This book is for you if you want to buy property in Panama, but don't because you are either uncertain or scared.

The book covers a wide range of topics in comprehensive detail, including:

After reading this guide, you will have the tools to buy your ideal property in Panama - with confidence & ease.

The book is titled:

Your Slice of Panama Paradise: How To Buy Panama Real Estate With Confidence & Ease (Even During Coronavirus)"

My intention in writing this guide was to provide comprehensive and detailed information on buying property in Panama. So that, armed with this knowledge, you will be able to overcome your uncertainty and go on to successfully buy Panama real estate.

I hope that you find the information in my Panama property buying guide helpful.

If you do find the information useful, I'd very much appreciate you giving me a review on Amazon.

Note: The book is available in 2 formats: Kindle and paperback. (The kindle version has color graphics, the paperback has black and white graphics.) Click here to see the book on Amazon.

Thank you!

February 14, 2020

In the case of Americans, forming a corporation can be a big disadvantage.

You do not need to form a corporation. There’s nothing to prevent you from buying a property in your own name.

Foreigners and locals alike can buy property in Panama - and in their own names.

Remember that the lawyers who insist you need to form a corporation will earn a fee when they help you create your corporation. And annually after that, they will continue to earn a fee (although smaller) to keep it active.

However, there are some good reasons to hold your Panama property in a corporation. I will describe those reasons further on in this post.

The way you choose to hold your Panama property depends upon the property, your needs, as well as other considerations particular to you. There are 3 ways to hold/buy your Panama real estate.

Putting your Panama property purchase in your own name is pretty straight forward. However, before you know whether to create a Panama corporation or foundation, you need to understand them better.

When choosing between holding your real estate in a corporation or foundation, your decision will depend upon how you will use the property.

If the property will generate income, it may be best to set up a corporation for tax purposes (except if you are an American, see below).

If you are going to live on the property, and will not be renting it out, you might consider a private interest foundation which can serve to hold your property, and also act as your living will.

The main difference between a private foundation and a corporation is that a private foundation cannot conduct income-producing business. However, a foundation can own investments such as real estate, other companies, stocks, bonds, etc.

Also, a Panama foundation is not the legal personification of a person or group of persons. There are no particular owners within a Panamanian foundation. That is, the assets of a private interest foundation in Panama represent a separate legal identity from the personal assets of its Founder, Protector, Council Members or Beneficiaries. Typically, a foundation has a specific mission that benefits a group of individuals.

There are 5 main reasons to have a corporation or foundation hold your property.

First the good news: there is no estate tax in Panama. The bad news is that you cannot avoid probate if a property is held under a person(s) name(s). Probate in Panama is conducted in court. This process is usually long and costly, requiring that you hire an attorney to represent you.

In a nutshell, having a will won’t save you from probate, unless your property is held in a corporation or a foundation.

No Right of Survivor-ship in Panama

Be aware that you cannot assume that the laws in Panama are similar to the laws of your home country. For instance, there is no ‘rights of survivor-ship’ in Panama.

That is, if a Panama property is registered under more than one person’s name, it just means that each party owns a share of the total. When one owner dies, the property does not automatically pass to the surviving co-owner(s). In some instances, especially when the co-owners are not married, the deceased partner’s share of the property may end up being passed on to his/her heirs.

This is true even if your co-owner has named you as his heir in his will. This is true even if the will was created in Panama, by a Panamanian lawyer.

However, all of this complexity disappears if the property is held in a corporation or foundation. In this case, it is a simple process to change ownership.

In conclusion, the specter of probate is a good reason to use a corporation or foundation to buy property in Panama. As long as the corporation or foundation’s shares are properly structured, you will avoid probate altogether.

You will often be told that if you want to avoid Panama’s transfer and capital gains tax when buying and selling land, you should use a corporation.

Yes, this is true; corporations don’t pay a title transfer or capital taxes. However, they do pay an equivalent amount in share transfer taxes.

Both the title transfer and capital gains taxes are paid by the seller. Between the 2 taxes, the seller pays a tax equivalent of 5% of the sales price.

However, while a corporation is exempt from those taxes, it must pay an equivalent share transfer tax of 5%.

Either way, you effectively pay the same amount of tax. However, if you sell via a corporation you lose out on getting a refund if it turns out that your capital gain is less than 3% of the sales price.

If privacy is your aim, you need to choose the right type of corporation and structure it appropriately.

To that end, there are 2 types of corporations in Panama, each with a different level of privacy.

International Business Corporation (IBC). An IBC requires at least 3 Directors and 1 or more shareholders who can enjoy participation privacy – for this reason, IBCs are also known as Anonymous Corporations. In an IBC the directors (president, secretary, and treasurer) are all listed in the Public Registry. These roles can be held by you, family members, partners, or by a nominee director service. If you use a nominee director service, you can have a higher level of privacy regarding your participation in the corporation. In addition, the names of the shareholders are kept private and are not publicly listed.

Keep in mind that you cannot maintain anonymity if you plan on getting a mortgage. When you apply for a mortgage, your loan documents will be publicly accessible. Plus the bank will require you to show up at the bank in person before they will approve your loan.

Limited Liability Corporations (LLC). Alternatively, you could choose to form an LLC. LLCs do not offer the same level of privacy as an IBC. If someone searches for a specific LLC in Public Registry records, they will easily discover the names of the managers and partners of that LLC. An LLC requires a minimum of 2 Managers and 2 or more Partners. You are not required to have an equal partner, one partner could only have a 1% share. The names of all the managers and partners must be publicly disclosed in all registration documents. The object here is to provide more transparency. Such transparency is typically a requirement of a partner’s country of origin, rather than a requirement of Panama.

IBCs and LLCs share similarities in that both are legal entities and they both limit a member’s responsibility to his participation as a shareholder or partner.

Highest Level of Privacy

If maximum privacy or anonymity is your goal, you should first create a foundation and then an IBC corporation. The key is to have the private foundation named onto the board of your IBC corporation, so you are not named specifically as a board member. That structure will give you maximum anonymity.

Another benefit of forming a corporation is that you can use your Panama corporation to establish residency under the Friendly Nations program. Creating a corporation is a fast and easy way to help qualify for the popular Friendly Nation visa.

After you receive your permanent residency status, you can terminate the Panama corporation. Maintaining your corporation means that you have to pay annual fees. If you are a US citizen you will also be required to report on the existence of your corporation as part of your tax return, even if your corporation holds zero assets.

Another important advantage of holding your assets under a corporate structure has to do with lawsuits. In the case of someone who attempts to sue you, they would not be able to go after your property since it is not owned by you. Instead, it is in the name of a Panamanian corporation or a private interest foundation.

Of course, there are negative considerations when deciding to create a corporation. I list 4 of them below, including why Americans, in particular, should think carefully before creating a corporation.

You must pay a lawyer to create a corporation or a foundation. After that, you need to pay an annual fee to keep the corporation or foundation active.

The typical cost for creating a corporation is from $1000 to $1500. The government then charges an annual fee of $300 for its right of existence. Additionally, the resident agent might charge his own fee to represent the corporation.

Note: if you feel your attorney is charging too much for this service, you could find an attorney with a more reasonable fee. It is a simple process to change your registered agent. You do not need to feel stuck with a lawyer as your registered agent just because you originally hired him or her to create the corporation.

Over time Panama corporations have grown more expensive and the paperwork associated with owning one has become more demanding.

In recent years, all Panamanian corporations and foundations, even those with no activity, are required to file annual financial statements with their registered agents. The goal of this new requirement is to increase transparency, something that has increased in importance in the aftermath of the Panama Papers.

Potential Paperwork - Esp for US Citizens

As you have probably heard, the IRS is very aggressive about collecting taxes from US citizens with overseas investments and income. Americans (US citizens and legal residents) that file taxes in the US are almost invariably required to file a form 5471 with the IRS. This is required if they are officers, directors, or shareholders in Panama corporations (or in certain corporations in other foreign countries as well). This is required even if the corporation has a net value of zero dollars.

Regardless of your citizenship, you should ask a tax specialist in your home country what reporting and tax requirements apply to owning a corporation in Panama.

If you own real estate that generates passive income (e.g., a rental property) and is registered under a Panama corporation, you could be in for a big tax headache as a US citizen or legal resident. This is true even if it is not passive income, for instance, if you run a business that is held by your corporation.

However, if it happens, if you earn money with a Corporation in Panama, you will be required to file even more forms with the IRS. Keep in mind, all US citizens have to declare as income on all money earned in a foreign country.

Very few Panama attorneys fully understand the tax issues this may cause Americans. And frankly, some don’t much care. They are more interested in the money they make selling you a Panamanian corporation than whether it is the best vehicle for you to hold income-generating property.

So keep all this in mind when your lawyer insists that you need to have a corporation. Remember, you do not need to hold your Panama property in a Panama corporation. And, I repeat, if you are an American, you may not want to hold income-generating Panama property in a Panama corporation.

Talk with your lawyer or tax accountant about other options. Perhaps an offshore corporation in another country, or some other solution that would give you the protection of a corporation, without the tax and reporting requirements.

Perhaps reading this information has prompted you to want to close your Panama corporation. The simplest way to close a corporation is to stop paying its annual registration fees. Eventually, the government will drop the corporation from its records. You can check the status of your corporation by searching via this link.

If you follow the guidelines established for closure by Law 32 of Public Limited Companies, it will still take more than 3 years to close the corporation. What follows is a summary of those guidelines. First, the board of directors of the corporation needs to vote on a dissolution agreement. If they vote in favor, then the shareholders need to vote on it. If they vote yes, then a certified copy of the agreement and the addresses of the directors and officers must be published in a local paper. After all that, the corporation is considered dissolved, but not closed. (Note: No corporation cannot be dissolved until all outstanding debts are made to the Ministry of Economy and Finance of Panama.) The government does not consider the corporation closed until 3 years after that notice is published in the newspaper. Not a fast method.

Given all that, the easiest way to close a corporation is to stop paying your annual corporation fees. Regardless of how you close it, you are not required to pay a lawyer to close your corporation.

The final decision to hold your property in your own name, the name of a Panama corporation, some other off-shore corporation, or a private interest foundation, will depend upon your individual circumstances. A style that is right for one expat in Panama, may not be beneficial to another.

Hopefully, this post has provided you with enough information so you can make the best use of the advice of your lawyer and/or tax accountants.

For some words of caution regarding buying and selling property from a corporation, see this post.

In Panama, most foreigners buy property with cash.

Of course, it isn’t usually a cold hard cash payment. Typically it is paid via a cashier’s check or a wire transfer from your bank account.

You don’t really want to pay with a suitcase full of cash, even if you could. It is always a good idea to have a paper trail of all payments made on a property.

There are two primary options for financing property in Panama.

I review those, and some less commonly used financing options, below

Some sellers (like us) offer to finance your purchase of their property. This way you can avoid dealing with a bank or mortgage company. It can be time-consuming for a foreigner to get a bank mortgage in Panama.

Seller financing is a good option for buyers who want to buy a home in Panama but need to sell their current home to pay for it.

In that case, a buyer may want to negotiate terms that include a small downpayment, payments until the house sells (say 3 years), and then a balloon payment at the end of the 3-year term. You can have your lawyer or agent help you with this if you would prefer.

This type of seller financing allows you to secure the property of your dreams and gives you plenty of time for the sale of your original home. If the original home sells earlier than expected, then you get to pay off the balance early. However, you need to ensure that the financing agreement includes a clause stating there is no penalty for early payoff.

For buyers, who have monthly income and some cash-on-hand, but not enough to pay for the property in full, they may ask to structure the financing to pay a larger downpayment of say 30 to 40%, then the remainder in monthly payments over 5 years or so.

Owner financing is a great option for potential buyers who know they want to purchase property in Panama but cannot pay for it fully upfront.

To discover our seller-financing terms, click here.

It is not an easy process to get a mortgage through a Panama bank. It is tedious. And it can take a long time, especially if you are an American.

If you plan to apply for a mortgage, allow for a good long wait before it is finalized and approved. You may get it quickly, although it isn’t likely. However, it will be a wonderful gift if it does happen fast.

The amount of documentation that is required will leave you flabbergasted. God forbid you forget to include a document when you submit your application. Your forgetfulness can bring the whole mortgage application process to a crawl.

Big Developments Can Be An Exception

The exception is if you are buying a property from a developer that already has a relationship with a bank.

These are usually large developments, especially the type that sell property in the pre-construction phase.

In those situations, your loan can be granted in a matter of days. But most property in Panama is not in that kind of development.

You do not have to be a resident to get a mortgage loan

But you do need to be under 75 years of age (see below for more).

In North America, qualifying for a loan is all about your credit history. However, in Panama the banks focus more on your ability to pay and the property’s loan to value ratio.

Because of this dual-focus, Panamanian banks require massive amounts of documentation.

Documents that:

Panama banks will only give loans on land that is:

The following are typical mortgage terms and requirements for foreigners.

I advise you ask multiple times about what documents are needed for your loan application. It is not unusual to submit your documents to the bank only to learn that they forgot to mention one or two other documents that you need to supply.

If you think you will be applying for a loan, you should bring some of these documents with you to Panama. Others you will gather in Panama. Most banks require them. Of course, every bank has slightly different requirements.

Plus Banks typically require all documents (like your bank statements) from other countries to be “authenticated” either through a Panamanian consulate or by “Apostille” which is a globally recognized type of a government certified authentication of public records.

Tip: Getting your documents apostilled is a better way to go than authenticated.

In addition, some banks require that you have a Panama bank account for at least 6 months before you can be given a mortgage.

If you are self-employed, you need to submit even more documents:

Once all the required documentation is in the bank’s hands, it goes to the bank’s credit committee.

The Committee has 14 days to analyze your loan application. Once approved, the buyer gets to review the terms.

If the buyer agrees to the loan, he signs it and returns it to the bank.

The bank then issues an irrevocable promissory letter for the approved loan amount.

The interest rates are generally in line with those offered in the USA. However, interest rates can vary depending upon:

Note, Interest rates are not credit-score driven. If approved for a loan, all non- residents qualify for the same interest rate.

Also, if you have a pensionado visa, you may be able to get a discount on your interest rate.

Panama has a law to help first time buyers, including foreigners, of new homes by subsidizing the mortgage interest rate. If you are looking to buy new titled construction priced between $35 to 120k (after the down payment), you might want to find out more about it.

Items to watch out for in the loan documents include:

How to Pay Less Interest

Here is a tip to help you pay less interest over the term of your loan.

Because of the difficulty in getting a traditional mortgage, many people, especially from the US, go an easier route. This can include developer financing, seller financing, paying cash, or borrowing against your retirement.

You can also get a loan directly with the developer of a property rather than the bank or mortgage company.

This is very common with pre-construction and during-construction developments.

It usually consists of small down payments, small monthly payments, and then a balloon payment once your property is complete.

If a bank is connected to the developer you are purchasing a property from, the loan can be pushed through within days, but only to buy that specific property.

In Central America, there are international banks that will provide mortgage financing for properties located in some other Central American countries.

If you plan to invest in Panama as well as in another Central American country, you may want to develop a relationship with one of these types of banks.

International banks such as Lloyds TSB International will often finance overseas properties in a range of countries. These larger banks will sometimes finance up to 70% of the value of the property.

Sometimes when you cannot get financing for a specific type of property from one sector of the banking community, another will find it more attractive.

List of Banks

Currently (in 2019), there are 67 banks (Regional, International & 2 State-owned) in Panama. Check out this list of Panama Banks maintained by Panamabank.info.

If you have an IRA at a traditional brokerage, you can roll it into a self-directed IRA. Self-directed or self-managed IRAs give you complete control over selecting and directing where to invest your IRA, including real estate.

This includes using your IRA to invest in overseas real estate.

However, this option is not for everyone. You need to be actively involved in managing your IRA and to learn the rules of the self-directed IRA. Also, depending upon how it is used, it may generate taxable income.

Want to learn more? Start by reading this 2019 Guide To Self-Directed IRAs by US News & World Report.

If you make your first investment a cash-flow property, you can use the proceeds to buy or finance future properties.

The CAP rate can be excellent. We know some people in Puerto Armuelles who pay rent of $500/month to an expat who had just bought the rental house for $50,000. You do the math. Even without looking at the CAP rate, the investor is making 12% a year plus appreciation.

Looking for more finance ideas? I brainstormed 18 ways to finance your Panama property. They might inspire even more ideas for your financial situation.

If you want to finance your Panama property, seller financing is the fastest and easiest to secure. However, as you read above, you have other options as well.

In this post, I suggest questions to ask before and during your property search.

First, take your time.

There are plenty of properties available. Don’t feel pressured to make a hasty decision.

Just as in the US or Canada, there are fast-talking, high-pressure salespeople in Panama. Although, in Panama, these salespeople are just as likely to be taxi drivers as realtors.

Before you take a deep dive into a property search, you need to know exactly what you are looking to buy. Take a good look at your needs and determine what you consider non-negotiable.

If you have a clear picture of your ideal property, your search will be faster, more fun, and ultimately more successful.

Specifically, before you buy a property you should determine your ideal property’s where, what, when, and how much.

Consider the following questions to help clarify your criteria for your perfect property.

Panama is a small country, but even so, before you start looking for a property you should narrow down where in Panama you would like to live. It will save you a lot of time and expense.

Here are some questions to help you narrow down your location options:

The point is to make sure the place you are exploring offers the types of activities you enjoy.

Once you narrow down which part(s) of Panama you’d like to consider calling home, you need to visit that area.

Online research is one thing however, exploring a place in person is the real test of whether you will be happy living there.

Keep in mind, it takes time to get a good sense of a place. You need to give yourself some time to explore and get to know an area. Think about what it would be like to live there. To help you do that, I suggest you consider doing the following during your visit

Now that you have a better idea of where you want to live in Panama, it is time to clarify what your ideal property looks like.

Again, you will more quickly find your perfect property if you are crystal clear about your most important property criteria.

Start by asking yourself these questions:

Once you are clear on your ideal property criteria, you can assess if the property you just fell in love with is really “the one”. You don’t want to buy a property only to find out that you were blind to the fact it did not meet a critical requirement on your list of non-negotiables.

Do you have a timeline for when you want to move to Panama?

Ideally, you should start well before that date. It can take time to find a place that resonates with you. And as you will see in the task list below, you need to do more than simply find your ideal property.

When creating your timeline, factor in these tasks.

These tasks don’t have to be done sequentially, you can have them overlap. And of course, some of them can happen after you purchase your property.

Keep in mind that these tasks may take longer than you think. Not only are they unfamiliar tasks, but everything in Panama takes longer than most North Americans anticipate.

Do you have a ball-park figure of what you can afford? Based on your finances, how much can you afford to spend on a property?

Do you need to sell your home or business before you can buy property in Panama? Do you want, or prefer, to take out a loan or use another financing tool?

Mortgages

People commonly think of taking out a mortgage to buy a home. However, obtaining a mortgage in Panama can be time-consuming and at times difficult to obtain. I write about how to get a mortgage here.

Seller Financing

An easier and common financing method that many foreigners use in Panama is seller-fiancing. That is when the seller of the property offers to finance the purchase. For an example, you can check out our seller-fiancing.

Looking for other ways to finance your purchase? A few years ago, I brainstormed 18 ways to finance your Panama property purchase. Not all of the ideas are ideal, however, perhaps they will get your own ideas flowing.

Conclusion

You need to do your homework. Be clear about where and what you are looking for. Then explore the community and property to make sure it is what you want.

Consider the wisdom of renting before you buy. This allows you to fully discover if the weather, the community, the lifestyle of your selected location is right for you.

Already know you want to live in Puerto Armuelles? Check out our beautiful properties for sale.

This property is located in the Corazon de Jesus neighborhood of Puerto Armuelles.

Hi, this is Betsy Czark from Living in Panama.

And this is a glimpse of the beach that's in front of this property we have for sale.

This gorgeous property is big:

- 11,000 sq. feet

- Only 70 yards from the beach

- Located in Puerto armuelles,

To get to the charming beach town of Puerto Armuelles,

- Take a short flight from Panama City to David, which is in the Chiriqui Province.

- Then drive an hour and 15 minutes to historic Puerto Armuelles.

What you see here is Puerto Armuelles’ downtown waterfront park.

Puerto was built by Chiquita Banana starting in the 1920s.

Chiquita built a town with a charming look and feel and one that looks different from most other towns in Panama.

Puerto is also unique in that it is one of the only ocean-front towns in Panama.

Up ahead you can see a row of restaurants and bars facing the waterfront park, as well as a statue of the town’s namesake, Colonel Armuelles

On the left, you can catch a glimpse of it’s popular “town square” park, plus a new playground.

Right now, let’s go to 11,000 sq foot property we have for sale.

This beautiful property is only 10 minutes from downtown Puerto Armuelles.

We are almost at the property now. All the beachfront homes, which are to your right on this street are owned by expats.

The property is in a great location.

Not only is it close to downtown, but there are restaurants, grocery store, and a hardware store even closer - 5 minutes away.

This beach neighborhood is a mixture of locals and expats.

The cement building on the corner has now been remodeled to be a garage for the expat who owns the beachfront house across the street.

This is the ample 16 foot wide access road to the property.

Welcome to the property!

This sizable property is both beautiful and quite affordable.As you can see, since I am easily driving on it, this property is flat and ready for your home construction.

Actually, this property could fit 2 or 3 houses on it.

The property is serviced by city electricity and water.

Currently, this neighborhood is not on the city sewer, but our new mayor has vowed to change that. In the meantime, like many beach communities, septic tanks are used.

And as I mentioned, this property is quite affordable.

This 11,000 sq foot property is only $40,500. Plus we offer easy financing.

As we exit the property, you will see how close the beach is.

You can easily stroll on the beach, swim, stand up paddle board, or surf from your property.

It is a wonderful place to live.

I leave you with some views of the beach.

For more information or to tour the property, contact me at LivinginPanama.com by clicking the link.

Living in Panama: The place for information & advice on being an expat in Panama.

Interested? Click "subscribe" and hit the bell so you so you don't miss a video.

Thanks for watching!

We are raising our property prices on March 16, 2019.

On average, our property prices will increase by 10%.

NOTE: Back in November, we posted about a property price increase to occur on January 15th.

However, we did not announce the January 15th price increase to our Newsletter subscribers until January 1st.

In response to our Newsletter subscribers, we have delayed the increase until March 16th.

Even with the price increase, we will continue to offer beautiful, high-quality properties - at some of the lowest prices around.

1. - For over a decade, property prices all over Panama have been going up.

Meanwhile, Puerto Armuelles, hidden away in the Northwest corner of Panama, has not seen those same price increases.

Puerto Armuelles is now hitting its stride to catch up with the rest of Panama. Consequently, real estate prices in Puerto are starting to go up.

2. - Property Upgrades. For over a decade, we have continued to make improvements to our properties. This means that we can offer you the best planned, best maintained, most attractive, properties in Puerto.

3. - Rising Costs. The cost of various types of permits, infrastructure, and maintenance has been going up.

4. - Buzz about Puerto Armuelles. For the past 2 decades, ever since Chiquita Banana pulled out, Puerto has been generally ignored. No longer. There has been a noticeable uptick of new people, esp. foreigners, spotted in Puerto Armuelles. This spike in interest goes beyond just visitors and retirees. There is also a significant push by Panamanians to develop more space for shops, restaurants, and offices.

5. - Puerto is getting more services. Renovations of existing services, as well as the construction of new public services, are at an all-time high in Puerto Armuelles. 4 significant civic projects are currently underway. (see below)

6. Arrival of Del Monte. Since Del Monte Foods arrived in Puerto Armuelles, about a year ago, there has been a big uptick in interest in our town, both by investors and prospective retirees.

Del Monte is a sign of better economic times to come. Not only will Del Monte's banana operations provide significant annual revenue to the city, but they will be cutting regular paychecks for many residents.

7. Return on investment looks very good. The Republic of Panama continues to attract investments from all over the world, particularly from China. More and more of that money is showing up in Puerto Armuelles.

It is clear that Puerto's dark ages, after the departure of Chiquita Banana, are in the past, and the "Puerto Armuelles' Renaissance" is moving forward full speed ahead.

We will make no official predictions, however, it would not surprise us if Puerto Armuelles provided retirees, investors, and 2nd home buyers with the biggest returns in all of Panama. Time will tell.

Have you been thinking about buying a property from us? Then take another hard look in the next 2 months, before the price increase - or before your lot is sold to someone else. Our real estate price increases go into effect on March 16, 2019.

If you have questions, please feel free to contact us.

Have you visited Puerto yet? Why not buy a ticket and come on down this year? Let us know you are coming and we will give you a tour.

You will never know if Puerto is right for you until you visit.

Do you currently have a property on Reserve? Or are you making payments on a property? In either case, these price changes obviously do not apply to you. However, they do indicate that you can easily sell your property for more than you paid for it.

Reserve one of our properties before March 16th, you will freeze the current price for 60 days.

Anyone else who wants to buy a property after March 16th, will have to pay more.

It is fast, easy, and inexpensive to reserve your property.

The reservation fee is only $1000, and it is credited toward the property purchase. The 60-day price freeze starts the day the hold fee is received.

Learn more about reserving a property here.

2018 has been a big year for Puerto Armuelles. And 2019 promises to be even bigger.

The Living In Panama House is, in essence, is a big covered porch, wrapped around the bedrooms and the bathrooms. Compare this with a more typical construction of a house with a porch attached.

Depending upon the model you choose, up to 75% of the house is an open-air secured and covered porch.

Our design gives you the same cool feeling as being in the shade under a big mango tree by the beach.

You’re protected from the sun, and there is nothing between you and the refreshing breeze.

Being under a big shady Mango tree at the beach is as cool as it gets here. That is, unless you turn on the air conditioning.

We are positive about this.

There is a big beautiful mango tree on lot 6 of our Corazon de Oro property, where we check the temperature throughout the day. It is the coolest spot around.

Made in the Shade of A Mango Tree

Why is it so cool and comfortable under a big shade tree with a cool breeze blowing?

This seems like a silly question. We all know it’s true.

However, when designing the perfect tropical house, you must ask, “Why is it true?"

1st - Mature Mango trees provide a wide area of dense shade.

The dense shade of the Mango tree protects you from the sun. Not only that, it also shades the ground all around you. This means that the entire area under the tree does not heat up, allowing you to stay cool and comfortable.

2nd - Mango tree branches are high up, so they don't block the ocean breezes.

Because it can easily flow under the Mango tree, the breeze is free to work its evaporative magic upon your skin, keeping you cool.

And, don’t forget about the psychological effect of air movement. Air flowing over our skin, makes us feel cooler, even if the temperature hasn’t changed. This phenomenon is known as the “perceived” cooling effect.

What else can we learn from the Mango tree, so we can build a really great tropical house?

Actually, that’s it. The secret to building a cool tropical house, believe it or not, is not to ruin this simple formula: Provide deep shade and don't obstruct the cooling breeze -- Shade, air movement, evaporation, and perceived cooling.

Most builders botch tropical houses because they build the way they always have. They don't stop to think about context, about what produces a comfortable house in the tropics.

Expats' Thoughts On Their North American Style Homes

From various studies and surveys, and through our own observations, we have learned a lot about expats who live in North American style homes in Panama.

How does the Living in Panama House bring together all the elements necessary to imitate the cool, comfort beneath our big mango tree? Shade, air movement, evaporation, perceived cooling.

The mango tree has these going for it. What about the Living in Panama House?

1st, the Living in Panama House has wide, 5-foot roof overhangs. This means that, just as if you were relaxing in a hammock beneath our big mango tree, you are protected from the sun by this big, sheltering roof. It also means that no part of the Living In Panama House, except the roof, is exposed to sunlight. By keeping the house structure from heating up during the day, you don’t heat up. What’s more, you will stay cool and comfortable all night.

Now, back to our mango tree comparison: The leaves at the top of the Mango tree get very hot, during the day, due to direct contact with the sun’s rays. Since a mango tree has so many layers of leaves, all that heat is trapped; It never gets to you, napping in your hammock down in the shade.

In the case of the Living in Panama House, we actually have the mango tree beat here. The mango’s tree’s thick canopy requires tons of branches and leaves to provide shade down below. Obviously, this is not a good model for building a house; It’s an inefficient use of materials), By contrast, The Living In Panama House has a metal roof, and galvanized steel roof framing.

Metal roofing is the most popular roofing in Panama, so it is readily available.

2nd, our metal roof system is very lightweight, or low in mass, which means that the roof can’t store heat.

3rd, the roof has a dramatically energy-efficient roof color, white. A white roof can reduce surface temperatures by as much as 100 degrees Fahrenheit, compared to a dark roof color. This means those solar rays are reflected right back into space. This is known as the Albedo Effect. The end result: a significantly cooler house. To learn more about why a white roof is the best choice for a cooler house, check out this article on the Texas Smart Roof, here.

4th, the metal roof is strong. It does not rest on top of the walls the way it does in typical house construction. Instead, the Living in Panama House roof is connected to the walls by a series of steel columns. The steel column supports are welded to steel reinforcement poured integrally into the concrete walls. This is the strongest roof design we have seen here.

Our Living In Panama House roof system is special in another way too.

5th, there is ample ventilation space to allow heat to escape and daylight to enter. In our current model home, there is 132 lineal feet of open ventilation between the roof and the top of the walls. At 2.5 feet in height, this ventilation system provides 330 square feet of ventilation, high up where you want it. (By comparison, a big 3’x 5’ double-hung window offers about 9 square feet of ventilation). This is just one of our vent systems.

What’s more, this high vent is not only a perfect way for the house to expel heat, but it is also the ideal location for clerestory lighting. This design, allowing natural daylight to enter the house high up, completely eliminates the dark, cave-like feeling that is found in many expat homes in the tropics.

Our tropical sun here is extremely bright. Without the extra effort to balance the lighting, the contrast between the blinding tropical sunshine and the relative dimness of the indoors gives an impression of gloominess. The interior daylight of most houses here makes you feel a bit as if you were in a basement apartment in the States. I like spaces that are light and cheery, so I find the interior light of theses homes depressing.

6th, There is no space where the heat will get trapped. Beneath the Mango tree, there are no walls (no doors, nor windows either). Nowhere for heat to get trapped. The Living In Panama House is similar, in that there is almost no floor to ceiling walls except in the bathrooms and bedrooms. (However, the bedrooms and bathrooms also have tall windows and doors for light and ventilation). The breeze can circulate freely throughout all of the living spaces, constantly exchanging the interior air for clean, fresh air right off the ocean.

7th, Long and lean design to allow free airflow. Another advantage to our design is that the Living In Panama House is long and lean, so the breeze can easily pass through the entire house.

Wide, fat houses are a mistake here in the tropics. That style of house requires more walls, plus interior hallways to access the spaces deep inside the house.

8th, Gable roof acts as a chimney to release any heat build up. The gable roof of The Living In Panama House is perfect for cross ventilation. Both ends are open. The peak of this beautiful roof is way up there, nearly 19 feet off the ground. There are no drop ceilings (unless you add them). This means there is a vaulted ceiling sloping upward from 13 to 19 feet overhead. We all know that heat rises. Since heat is free to migrate naturally upward and then be whisked away by the breeze, The House stays cooler. You stay cooler.

I have always loved the look of the old Chiquita Banana houses with their half-hipped roofs. You have probably seen them on our website, or maybe you’ve already visited Puerto Armuelles and seen them there. These roofs are a classic. They are part of the historic look of Puerto Armuelles.

When we first arrived in Puerto, I thought I'd like to copy the look of the Chiquita era homes, including the half hip roofs, but with a few design tricks to make them more efficient. To be honest, it took me a few years to finally accept the reality that hip roofs are beautiful and historic, but they don’t work.

Hip roofs, even half hip roofs trap heat. Even when they have those charming little wooden vents on the half gable ends In fact, the attic of our own Chiquita Banana House heats up to over 150 degrees on summer days. Finally, I had to let go of my love affair with the Chiquita Banana half-hipped roof.

9th, the Living in Panama house is designed for big ceiling fans for those days when the wind doesn’t want to blow. Ceiling fans are an attractive and efficient way to move warm air up and out of the house. They are a classic, tropical look that dates back over a hundred years.

10th, the Living in Panama house is A/C ready too. Obviously, not everyone wants to live without air conditioning. Some days, you just feel like going indoors and sitting in the media room, or the office, or taking a nap in a truly “chill” space. For that reason, the bedrooms, office/media room, and the bathroom zones are all designed for air conditioning. The decision to create an air-conditioned “cool zone” is up to you. These zones can be as big, or as small as you wish.

11th, easy to enclose more space over time. With our Living In Panama House design, it’s simple to enclose more space. You could even enclose it all if you really want to A/C the entire house. However, we suggest that you live in your new house for a while to experience what combination of fan vs A/C fits your tropical lifestyle. Then, with our system, it is very easy and fast to add walls, windows, etc, if you decide to adjust the Living In Panama House to your needs.

We think you will enjoy living in a Living in Panama House. If a Living In Panama House fits your needs, please let us know.

We will send you its construction plans. They cost $250 if you are not buying one of our properties. The plans are free if you do buy a property from us.

Don't forget, if you buy one of our properties, we are here to help answer your questions about the LIP House all along the way.

If you have questions, please feel free to contact us.

Explore Corazon de Oro: The most beautiful beach properties in Puerto Armuelles.

Here it is:

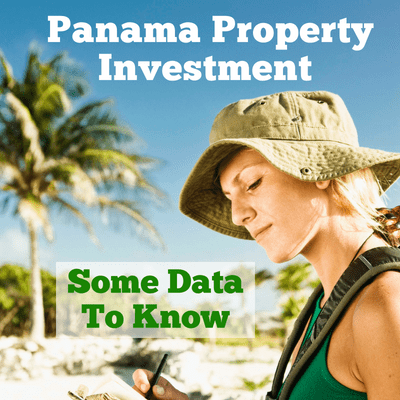

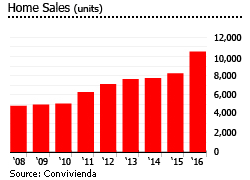

Foreign buyers are pushing up property prices in Panama. The average dwelling sales price surged by 21% from January 2015 to June 2017 in Panama's metropolitan area, according to the Panamanian Chamber of Construction (Capac) as reported by La Estrella de Panama.

Foreign buyers tend to be from the United States, Europe, Canada, and Latin America.

Yet at US$2,050 per square meter (sq. m.) in June 2017, the average price of residential properties in Panama still looks very reasonable, with metropolitan prices ranging widely from US$ 928 to US$ 2,892 per sq. m., according to Capac.

In Punta Pacifica, a collection of exclusive waterfront skyscrapers, high-end apartment prices are rising by 6% to 12% per annum, due to a shortage of available units. The average price in Punta Pacifica stood at around US$ 2,300 per sq. m. as end-2017.

Sales and construction were both up in 2017, says Maria Arias of TDI Real Estate. Arraiján and La Chorrera, where property prices start at around US$30,000, are specially active, due to infrastructure developments in Panama West and Panama East's constant growth.

It is a big turnaround. After the global financial crisis in 2008, Panama's dwelling prices declined by an average of 20% to 30%, according to Kent Davis of Panama Equity Real Estate.

Only after 2012 did foreign buyers return to the market.

Now it is the opposite story. Many infrastructure projects are approaching completion, and Panama's economy will continue to accelerate in 2018 and 2019.

Another boost to the market will be the new property tax law to be implemented from January 2019, which gives tax exemption to all primary residences worth more than US$ 120,000 (previously US$30,000), and generally reduces property tax rates.

Read about the new Panama property tax law

Tourist arrivals rose by 7.5% to about 2.5 million people in 2017, says the Panama Tourism Authority, with European visitors up 8.1% (though tourist spending only rose 3.8% to US$ 4.5 billion in 2017).

According to the Panama Tourism Authority, these numbers are expected to rise further since Air China now has direct flights to Panama. This will attract Chinese tourists.

Foreigners can own real properties in Panama, and are accorded with the same property rights as Panamanians. However, mortgages can be difficult to obtain, especially for foreigners, and the purchase process can take two to three months. More than 80% of real estate transactions involving foreign buyers are in cash.

Beach apartments are increasingly in demand by both local and foreign buyers. The most popular areas include Punta Chame, Playa Blanca, Farallon, El Palmar (Hato River), Santa Clara, and Rio Mar (San Carlos).

Demand is supported by a stronger mortgage market. "The improvement in conditions for residential mortgages in recent years has been the principal promoter for housing," says the Superintendencia de Bancos de Panamá. Residential mortgages granted rose 10.1% to PAB 14.08 billion (US$ 14.13 billion) in 2017, as low interest rates and higher average terms increased the purchasing power of families. The interest rate on housing loans was 5.5% in December 2017, unchanged from the same period last year.

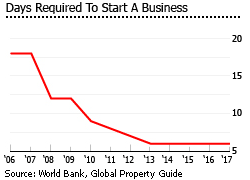

It requires only six days to start a business in Panama, according to the World Bank’s 2017 survey. Panama is the 2nd most competitive country in Latin America and the Caribbean, according to the World Economic Forum's Global Competitiveness Report 2017-2018.

Panama draws multinational companies and foreign investors with significant tax breaks, the free-trade zone, improved infrastructure, and a low cost of living. The expansion of the Panama Canal, which was opened in June 2016, is expected to bring in over US$2 billion in annual revenues by 2021.

“There are so many new businesses moving to Panama,” said Kent Davis of Panama Equity Real Estate. “It’s one of the reasons people are coming down – because there is still money to be made, locally, and as a regional base of operations.”

“People aren’t just moving here to relax,” Davis added. “They’re coming here to work because there is so much business around.”

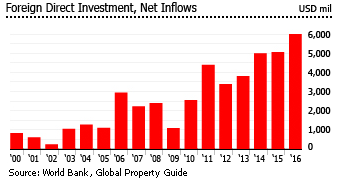

Panama encourages foreign direct investment (FDI) in real estate by offering various incentives such as property tax exemptions, according to Jeff Barton of Punta Pacifica Realty.

Panama has the highest foreign direct investment (FDI) share of GDP in Latin America, at more than 10% of GDP, according to a United Nations report. Panama is also the largest recipient of FDI in Central America, with 44% of 2016's regional FDI total of US$ 11.97 billion. In 2017, the country's FDI rose by about 1.8% to about US$ 5.319 billion from the previous year, according to the Comptroller General of the Republic of Panama.

"The international community recognizes that Panama is a stable democracy and it is the fastest-growing country in Latin America," said Economy and Finance Minister Dulcidio De La Guardia.

For what it is worth, International Living’s Global Retirement Index names Panama as one of the world’s best places to retire in 2018, due to its convenience (ease of access from US, currency in US dollars, English is widely understood), world-class amenities, good beaches, and affordability.

Panama has been removed from Financial Action Task Force's (FATF) "grey list", but money-laundering is still rampant.

In June 2014, Panama was placed on the "grey list" of Financial Action Task Force (FATF) of countries not doing enough to fight money laundering. FATF officially took Panama off its money laundering and terrorism financing watch list in February 2016, after new government regulations.

Despite this, money laundering and terrorist financing are believed still rampant in Panama. No real controls prevent funds moving through Panama to terrorist organizations, nor are do money laundering prosecutions actually take place. Moreover, Panama's powerful criminal syndicates remain fully operational.

In a recent report by the Latin America Financial Action Task Force (Grupo de Acción Financiera de Latinoamérica – GAFILAT), GAFILAT noted that the government's anti-laundering efforts are good, signalling progress in fighting money laundering. However, the report also pointed some deficiencies that the government must work on.

According to the GAFILAT report, the country was observed to be more susceptible to illicit streams of revenue from foreign sources than domestic ones. The GAFILAT enumerated the sectors of real estate, banking and corporate services, and free trade zones as the most vulnerable sectors to money laundering.

The task force also identified almost 730,000 businesses in the country that are considered at "high risk" of partaking in money laundering, during its investigation in May 2017.

Panama City is divided into two main areas – the old colonial town of Casco Viejo, and the modern business and shopping district of high-rise buildings and malls.

Panama's gross rental yields are still good, despite having declined over the past few years. Rental yields are range from 5.7% to 7.3%, with smaller apartments tending to yield more, based on the Global Property Guide research in November 2016.

Most properties in Panama City are apartments.

Based on the figures from Encuentra24, 2016 apartment prices in Panama City were:

Inland apartments ― ranging from US$ 1,900 per sq. m. to almost US$ 2,500 per sq. m.

Beachfront apartments ― ranging from US$ 1,800 per sq. m. to US$ 3,600 per sq. m.

Boquete, in Panama’s mountain highlands, has a fast growing expatriate community. The popular option here is to buy land and build a home, but there are many completed homes on offer.

Sample property prices for Boquete are as follows:

2-bedroom, 1-bathroom home, about 1,600 sq. ft. – US$90,000

3-bedroom, 2-bathroom home, about 1,500 sq. ft.– US$179,000

Another desirable location is Coronado, a popular beach town and relaxed community for expats, and only an hour from Panama City.

Sample property prices for Coronado are as follows:

3-bedroom, 2-bathroom home, about 1,300 sq. ft. – US$132,000

2-bedroom, 1-bathroom furnished condo, about 850 sq. ft. – US$135,000

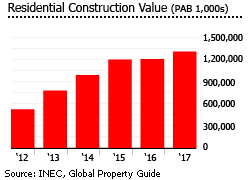

In 2017, the value of residential construction rose by 12.2% to PAB 1.29 billion (US$ 1.29 billion) from the previous year, when it rose by 0.6%m, after annual increases of 21.1% in 2015, 26.8% in 2014, and 48.8% in 2013, according to the Instituto National de Estadistica y Censo (INEC), all of which follows a decade of breakneck building which raised occupied housing units by 31.5% between 2000 and 2010, according to the National Censuses.

Total credits granted to the construction sector rose by 8.2% In 2017 to around PAB 6.74 billion (US$ 6.77 billion), according to Superintendencia de Bancos de Panamá.

"This increase is explained primarily by the behaviour of economic activities related to the external sector. Among them, those of the Panama Canal, air and financial services stand out positively," noted a recent report of the Comptroller General of the Republic.

The US$5.25 billion expansion of the Panama Canal, which began in 2007, has experienced delays and cost overruns amounting to US$1.6 billion. But the expansion, which started operations in June 2016, has doubled the Panama Canal's capacity, with wider and deeper lanes and locks, and a new lane of traffic allowing more and larger ships. This year's tonnage of 403.8 million Panama Canal tons (PC/UMS) was the highest in its history, and a 22.2% increase on last year.

"These record figures reflect.... the Panama Canal’s continued ability to transform the global economy and revitalize the maritime industry," says Panama Canal's administrator, Jorge L. Quijano.

Major infrastructure projects scheduled to finish this year or in early 2019 include Panama’s metro system, the first in Central America. Line 1 was completed in April 2014, while the second line is expected to be completed in 2018.

The port of Colon upgrade is expected to be completed by the end of 2018, while the construction of the second Tocumen International Airport is currently in its final phase.

All these major infrastructure projects will improve the country’s connectivity, and breathe new life to the economy and the real estate market.

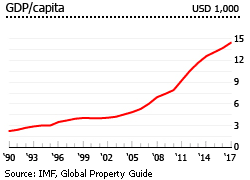

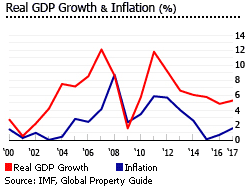

The economy is expected to expand by 5.6% this year, and further accelerate by 5.8% in 2019, according to the IMF.

After more than 10% annual GDP growth in 2011-2012, Panama’s economy slowed to 6.9% in 2013, 5.1% in 2014, 5.6% in 2015, and 5% in 2016, according to the National Institute of Statistics and Census (INEC).

The more moderate pace of recent growth reflects work delays at the Panama Canal (from August 2014, the completion date moved several times to June 2016), and the end of other public work projects, and the Colon Free Zone dispute with Venezuela and Colombia.

I have edited this Global Property Guide article slightly to make it easier to read.

Source: GlobalPropertyGuide.com

But, yes, there are real estate-related taxes in Panama.

In this post, I cover real estate-related taxes as follows: property, sales, transfer, capital gains, rental income, and gift taxes in Panama.

As you may have heard, Panama has radically revised its property tax system. It goes into effect on January 1, 2019.

Through 2018, if your Panama property is valued at or under $30,000, your property is completely exempt from property tax. In 2019, that exemption surges up to $120,000.

Learn about the current 2018 property tax rates and rules

Since most property in Panama is valued at under $120,000, most real estate in Panama will have zero property tax. Keep in mind, this exemption only applies to your primary residence.

Own 1 Property? If you only own one property in Panama, regardless of anything you own outside of the country or how much time you spend in Panama, Panama views that property as your primary residence.

Own Multiple Properties? If you own more than 1 Panama property, all but your primary residence will be taxed at the investor rate (see below). This rate is still a 50% reduction from the old Panama property tax rate. And even those properties enjoy an exemption on the first $30,000 of value.

Primary Residence Property Tax Rates

A property tax example. Say you buy your house for $350,000. You would pay property tax on $230,000 ($350,000 - $120,000) at a rate of .5%. Which means you would owe $1,150 in property taxes a year.

Investor Property Tax Rates

This "investor" rate applies to secondary residences, commercial and industrial properties.

A property's registered value is the same as the sales price. The registered value will only get updated when you sell the property. Panama has no property assessors.

ANATI is the government department that keeps records of a property's registered value. Keep in mind, only titled property is registered; and therefore, has a registered value.

Right of Possession (ROP) properties do not pay property taxes. And most property in Panama is ROP..

Most people don't title their ROP property because of cost. Not only does it cost money to title, but once you title, you are required to pay property taxes.

Learn more about ROP property.

For many people, especially Panamanians, there is little reason to title their ROP property. Titling means they will have to pay a lawyer and the government a chunk of change. And then property taxes every year after that.

But the Varela government really wants to rid Panama of its informal ROP property system. It wants to modernize its land system to include better centralized tracking and to allow for better protections of property owners.

Enter the new property tax law. The new law slashes property tax rates. Most critically, it exempts properties valued at up to $120,000 from paying any property tax whatsoever. As I've mentioned, the vast majority of real estate in Panama is under $120,000.

The Varela government is doing all it can to get property titled. It has even created mobile ANATI offices to travel around Panama to help ROP property owners to title their property. Time will tell how effective the new property tax law & government efforts are at nudging people to title their ROP homes.

Panama is also under pressure from the World Bank and other lending institutions to do a better job at collecting the millions of dollars of unpaid property taxes.

Given that Panama does a terrible job at collecting property taxes, it won't be hard to show improvement.

Many, maybe most, property owners in Panama don't pay their property taxes until they sell.

That is only time the government tries to collect property taxes - at the point of sale. At that time, the seller not only has to pay all unpaid property taxes, but all the fines accrued for the late payments.

Notification of Taxes Owed

Of course, not paying your property tax in Panama is an easy thing to do. Property owners never receive a bill or reminder to pay the tax. No instructions are given on how to pay property taxes at the time of purchase. So unless you remind yourself, it is easy to forget to pay. (FYI Panama property taxes are due 3 times a year: April, August and December.)

Starting in 2019, Panama will likely try to develop some kind of property tax-notification system. The easiest way, for those with a mortgage loan, is to partner with banks to notify owners.

However, most expats do not have mortgages. And given Panama's lack of a postal system, it is unclear how property owners with no mortgages will be notified of their tax bills. The electric company in my town, slips my power bill into my fence. But that does not seem like a viable option for ANATI. And regardless, it is certainly not a good "system". (Find out how to pay your utilities in Panama)

Panama’s has had a famous tax exoneration law.

In 2008, it allowed for a 20-year tax exoneration for properties which were built prior to January 1, 2012. Then, in 2012, the tax exoneration rules changed. You could get a property tax exoneration for houses or condos built after 2012. But not a 20 years exoneration, depending on the price, the tax exoneration varied from 5 to 15 years.

Panama's tax exoneration program ends on January 1, 2019; the same date the new property tax system comes into play.

However, if you own a property that is currently built and has an exoneration, then you are good.

And if you buy a property that has a tax exoneration, you are good too. The exoneration remains with the building, not the owner. So it can be transferred from one owner to the next.

Keep in mind, the tax exoneration only applies to the improvements or construction. You will still need to pay taxes on the land.

As far as registering improvements, you need to file the value. This is done as part of the construction permit process. That is what constitutes “mejoras,” (improvements). Improvements can still be exonerated from taxes, but the filing must be done before the law changes in 2019.

Remember, after the exoneration law ends, $120,000 of your property's value will be fully exempt from property taxes.

As I mentioned above, the seller must pay any unpaid property taxes upon the sale of the property.

At the time of purchase, the following taxes must also be paid:

The capital gains tax is a little complicated. The seller will initially be charged, and must pay, 3% of the sales price. After this payment, if 10% of the actual gain is less than 3% of the sales price, the seller can then apply to the government for a refund for the difference. However, getting this refund takes time. But I know of people who have been successful.

Technically, you are supposed to include your capital gains as part of your income tax return. But that is not generally done, and you will not be penalized for not doing so.

(FYI Most expats do not file an Panama income return. You are only required to file an income tax return if you earn income in Panama. Keep in mind, income earned online, even while you are in Panama, does not count as income earned in Panama.)

Using A Corporation

If you form a corporation to buy or sell property, you don't pay a title transfer and capital gains tax.

However, you are then required to pay a 5% share transfer tax. Tax-wise it is usually a wash. You effectively pay the same amount of tax. And you lose out on getting a refund if your capital gain is less than 3% of the sales price.

In addition, you also have to pay to create a corporation and then pay an annual fee to keep it current. However, as in every country, you do gain protections from having your property in a corporation's, rather than in your own, name. (Read about the dangers of buying from a corporation)

Purchase The Corporation Instead?

If the property is owned under a corporation and the registered value of the property is significantly lower than your purchase price, you should consider purchasing the corporation. This is because, for tax purposes, the registered values do not update when the shares of the corporation are sold. Of course, this only applies if the corporation only owns the property you are purchasing.

If you rent out your property, you may need to pay tax on the income.

Rental income is taxed at the following progressive rates.

However, if you own a hotel or condo-hotel in one of the special “tourism zones,” you may be exempt from income tax for 15 years.

Deductions. Panama does allow the following deductions when calculating your rental income.

The inheritance tax does not exist in Panama. It has been completely abolished.

However, there is a gift (inter-vivos) tax on properties located in Panama.

The gift tax rate depends on the degree of relationship between the donor and the donee. You should speak with your lawyer for the details. This tax does not apply to gifted property located outside of Panama.

Overall, Panama real estate taxes are low. You can make them lower, if you pay your property taxes on time. Then when you sell your property you can avoid paying late fees. Another tax saving is to pay the whole year's property tax at once. Then Panama will give you a 10% discount.

If you are an American, you can avoid double taxation, use loop-holes and more by reading this article on how buying and selling real estate in Panama can impact your US taxes.

Buying Panama real estate can also help you qualify for one of Panama's best visa programs, the Friendly Nations Visa. This visa program allows you to get your permanent residence quickly, as well as gives you a shot at becoming a Panama citizen in 5 years.

Please note: I am not a tax accountant. While I strive to make sure everything in this article is up-to-date and accurate, you should consult a knowledgable tax accountant when making your tax-related decisions.