualifying for a loan is all about your credit history. However, in Panama the banks focus more on your ability to pay and the property’s loan to value ratio.

Because of this dual-focus, Panamanian banks require massive amounts of documentation.

Documents that:

Panama banks will only give loans on land that is:

The following are typical mortgage terms and requirements for foreigners.

I advise you ask multiple times about what documents are needed for your loan application. It is not unusual to submit your documents to the bank only to learn that they forgot to mention one or two other documents that you need to supply.

If you think you will be applying for a loan, you should bring some of these documents with you to Panama. Others you will gather in Panama. Most banks require them. Of course, every bank has slightly different requirements.

Plus Banks typically require all documents (like your bank statements) from other countries to be “authenticated” either through a Panamanian consulate or by “Apostille” which is a globally recognized type of a government certified authentication of public records.

Tip: Getting your documents apostilled is a better way to go than authenticated.

In addition, some banks require that you have a Panama bank account for at least 6 months before you can be given a mortgage.

If you are self-employed, you need to submit even more documents:

Once all the required documentation is in the bank’s hands, it goes to the bank’s credit committee.

The Committee has 14 days to analyze your loan application. Once approved, the buyer gets to review the terms.

If the buyer agrees to the loan, he signs it and returns it to the bank.

The bank then issues an irrevocable promissory letter for the approved loan amount.

The interest rates are generally in line with those offered in the USA. However, interest rates can vary depending upon:

Note, Interest rates are not credit-score driven. If approved for a loan, all non- residents qualify for the same interest rate.

Also, if you have a pensionado visa, you may be able to get a discount on your interest rate.

Panama has a law to help first time buyers, including foreigners, of new homes by subsidizing the mortgage interest rate. If you are looking to buy new titled construction priced between $35 to 120k (after the down payment), you might want to find out more about it.

Items to watch out for in the loan documents include:

How to Pay Less Interest

Here is a tip to help you pay less interest over the term of your loan.

Because of the difficulty in getting a traditional mortgage, many people, especially from the US, go an easier route. This can include developer financing, seller financing, paying cash, or borrowing against your retirement.

You can also get a loan directly with the developer of a property rather than the bank or mortgage company.

This is very common with pre-construction and during-construction developments.

It usually consists of small down payments, small monthly payments, and then a balloon payment once your property is complete.

If a bank is connected to the developer you are purchasing a property from, the loan can be pushed through within days, but only to buy that specific property.

In Central America, there are international banks that will provide mortgage financing for properties located in some other Central American countries.

If you plan to invest in Panama as well as in another Central American country, you may want to develop a relationship with one of these types of banks.

International banks such as Lloyds TSB International will often finance overseas properties in a range of countries. These larger banks will sometimes finance up to 70% of the value of the property.

Sometimes when you cannot get financing for a specific type of property from one sector of the banking community, another will find it more attractive.

List of Banks

Currently (in 2019), there are 67 banks (Regional, International & 2 State-owned) in Panama. Check out this list of Panama Banks maintained by Panamabank.info.

If you have an IRA at a traditional brokerage, you can roll it into a self-directed IRA. Self-directed or self-managed IRAs give you complete control over selecting and directing where to invest your IRA, including real estate.

This includes using your IRA to invest in overseas real estate.

However, this option is not for everyone. You need to be actively involved in managing your IRA and to learn the rules of the self-directed IRA. Also, depending upon how it is used, it may generate taxable income.

Want to learn more? Start by reading this 2019 Guide To Self-Directed IRAs by US News & World Report.

If you make your first investment a cash-flow property, you can use the proceeds to buy or finance future properties.

The CAP rate can be excellent. We know some people in Puerto Armuelles who pay rent of $500/month to an expat who had just bought the rental house for $50,000. You do the math. Even without looking at the CAP rate, the investor is making 12% a year plus appreciation.

Looking for more finance ideas? I brainstormed 18 ways to finance your Panama property. They might inspire even more ideas for your financial situation.

If you want to finance your Panama property, seller financing is the fastest and easiest to secure. However, as you read above, you have other options as well.

We are raising our property prices on March 16, 2019.

On average, our property prices will increase by 10%.

NOTE: Back in November, we posted about a property price increase to occur on January 15th.

However, we did not announce the January 15th price increase to our Newsletter subscribers until January 1st.

In response to our Newsletter subscribers, we have delayed the increase until March 16th.

Even with the price increase, we will continue to offer beautiful, high-quality properties - at some of the lowest prices around.

1. - For over a decade, property prices all over Panama have been going up.

Meanwhile, Puerto Armuelles, hidden away in the Northwest corner of Panama, has not seen those same price increases.

Puerto Armuelles is now hitting its stride to catch up with the rest of Panama. Consequently, real estate prices in Puerto are starting to go up.

2. - Property Upgrades. For over a decade, we have continued to make improvements to our properties. This means that we can offer you the best planned, best maintained, most attractive, properties in Puerto.

3. - Rising Costs. The cost of various types of permits, infrastructure, and maintenance has been going up.

4. - Buzz about Puerto Armuelles. For the past 2 decades, ever since Chiquita Banana pulled out, Puerto has been generally ignored. No longer. There has been a noticeable uptick of new people, esp. foreigners, spotted in Puerto Armuelles. This spike in interest goes beyond just visitors and retirees. There is also a significant push by Panamanians to develop more space for shops, restaurants, and offices.

5. - Puerto is getting more services. Renovations of existing services, as well as the construction of new public services, are at an all-time high in Puerto Armuelles. 4 significant civic projects are currently underway. (see below)

6. Arrival of Del Monte. Since Del Monte Foods arrived in Puerto Armuelles, about a year ago, there has been a big uptick in interest in our town, both by investors and prospective retirees.

Del Monte is a sign of better economic times to come. Not only will Del Monte's banana operations provide significant annual revenue to the city, but they will be cutting regular paychecks for many residents.

7. Return on investment looks very good. The Republic of Panama continues to attract investments from all over the world, particularly from China. More and more of that money is showing up in Puerto Armuelles.

It is clear that Puerto's dark ages, after the departure of Chiquita Banana, are in the past, and the "Puerto Armuelles' Renaissance" is moving forward full speed ahead.

We will make no official predictions, however, it would not surprise us if Puerto Armuelles provided retirees, investors, and 2nd home buyers with the biggest returns in all of Panama. Time will tell.

Have you been thinking about buying a property from us? Then take another hard look in the next 2 months, before the price increase - or before your lot is sold to someone else. Our real estate price increases go into effect on March 16, 2019.

If you have questions, please feel free to contact us.

Have you visited Puerto yet? Why not buy a ticket and come on down this year? Let us know you are coming and we will give you a tour.

You will never know if Puerto is right for you until you visit.

Do you currently have a property on Reserve? Or are you making payments on a property? In either case, these price changes obviously do not apply to you. However, they do indicate that you can easily sell your property for more than you paid for it.

Reserve one of our properties before March 16th, you will freeze the current price for 60 days.

Anyone else who wants to buy a property after March 16th, will have to pay more.

It is fast, easy, and inexpensive to reserve your property.

The reservation fee is only $1000, and it is credited toward the property purchase. The 60-day price freeze starts the day the hold fee is received.

Learn more about reserving a property here.

2018 has been a big year for Puerto Armuelles. And 2019 promises to be even bigger.

Here it is:

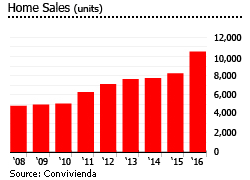

Foreign buyers are pushing up property prices in Panama. The average dwelling sales price surged by 21% from January 2015 to June 2017 in Panama's metropolitan area, according to the Panamanian Chamber of Construction (Capac) as reported by La Estrella de Panama.

Foreign buyers tend to be from the United States, Europe, Canada, and Latin America.

Yet at US$2,050 per square meter (sq. m.) in June 2017, the average price of residential properties in Panama still looks very reasonable, with metropolitan prices ranging widely from US$ 928 to US$ 2,892 per sq. m., according to Capac.

In Punta Pacifica, a collection of exclusive waterfront skyscrapers, high-end apartment prices are rising by 6% to 12% per annum, due to a shortage of available units. The average price in Punta Pacifica stood at around US$ 2,300 per sq. m. as end-2017.

Sales and construction were both up in 2017, says Maria Arias of TDI Real Estate. Arraiján and La Chorrera, where property prices start at around US$30,000, are specially active, due to infrastructure developments in Panama West and Panama East's constant growth.

It is a big turnaround. After the global financial crisis in 2008, Panama's dwelling prices declined by an average of 20% to 30%, according to Kent Davis of Panama Equity Real Estate.

Only after 2012 did foreign buyers return to the market.

Now it is the opposite story. Many infrastructure projects are approaching completion, and Panama's economy will continue to accelerate in 2018 and 2019.

Another boost to the market will be the new property tax law to be implemented from January 2019, which gives tax exemption to all primary residences worth more than US$ 120,000 (previously US$30,000), and generally reduces property tax rates.

Read about the new Panama property tax law

Tourist arrivals rose by 7.5% to about 2.5 million people in 2017, says the Panama Tourism Authority, with European visitors up 8.1% (though tourist spending only rose 3.8% to US$ 4.5 billion in 2017).

According to the Panama Tourism Authority, these numbers are expected to rise further since Air China now has direct flights to Panama. This will attract Chinese tourists.

Foreigners can own real properties in Panama, and are accorded with the same property rights as Panamanians. However, mortgages can be difficult to obtain, especially for foreigners, and the purchase process can take two to three months. More than 80% of real estate transactions involving foreign buyers are in cash.

Beach apartments are increasingly in demand by both local and foreign buyers. The most popular areas include Punta Chame, Playa Blanca, Farallon, El Palmar (Hato River), Santa Clara, and Rio Mar (San Carlos).

Demand is supported by a stronger mortgage market. "The improvement in conditions for residential mortgages in recent years has been the principal promoter for housing," says the Superintendencia de Bancos de Panamá. Residential mortgages granted rose 10.1% to PAB 14.08 billion (US$ 14.13 billion) in 2017, as low interest rates and higher average terms increased the purchasing power of families. The interest rate on housing loans was 5.5% in December 2017, unchanged from the same period last year.

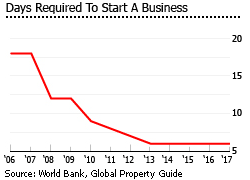

It requires only six days to start a business in Panama, according to the World Bank’s 2017 survey. Panama is the 2nd most competitive country in Latin America and the Caribbean, according to the World Economic Forum's Global Competitiveness Report 2017-2018.

Panama draws multinational companies and foreign investors with significant tax breaks, the free-trade zone, improved infrastructure, and a low cost of living. The expansion of the Panama Canal, which was opened in June 2016, is expected to bring in over US$2 billion in annual revenues by 2021.

“There are so many new businesses moving to Panama,” said Kent Davis of Panama Equity Real Estate. “It’s one of the reasons people are coming down – because there is still money to be made, locally, and as a regional base of operations.”

“People aren’t just moving here to relax,” Davis added. “They’re coming here to work because there is so much business around.”

Panama encourages foreign direct investment (FDI) in real estate by offering various incentives such as property tax exemptions, according to Jeff Barton of Punta Pacifica Realty.

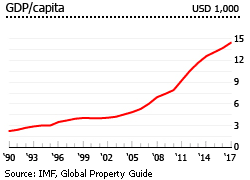

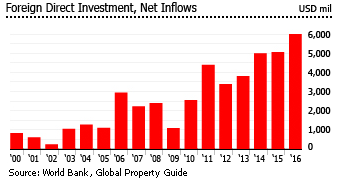

Panama has the highest foreign direct investment (FDI) share of GDP in Latin America, at more than 10% of GDP, according to a United Nations report. Panama is also the largest recipient of FDI in Central America, with 44% of 2016's regional FDI total of US$ 11.97 billion. In 2017, the country's FDI rose by about 1.8% to about US$ 5.319 billion from the previous year, according to the Comptroller General of the Republic of Panama.

"The international community recognizes that Panama is a stable democracy and it is the fastest-growing country in Latin America," said Economy and Finance Minister Dulcidio De La Guardia.

For what it is worth, International Living’s Global Retirement Index names Panama as one of the world’s best places to retire in 2018, due to its convenience (ease of access from US, currency in US dollars, English is widely understood), world-class amenities, good beaches, and affordability.

Panama has been removed from Financial Action Task Force's (FATF) "grey list", but money-laundering is still rampant.

In June 2014, Panama was placed on the "grey list" of Financial Action Task Force (FATF) of countries not doing enough to fight money laundering. FATF officially took Panama off its money laundering and terrorism financing watch list in February 2016, after new government regulations.

Despite this, money laundering and terrorist financing are believed still rampant in Panama. No real controls prevent funds moving through Panama to terrorist organizations, nor are do money laundering prosecutions actually take place. Moreover, Panama's powerful criminal syndicates remain fully operational.

In a recent report by the Latin America Financial Action Task Force (Grupo de Acción Financiera de Latinoamérica – GAFILAT), GAFILAT noted that the government's anti-laundering efforts are good, signalling progress in fighting money laundering. However, the report also pointed some deficiencies that the government must work on.

According to the GAFILAT report, the country was observed to be more susceptible to illicit streams of revenue from foreign sources than domestic ones. The GAFILAT enumerated the sectors of real estate, banking and corporate services, and free trade zones as the most vulnerable sectors to money laundering.

The task force also identified almost 730,000 businesses in the country that are considered at "high risk" of partaking in money laundering, during its investigation in May 2017.

Panama City is divided into two main areas – the old colonial town of Casco Viejo, and the modern business and shopping district of high-rise buildings and malls.

Panama's gross rental yields are still good, despite having declined over the past few years. Rental yields are range from 5.7% to 7.3%, with smaller apartments tending to yield more, based on the Global Property Guide research in November 2016.

Most properties in Panama City are apartments.

Based on the figures from Encuentra24, 2016 apartment prices in Panama City were:

Inland apartments ― ranging from US$ 1,900 per sq. m. to almost US$ 2,500 per sq. m.

Beachfront apartments ― ranging from US$ 1,800 per sq. m. to US$ 3,600 per sq. m.

Boquete, in Panama’s mountain highlands, has a fast growing expatriate community. The popular option here is to buy land and build a home, but there are many completed homes on offer.

Sample property prices for Boquete are as follows:

2-bedroom, 1-bathroom home, about 1,600 sq. ft. – US$90,000

3-bedroom, 2-bathroom home, about 1,500 sq. ft.– US$179,000

Another desirable location is Coronado, a popular beach town and relaxed community for expats, and only an hour from Panama City.

Sample property prices for Coronado are as follows:

3-bedroom, 2-bathroom home, about 1,300 sq. ft. – US$132,000

2-bedroom, 1-bathroom furnished condo, about 850 sq. ft. – US$135,000

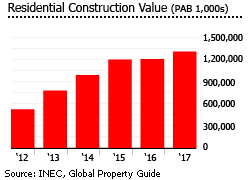

In 2017, the value of residential construction rose by 12.2% to PAB 1.29 billion (US$ 1.29 billion) from the previous year, when it rose by 0.6%m, after annual increases of 21.1% in 2015, 26.8% in 2014, and 48.8% in 2013, according to the Instituto National de Estadistica y Censo (INEC), all of which follows a decade of breakneck building which raised occupied housing units by 31.5% between 2000 and 2010, according to the National Censuses.

Total credits granted to the construction sector rose by 8.2% In 2017 to around PAB 6.74 billion (US$ 6.77 billion), according to Superintendencia de Bancos de Panamá.

"This increase is explained primarily by the behaviour of economic activities related to the external sector. Among them, those of the Panama Canal, air and financial services stand out positively," noted a recent report of the Comptroller General of the Republic.

The US$5.25 billion expansion of the Panama Canal, which began in 2007, has experienced delays and cost overruns amounting to US$1.6 billion. But the expansion, which started operations in June 2016, has doubled the Panama Canal's capacity, with wider and deeper lanes and locks, and a new lane of traffic allowing more and larger ships. This year's tonnage of 403.8 million Panama Canal tons (PC/UMS) was the highest in its history, and a 22.2% increase on last year.

"These record figures reflect.... the Panama Canal’s continued ability to transform the global economy and revitalize the maritime industry," says Panama Canal's administrator, Jorge L. Quijano.

Major infrastructure projects scheduled to finish this year or in early 2019 include Panama’s metro system, the first in Central America. Line 1 was completed in April 2014, while the second line is expected to be completed in 2018.

The port of Colon upgrade is expected to be completed by the end of 2018, while the construction of the second Tocumen International Airport is currently in its final phase.

All these major infrastructure projects will improve the country’s connectivity, and breathe new life to the economy and the real estate market.

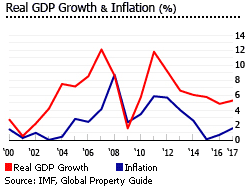

The economy is expected to expand by 5.6% this year, and further accelerate by 5.8% in 2019, according to the IMF.

After more than 10% annual GDP growth in 2011-2012, Panama’s economy slowed to 6.9% in 2013, 5.1% in 2014, 5.6% in 2015, and 5% in 2016, according to the National Institute of Statistics and Census (INEC).

The more moderate pace of recent growth reflects work delays at the Panama Canal (from August 2014, the completion date moved several times to June 2016), and the end of other public work projects, and the Colon Free Zone dispute with Venezuela and Colombia.

I have edited this Global Property Guide article slightly to make it easier to read.

Source: GlobalPropertyGuide.com

But, yes, there are real estate-related taxes in Panama.

In this post, I cover real estate-related taxes as follows: property, sales, transfer, capital gains, rental income, and gift taxes in Panama.

As you may have heard, Panama has radically revised its property tax system. It goes into effect on January 1, 2019.

Through 2018, if your Panama property is valued at or under $30,000, your property is completely exempt from property tax. In 2019, that exemption surges up to $120,000.

Learn about the current 2018 property tax rates and rules

Since most property in Panama is valued at under $120,000, most real estate in Panama will have zero property tax. Keep in mind, this exemption only applies to your primary residence.

Own 1 Property? If you only own one property in Panama, regardless of anything you own outside of the country or how much time you spend in Panama, Panama views that property as your primary residence.

Own Multiple Properties? If you own more than 1 Panama property, all but your primary residence will be taxed at the investor rate (see below). This rate is still a 50% reduction from the old Panama property tax rate. And even those properties enjoy an exemption on the first $30,000 of value.

Primary Residence Property Tax Rates

A property tax example. Say you buy your house for $350,000. You would pay property tax on $230,000 ($350,000 - $120,000) at a rate of .5%. Which means you would owe $1,150 in property taxes a year.

Investor Property Tax Rates

This "investor" rate applies to secondary residences, commercial and industrial properties.

A property's registered value is the same as the sales price. The registered value will only get updated when you sell the property. Panama has no property assessors.

ANATI is the government department that keeps records of a property's registered value. Keep in mind, only titled property is registered; and therefore, has a registered value.

Right of Possession (ROP) properties do not pay property taxes. And most property in Panama is ROP..

Most people don't title their ROP property because of cost. Not only does it cost money to title, but once you title, you are required to pay property taxes.

Learn more about ROP property.

For many people, especially Panamanians, there is little reason to title their ROP property. Titling means they will have to pay a lawyer and the government a chunk of change. And then property taxes every year after that.

But the Varela government really wants to rid Panama of its informal ROP property system. It wants to modernize its land system to include better centralized tracking and to allow for better protections of property owners.

Enter the new property tax law. The new law slashes property tax rates. Most critically, it exempts properties valued at up to $120,000 from paying any property tax whatsoever. As I've mentioned, the vast majority of real estate in Panama is under $120,000.

The Varela government is doing all it can to get property titled. It has even created mobile ANATI offices to travel around Panama to help ROP property owners to title their property. Time will tell how effective the new property tax law & government efforts are at nudging people to title their ROP homes.

Panama is also under pressure from the World Bank and other lending institutions to do a better job at collecting the millions of dollars of unpaid property taxes.

Given that Panama does a terrible job at collecting property taxes, it won't be hard to show improvement.

Many, maybe most, property owners in Panama don't pay their property taxes until they sell.

That is only time the government tries to collect property taxes - at the point of sale. At that time, the seller not only has to pay all unpaid property taxes, but all the fines accrued for the late payments.

Notification of Taxes Owed

Of course, not paying your property tax in Panama is an easy thing to do. Property owners never receive a bill or reminder to pay the tax. No instructions are given on how to pay property taxes at the time of purchase. So unless you remind yourself, it is easy to forget to pay. (FYI Panama property taxes are due 3 times a year: April, August and December.)

Starting in 2019, Panama will likely try to develop some kind of property tax-notification system. The easiest way, for those with a mortgage loan, is to partner with banks to notify owners.

However, most expats do not have mortgages. And given Panama's lack of a postal system, it is unclear how property owners with no mortgages will be notified of their tax bills. The electric company in my town, slips my power bill into my fence. But that does not seem like a viable option for ANATI. And regardless, it is certainly not a good "system". (Find out how to pay your utilities in Panama)

Panama’s has had a famous tax exoneration law.

In 2008, it allowed for a 20-year tax exoneration for properties which were built prior to January 1, 2012. Then, in 2012, the tax exoneration rules changed. You could get a property tax exoneration for houses or condos built after 2012. But not a 20 years exoneration, depending on the price, the tax exoneration varied from 5 to 15 years.

Panama's tax exoneration program ends on January 1, 2019; the same date the new property tax system comes into play.

However, if you own a property that is currently built and has an exoneration, then you are good.

And if you buy a property that has a tax exoneration, you are good too. The exoneration remains with the building, not the owner. So it can be transferred from one owner to the next.

Keep in mind, the tax exoneration only applies to the improvements or construction. You will still need to pay taxes on the land.

As far as registering improvements, you need to file the value. This is done as part of the construction permit process. That is what constitutes “mejoras,” (improvements). Improvements can still be exonerated from taxes, but the filing must be done before the law changes in 2019.

Remember, after the exoneration law ends, $120,000 of your property's value will be fully exempt from property taxes.

As I mentioned above, the seller must pay any unpaid property taxes upon the sale of the property.

At the time of purchase, the following taxes must also be paid:

The capital gains tax is a little complicated. The seller will initially be charged, and must pay, 3% of the sales price. After this payment, if 10% of the actual gain is less than 3% of the sales price, the seller can then apply to the government for a refund for the difference. However, getting this refund takes time. But I know of people who have been successful.

Technically, you are supposed to include your capital gains as part of your income tax return. But that is not generally done, and you will not be penalized for not doing so.

(FYI Most expats do not file an Panama income return. You are only required to file an income tax return if you earn income in Panama. Keep in mind, income earned online, even while you are in Panama, does not count as income earned in Panama.)

Using A Corporation

If you form a corporation to buy or sell property, you don't pay a title transfer and capital gains tax.

However, you are then required to pay a 5% share transfer tax. Tax-wise it is usually a wash. You effectively pay the same amount of tax. And you lose out on getting a refund if your capital gain is less than 3% of the sales price.

In addition, you also have to pay to create a corporation and then pay an annual fee to keep it current. However, as in every country, you do gain protections from having your property in a corporation's, rather than in your own, name. (Read about the dangers of buying from a corporation)

Purchase The Corporation Instead?

If the property is owned under a corporation and the registered value of the property is significantly lower than your purchase price, you should consider purchasing the corporation. This is because, for tax purposes, the registered values do not update when the shares of the corporation are sold. Of course, this only applies if the corporation only owns the property you are purchasing.

If you rent out your property, you may need to pay tax on the income.

Rental income is taxed at the following progressive rates.

However, if you own a hotel or condo-hotel in one of the special “tourism zones,” you may be exempt from income tax for 15 years.

Deductions. Panama does allow the following deductions when calculating your rental income.

The inheritance tax does not exist in Panama. It has been completely abolished.

However, there is a gift (inter-vivos) tax on properties located in Panama.

The gift tax rate depends on the degree of relationship between the donor and the donee. You should speak with your lawyer for the details. This tax does not apply to gifted property located outside of Panama.

Overall, Panama real estate taxes are low. You can make them lower, if you pay your property taxes on time. Then when you sell your property you can avoid paying late fees. Another tax saving is to pay the whole year's property tax at once. Then Panama will give you a 10% discount.

If you are an American, you can avoid double taxation, use loop-holes and more by reading this article on how buying and selling real estate in Panama can impact your US taxes.

Buying Panama real estate can also help you qualify for one of Panama's best visa programs, the Friendly Nations Visa. This visa program allows you to get your permanent residence quickly, as well as gives you a shot at becoming a Panama citizen in 5 years.

Please note: I am not a tax accountant. While I strive to make sure everything in this article is up-to-date and accurate, you should consult a knowledgable tax accountant when making your tax-related decisions.

When we arrived in Puerto there was lots of property available to buy. We chose only what we thought was the most appealing.

We singled out the properties where we would be happy to live. Reyn, as a designer, was always thinking of the end user. The person who would ultimately live on the property.

While the price was a factor, it was not our main determining criteria.

We looked for property where we would have liked to live ourselves. Locations that made us feel joy and that we were glad to be alive.

Only then, did we start our careful evaluation of the property as a potential purchase.

We looked at:

If the property had any significant issue, no matter how much we liked the property, we did not buy it.

When we bought property, we took our responsibility as owners seriously.

As the years go by, we are always trying to make the property more attractive, livable, valuable, and secure. Over time we have become pretty good at this. At least, we think so. We welcome your thoughts on the matter.

We have thoroughly vetted and researched all of our investment properties.

Many we have owned for up to 10 years. There are no outstanding ownership issues.

All properties have been well-maintained and improved over the course of our ownership.

We have all of the original property documents. Even the old yellowed originals, some dating back all the way back to the very first issuance of Right of Possession of the property, on up to the present year. (These are kept in a safe deposit box in the US.) All property transactions have been witnessed by the notary and by relevant neighbors, ex-wives, children, etc. Of course, we also have the official engineers’ drawings for all the properties.

Very importantly here in Panama, we have gotten to know all of the neighbors of the properties. We have met all, or at least most, of the siblings and children of the sellers. In many cases, Reyn even knows the neighbors' dogs by name.

All the neighbors recognize us as the sole owners of our properties. Because of our good relations with these neighbors, they would inform us of any suspicious behavior or encroachment. (Thankfully, it is very rare to have such issues in Puerto.)

As we have said elsewhere, most issues, especially ownership issue surface in the first few weeks of a new purchase.

Our goal is to have the best prices in town. If you find a similar property at a better price, please let us know.

Please do your research. You will find that our prices, for what you get, is lower than other expat-owned property for sale in the area. When evaluating a property given its price, you should look at the quality of location, view, size, aesthetic appeal and other critical factors of a quality living experience.

We appreciate your feedback. We'd love to hear what you found. We want to continue to deliver the best quality at the best price.

We love the beach. So we chose properties that would easily allow a beach lifestyle.

Much of our property is beach front. And if it is not at the beach, it is less than 100 yards from the beach.

We only have 2 properties that are not considered beach properties, but even those have views of the ocean.

Puerto Armuelles is a wonderful place to live in. It isn't a tourist destination yet, but it is an ideal place to enjoy a relaxing beach lifestyle.

Puerto Armuelles is a unique town. It has a real sense of place. We loved Puerto from the moment we set eyes on it.

Location is key.

After 3+ months of traveling all over Panama. We decided to buy in Puerto Armuelles.

We wanted to live in a real beach town. We didn't want to live in a resort community, or somewhere which would require a lot of driving to accomplish our daily errands.

Puerto Armuelles was the only place that fit all of our "happy living" requirements. Simply put, Puerto felt right. And it still does.

More and more expats who move here each year agree with our assessment.

I have written about Puerto Armuelles extensively in other parts of our site, so I will just give you a summary of Puerto's features below.

Puerto Armuelles - a Summary

Although it is not yet a tourist destination, Puerto has features that are beginning to attract recreational visitors, as well as retirees.

Puerto Armuelles is a place where you can easily build a happy and relaxed life. Come visit and see if you agree with us.

Everyone in Panama could be a happy recipient of this advantage. Starting in January 2019, if your property is valued at less than $120K, it will be exempt from property taxes. In Panama, the value of the property is assumed to be the purchase price.

Fortunately, all our properties are under $120,000 - many are well under $120,000.

Currently, there is no system in Panama that reassesses a property's value.

Which means that if you build a house on the property, your property value, for tax purposes, will not increase. Or if property prices increase in your area, the value of your property, again for tax purposes, will not increase. It will still be taxed, or be exempt, based on the purchase price.

Of course, this lack of up-to-date assessments may change, but for the foreseeable future, that is the situation. A good situation for property owners in Panama.

Learn more about the Panama property tax reform here.

If you buy one of our properties during your visit, we will pay the airfare you spent to get here.

Our "Welcome to Puerto Armuelles" gift to you. A happy perk to celebrate your new life in Puerto Armuelles. (Note: We cover the airfare of one person only.)

We have been asked about reserving property in the past. And we always said no. We really want people to visit Puerto first. But we have been convinced to change our mind. So now we have the option.

You can now reserve a property for 60 days for only $1,000.

Discover all the details about reserving a property, Click here.

We offer to finance.

This is a great advantage to you since it can be time-consuming and difficult to get bank financing in Panama.

And, if you are interested in ROP property, bank financing is non-existent. You can only obtain bank financing for titled property.

We carefully determined our terms by considering both what our clients have been asking for and looking at other owner-financing options available in the area.

We feel that our terms are fair and competitive. We think that you will agree.

Find out more about our financing.

You can rely on us to provide you with good advice and critical information necessary for success in Panama.

As you can easily see by browsing our website, LivinginPanama.com, we have a wealth of information about moving to Panama, setting up house, understanding the culture, and creating a happy life here in Puerto Armuelles.

We are happy to share this information with you throughout the purchase process and beyond.

Of course, no matter how compelling you find these 10 reasons, you must find a property that suits you.

One of our properties may be perfect for you. Or maybe none of them will call to you. Regardless, we are happy to help and answer your questions.

The main focus of our website is to help expats be successful and happy in Panama.

Of course, we would be thrilled if you bought one of our fabulous properties.

We'd have even more reason to celebrate your decision to join us down in Puerto Armuelles, Panama. The first round is on us!

Thanks for reading.

Betsy & Reyn

We hope you can benefit from the lessons we learned.

Don't Make Emotional Purchase

We have made dozens of property purchases safely and without regret in Panama.

Our achilles heel in this particular case was that this was an emotional purchase.

We LOVED the property too much, and we really WANTED it.

This is precisely the way expats get tricked into buying a property that they shouldn’t.

You need to use your prefrontal cortex to purchase property, not your amigdala. Definitely don’t use your tequila sunrise, or your vodka and tonic brain either. This needs to be a morning coffee sort of a decision.

In our case, the property in question was to have been for our own personal use, at a popular surfing spot in the neighborhood of Corazon de Jesus.

You see, we had gotten to know the sellers so well over the years of surfing and swimming there, and we liked the property so much for having used it every day or so over that time, and we were paying such a high price for the land…….(Blah, Blah, Blah)…

We assumed we knew everything we needed to know about the property. We had know the sellers for years, and made the mistake of believing what the sellers told us.

(Notice that our train of thought in this emotional purchase is not logical. We were using the wrong part of our brain. Basically, we were worried that if we didn’t buy it, someone else would, since many other properties in Corazon de Jesus had sold fast at that time).

Fortunately, we did much more cognitive research on our investment properties, since we bought for resale purposes. We made doubly sure we were on top of all stages of the vetting process.

We only purchased properties where we ourselves would be happy to live. And over the years, we have fallen in love with them, especially with the Corazon de Oro development where I now swim every day, or stroll 5 minutes down the beach to Corazon de Jesus to go surfing. As it turns out, we like it better than we ever liked Corazon de Jesus and the purple house.

We made several payments for the property, over 2 years, and were about to make our final, largest payment for the land, when we began to hear things that made us suspect that what we had been told by the family of the seller might not have been true.

You see, in this family there is an adult son who drinks too much. However, since I usually visited the property in the early morning when I swam, or surfed, I rarely ran into him, or if I did, he was not drunk in the mornings.

However, a couple of times, near the due date for our final payment, I visited the property in the afternoon. I got to witness this man drunk and belligerent. Most importantly to this story, this guy was yelling “crazy” things to me about the property having been left to him by his late father, as well as to the family member we were buying from. Previously, the family had convinced us that this person was the only legal owner of the property.

At this late date and for the 1st time, it was clear that this drunken relative was not happy with the idea of this sale. (Huh? I had been so confident that I knew everything about the property). I had spent hundreds of hours there over the years. I had been to births and funerals of various members of the family of the seller. I had lent the family money to help with travel and education expenses. How could this be?

Betsy and I immediately asked our lawyer do a review of the property documents to ease our doubts, before we handed over the final payment for the property.

It took this lawyer all of 5 minutes to discover that the drunk was exactly correct.

You see, the grandmother of the family, had (intentionally or not. We cannot be sure, although the last minute will was drawn up by this woman’s attorney who certainly should have known what he was doing) written a new will ceding her portion of the property back to her husband just before he died.

This meant that, though the property had been given to the seller only, by both his grandmother and his grandfather, upon the death of the grandfather all of this widow’s children, and their children’s children, as legal heirs, became the rightful owners of the property.

In the developed world, this series of events would have been labeled “felony real estate fraud”. In Panama this is considered a "grey area" especially where poor Panamanians are the sellers and expats are the buyers.

In fact they admitted it was fraud.

When we called them on their deception, they admitted it was true. There was more than one owner of the property.

They even signed a notarized declaration to that fact. Their attitude was one of, "Okay, we tried to defraud you. So what?"

At this point, we are fed up. And we are also "tied up" on this deal.

We are taking measures to protect ourselves and our investment. In our case, we own lots of other great properties so it is not the end of the world. However, for a retiree on a limited budget this could be devastating. They might have decided to give up and go home to North America.

We still want to buy the property. We have invested too much in it now to back down.

We have been informed by neighbors that they are now trying to sell this property to other unsuspecting victims. So please beware. This property is in litigation. It is not a property you should buy, unless you want to inherit problems.

We certainly hope that no other expats get involved in this troubled property until we win our suit. Feel free to contact us for more information.

This is why, for most expats, it is not a good idea to buy property directly from Panamanian sellers, or to buy a property that was only recently purchased from Panamanians.

Learn how to be safe buying property in Panama.

It is far safer to buy from expats who have held the property for a number of years.

Yes, you as the end user, pay a premium for property being sold by expats. But in exchange you get much more assurance that there are no conflicting ownership issues.

Of course, you should still throughly investigate the property and get to know all the parties, but the risk is much lower.

And we are not saying you should not buy from Panamanians. We bought almost all our properties from Panamanians. All with absolutely no issues. But keep in mind, we decided not to buy some properties because of issues that our investigations uncovered.

Buying from Panamanians directly is a great way to get a good deal. But to do that, you really should move here first. You need to personally get to know the players. And you need to do a tremendous amount of research. Buying from locals is a higher risk purchase. You should exercise greater caution. Go slowly and investigate the property and ownership throughly.

Such research will be more effective, and less likely for you to be a victim of fraud, if you are living in the area you want to buy. Plus, you will find out if you really will be happy in the area.

The most important detail to investigate is whether you will enjoy living on the property. After all, the end goal is not only to make a safe purchase, but to be happy with your life on that property.

We hope you found this tale informative.

October 24, 2017

But there are risks to any move.

In this post, I want to warn you of some risks, so you can avoid them.

The number one risk I see for expats is that some expats moving to Panama are rushed into buying a property too fast.

Often licensed or unlicensed real estate agents, taxi drivers, hotel owners, or others will work the newcomer fast, or sometimes subtly, in an effort to get them to make a purchase. These types of purchases are far more beneficial to this real estate agent/ “finder” than they are to the buyer.

The buyer is made to feel that there is no time for a thorough background investigation of the property. No time to find out if this is actually a good property investment or even a safe one.

Sometimes the buyer is so charmed by the agent that they trust too much. The buyer is “primed” to make a quick purchase by being told that several other expats are also interested in buying the property, or that the price is so low that it can’t last. Or, in the case of Puerto Armuelles, since Del Monte is coming to town, they had better buy now, rather than wishing that they had.

A too-fast purchase can even be made after 3 or 4 previous visits to a destination in Panama.

Just because you feel that you know the town, does not mean that you know enough about the specific property that you are about to purchase.

Unscrupulous real estate agents/"finders" know that since you have been here before, and you are back looking for a property, you are more likely to be "hot" to make a quick purchase. Obviously, repeat visitors are the “likely” ones to buy.

No Code of Ethics for Realtors

Sadly, the bar is very, very low, in terms of what is considered honest real estate practices. In Panama, there are no legal requirements for “full disclosure” in property sales, nor is there a code of ethics for real estate agents here.

The actual commission or hidden profit you pay an agent is often not fully disclosed. A real estate agent (licensed or unlicensed) can effectively earn 30%, 50%, even 300% of the sale price on a property. They do this without the buyer knowing it.

How agents earn these high commissions

Basically it is a con job. Although you do end up owning the property.

The agent/finder simply "ties up" the property just before you buy it. They may buy it in their name, a ghost buyer's, or in a Panamanian corporation's name. However they do it, the agent buys the property at the seller's asking price. Then the agent sells that property to you as if you are buying it from the original seller. However, they sell it to you at a much higher price than what the original seller was asking or the price they paid.

Typically, this agent brings the buyer to look at the property. If the buyer wants to make an offer, the agent then "pre-buys" the property since they already know that they can make a “killing” on the flip.

There are variations on this theme, but in general, the price the original seller gets is much less than what the expat buyer pays. The agent pockets the difference. And the buyer never knows what happened.

In another example, an unscrupulous agent might email a potential customer who has already visited once or twice, telling them that “an amazing property has just come up for sale”. If the person is truly interested in buying, these helpful agents then “tie up” the property, using minimal funds of their own, or more likely, the money that the expat buyer gives them, or sends them long distance. In this way, the unscrupulous agent, putting none of their own money at risk, sells a property to an expat buyer as if the agent’s only connection with the property were as someone helping the expat to make the purchase from the original seller.

In one case, we know about a property in Puerto where the Panamanian seller had been asking $5,000 for 2 or 3 years. These folks were desperate to sell. Suddenly, we learned from the neighbors that this property has just sold for $20,000! Amazing! (Not really). When we discovered that it sold to someone new to Puerto and which local "agent" helped broker the deal, it is quite clear what happened.

When I met the new owner, all I could do is smile and congratulate them on their purchase. What can I do now? It is too late to help them. Plus, no one wants to hear that they have just been swindled.

Of course, this practice can happen anywhere. To avoid it, the solution is to take your time so you, and your lawyer, can review the property's transaction history carefully. You should meet the seller yourself, with a translator if needed, and without your realtor, to ensure you are buying the property from them, not from your agent/property finder.

Sadly, these victims may continue to trust the “friendly” agent and even allow them to help manage a remodel or new construction project for them, all without having any idea of the true costs for these services.

In this particular practice, not only is the innocent expat buyer paying what amounts to a monumental real estate commission, but they are taking on another, even greater risk as well.

It is usually within the first few weeks after a property changes hands that problems concerning ownership begin to surface. This risk is there regardless of any commission-slight-of-hand. It is due to the too-quick purchase without thorough investigation.

That is, you will discover that the owner you bought the property from is not the only owner of the property. Most common and most distressing is that additional owners of the property may claim the sale void since they did not sign off on it. Or they may demand additional payment from you, the buyer.

Panamanian families, particularly families with middle-aged siblings, often are quite large: 6, 8, 10 siblings all with an equal claim to the family home/estate.

If an elderly parent has died without a will (this is the norm, not the exception, in Panama), the house automatically becomes the property of all of the living offspring. However, when an expat buyer arrives to look at a property, the people living they may claim to be the sole owners of the property. They may say, "my mom always wanted me to own the house".

Panamanian law does not work this way. There may be several legal owners of a property. You need to find this out in advance of investing your money. If there are too many conflicting claims of ownership, or if the family can’t all agree to sell the property, now is your chance to run away as fast as you can from what would have turned into a nightmare.

Find out how we were once conned when purchasing a property.

Obviously, the people who are most successful at this kind of fraud present themselves as the expat's friend. They might even introduce you to a few other expats who will vouch for them. The salient trait of a good con man is the ability to appear to be someone with insider knowledge who is going to be your friend for years to come.

Another tactic used by real estate agents who work in this unscrupulous way is to create a “smokescreen” (in Panama they call this practice “throwing feathers into the fan”) to disguise their dishonest business practices and to separate their prey out from others who could have warned them about the likelihood of a con job.

One practice that is popular in Puerto and other places is to assassinate the character of anyone they think could tip off the prospective buyer, whether those are their real estate "competitors" or simply other expats who might also caution you to take it slow. The agent keeps you in a bubble of people who won't rock the boat for them, so all systems are "go" for a sale.

Another thing that the swindlers do to delay or camouflage these scams is to warn the expat buyer “Whatever you do, don’t tell anyone that you bought this. I don’t want any of the other folks who wanted the house to be upset." Or “Don’t tell anyone you just bought this, because we don’t want anyone to know that the man/woman who sold the property has all this cash on them….they might get robbed”. I’ve heard this one several times over the years. These techniques are designed to isolate the buyer from those who might have been able to help them, until after all the payments have been made.

I do not write this article to dissuade anyone who is considering a move to Panama.

You can be safe and happy buying property in Panama. The vast majority of people are.

But you need to resist the temptation to make a rash purchase, one you may regret.

This is especially true if you are buying through an intermediary/agent of some kind - particularly if the seller is Panamanian. In that situation, an unscrupulous agent will find it easier to work some kind of sleight of hand.

You should make sure you and your lawyer do a thorough job of researching a property before you buy it.

If it is titled property, the investigation is a simpler process than an ROP property. But in either case, research needs to be done.

For Titled property, a thorough title search and investigation needs to be conducted.

In the case of ROP property, this investigation will involve looking at the full history of transactions of the property. Including the knowledge that if one of the property owners died, most likely each that person's children and spouse now have an ownership share of the property. If the children and spouse claim they are not owners, they must sign a notarized & stamped declaration to that effect. Your lawyer (or another person) should also ask all the neighbors about the property to ensure there is a consensus about who the true owners are. This sounds too simplistic. However, this simple asking the neighbors, never fails, if done thoroughly. In Panama, especially in small towns, there are no secrets.

Read "How to Buy ROP Property Safely" for more info. as well as "Understanding what ROP Property is"

Puerto is no worse than other parts of Panama, or Costa Rica, as far as real estate integrity is concerned (There’s a comfort, eh?). And we want you to have the greatest chance of a successful landing here.

Get a Lawyer

For a property investigation, a local lawyer is best. They know all the players involved and can help intuit if something feels fishy. You may or may not choose them to help you with any subsequent property purchase.

Ask local expats for what lawyers they would recommend. There are both bilingual and Spanish-only lawyers in Puerto. We also have a certified translator in Panama who can help you communicate with the latter.

For instance, most lawyers can easily find out if the property was recently visited, even purchased by a local “realtor type” by simply talking to the neighbors. In this small town, everyone talks about everything. It is not too hard to get the facts, you just need to ask.

If you would like a recommendation or places to ask for recommendations, please ask via our contact page.

For more information on buying property, read this.

We are truly in love with this town. It is one of a kind, complete beach town and a super cool place to live.

Puerto Armuelles always benefits from the arrival of people who can enjoy a happy life here. Happy people contribute to the well being of everyone. Happy expats who find what they are looking for here contribute by helping our town continue to be a great place to retire or to start a business.

We want to continue to see Puerto Armuelles expat success stories.

Puerto Armuelles still holds amazing value for beachfront property, or property within sight and sound of the waves.

So do your research. Cross-check your references.

If you take it slow and check out your information thoroughly, you can be safe and happy buying property anywhere in Panama.

And slow is the pace of life in Panama, so you might as well start taking it slow from the beginning..

Betsy and I are always available to help answer your questions.

Thanks for reading

Reyn

Below is a partial list of some recent positive developments in Puerto

(Please note: We are investors and builders here. Plus we really love our town. So our views are bound to be biased. We encourage you to ask others familiar with Puerto Armuelles for their views).

Obviously, the biggest news is that Del Monte is actively preparing to use the old Chiquita Banana plantation lands.

We are told that work has already begun to restore the plantations to an arable state.

All signs seem to point to Del Monte successfully setting up shop here in Puerto Armuelles.

However, I tend to agree with my Panamanian neighbor, who says he won't truly believe that Del Monte is coming to Puerto Armuelles, “until I have tasted my first locally grown Del Monte banana”.

The issue is that there is too little access to reliable news about this deal. For the most part, you need to rely on what you read in the political party-controlled national news.

Please read our other posts on Del Monte in Puerto Armuelles.

Regardless, I believe that there is much more than “just a banana deal” underway in Puerto Armuelles.

It has recently become more difficult to find a good mason in Puerto Armuelles. This is good news.

The reason for this is because the construction of a modern new hospital has required the hiring of numerous skilled masons, electricians, plumbers, welders, etc…

This project is predicted to take two years to complete. Read more about Puerto Armuelles new hospital here.

I am looking forward to rehiring one of my favorite masonry workers when the masonry phase of construction at the hospital is complete.

All of that digging up of our local roadways appears to be bearing fruit, as the improved fresh water supply and waste water removal systems are starting to come online.

Granted, the final waste water disposal plant, a couple of miles south of town, is not yet up and running. But, there is noticeable improvement to our fresh water supply, and pressure. It seems almost inevitable that both systems will soon be complete.

At the entrance into town, there is now a big new Terpel brand gas & service station.

This might not seem too significant; after all it’s just a gas station.

However, when the main national fuel brand decides to build a large new gas station, with a mini mart and an automotive repair shop, right at the main entrance to a town, it's a good sign for future development.

I imaging that the executives at Terpel are privy to more development information than the rest of us. The fact that the big players are purchasing strategic pieces of Puerto Armuelles, can only be considered a positive growth indicator.

The gas station was completed late last year. Now, almost suddenly, a large traffic circle, right in front of the gas station, is nearly complete (see photo).

The traffic circle (or roundabout) is a good choice for this busy 3-way intersection.

Unlike past traffic improvements, the traffic circle looks like the kind of quality forward-thinking decision that is made when it is known that car traffic will definitely be increasing. The last time that this sort of planning took place in Puerto Armuelles was when Chiquita Banana Co. was here.

As I have mentioned in previous posts, in 2006, when our family arrived in Puerto Armuelles, literally a third of the downtown retail shops were closed and their store fronts covered with plywood (the look was like New Orleans, post Hurricane Katrina).

Fast forward 11 years:

In all cases, it is crystal clear that local business owners are now willing to invest in their town again. In my conversations with local business owners, they have told me that they now feel confident about expanding their business and even opening new ones.

So it is not just Del Monte and the Government investing in Puerto Armuelles. It is local and outside of Puerto business people too. Private investment of this scale builds its own momentum.

It seems clear that Puerto Armuelles is on an up escalator.

Another sign of the increased activity in Puerto is the very noticeable increase in the number of the 'For Rent' signs you now see. As well as a few more 'For Sale' signs.

In the past, people who were looking for a rental, just asked around. News of rentals was mostly word of mouth. There weren't many rentals, but there weren't many people looking for rentals anyway.

Now that has changed.

A new influx of Del Monte employees are coming in, and more are expected. But it is more than Del Monte workers. More people, both expats and Panamanians, are coming to Puerto Armuelles looking for rentals. As well as property to purchase.

So now people who had not considered being landlords, are preparing vacant houses for rent. Landlords who have rented out houses, are now turning those houses into duplexes to capture the increased demand.

Also, since there are now there are more buyers, more sellers want it to be known that they are willing to sell. That is why you see more for sale signs as well.

Of course, many people here do not want to sell. People here generally love Puerto Armuelles. As a general rule, Portenos only leave Puerto if they cannot find work here.

Along with the increased demand for services comes, obviously, an increased demand for places to dine out. There have been new restaurants sprouting up all over town.

Of course, not all are of a quality that is of interest to most expats. However, there are a few good, but not great,places to eat out.

Most recently, we have a new chain restaurant, Rosti Pollo. I have not eaten there yet.

I could add many more development details. But I will close with a couple that appeal to me personally.

First, there is an expat woman, Joan, who is opening a yoga retreat center here in Puerto Armuelles. She is opening it in partnership with the Tsunami Inn, which is located in the San Vicente neighborhood.

Joan is a yoga practitioner who was looking for a retirement business, as well as a retirement location that really attracted her. She chose Puerto Armuelles.

Betsy and I have both taken yoga classes in the past, so we are especially interested in the arrival of such an opportunity. Please see Betsy’s video interview of Joan here.

I recently learned about another great development. Milton Hutto, owner of Heavenly’s Hotel, is purchasing a 30' boat for use by visitors. I did not ask him for details when he mentioned this, because we were having a planning meeting for the upcoming Flea market/artisan market on September 2 at Heavenly’s Hotel.

Which is anther sign of the times. On the 1st Saturday of every month, Puerto Armuelles will now have a artisan & flea market. The first one is in just a few days, Sept. 2nd, 2017. You can learn more about The Puerto Armuelles Saturday Market here.

I am thrilled that Milton is getting a boat as a first step to kick off a marine tourism business here in Puerto Armuelles. In addition, he will be creating a floating dining area, on the sea, just outside his hotel/restaurant. His hotel is located in the San Vicente neighborhood.

We have plans to open a small boat launch at the Corazon De Oro development. However, we are waiting to see how many people are interested. We have already heard from 5 or 6 that say they are.

Currently, we are focussed on building our first Living In Panama House. We have had nothing but positive feedback from the people who have visited the site. Click to see the 1st phase of construction of the Living in Panama House.

We will be filming comprehensive videos of these properties this summer. After which time we will start marketing them in earnest.

If you have a chance, check them out before your favorite one is taken or its price goes up.