This means I filed my 2015 taxes only a week ago. As I did them, it reminded me of how taxes are both the same and different for Americans abroad.

Taxes are something you should think about before you buy or sell international real estate, no matter what your home country. However, I can only speak to the impact on Americans.

If you are an American thinking about investing in Panama or other international real estate, you should know how it will impact your taxes "back home".

If you are a US citizen, the IRS requires you to pay taxes whenever you sell offshore real estate.

Actually, you are required to pay U.S. taxes on any and all of your worldwide income, which includes all passive and investment income. For Americans, income is taxable as earned, no matter where you reside.

Offshore real estate is taxed at the same tax rates, the same allowable deductions for expenses, and the same available credits. The only exception is in how depreciation is handled.

Keep in mind, active investors, real estate professionals, and those who buy using a retirement account are exceptions to this rule.

I will describe how various overseas transactions can impact your US taxes below. (For purposes of this post, I will assume a US long term capital gain rate of 20%.)

The only deduction available for passive income (such as real estate) is the foreign tax credit. The purpose of this deduction is to eliminate double taxation on investment income. Don't get too excited about this deduction, it in no way allows you to pay less in total taxes (US and foreign country taxes combined).

The IRS allows you to deduct or take a dollar-for-dollar credit for any taxes paid to a foreign country. In practice, this never works out perfectly, but it does eliminate most double taxes. How much you can deduct depends upon the tax rate of the country your land is located. Here are some examples.

Capital gains tax of 33% (Columbia)

Say you bought a property in Medellin, Colombia in 2005 for $100,000. In 2013, you received an offer you couldn’t refuse for $150,000, giving you a capital gain of $50,000. The capital gains tax rate in Colombia is 33%, so you pay $16,500 to Colombia.

Since Columbia's rate (33%) is so much higher than the US (20%), you wouldn't owe any tax to the US. In this case, you would report the sale on Schedule D of your US personal return and deduct or take a credit for the $16,500 you paid to Columbia on Form 1116. This would allow you to pay $0 to the IRS.

Capital gains tax of 10% (Panama)

Now let’s say you sell a property in Panama. Panama's capital gains are taxed at 10%. In this case, you will pay 10% to Panama and 10% to the United States, to arrive at the US's 20% rate for long term capital gains.

Capital gains tax of 0% (Costa Rica)

If you had this same transaction in Argentina, Ecuador or Costa Rica, where real estate sales are not taxed, you would pay the full 20% capital gains tax to the IRS.

Important Note: When deciding in which country to buy real estate, that country’s capital gains rate only comes in to play if it exceeds the US rate. If a country’s capital gains rate is 0% to 20%, you will pay 20% in total. If a country’s rate is more than 20%, then only the excess should be considered in your decision. For example, Columbia's higher tax rate of 33%, means you will pay more (13%) in capital gains tax than if that property was in Panama or Costa Rica.

Caution, while you may think you are saving money by buying and selling land in Costa Rica because they have no capital gains tax, it might not be the case. Costa Rica and other such countries have other taxes and duties to make up for their zero capital gains rate. Taxes which might not be deductible on your US return. In most cases, you are better off buying property in a country whose tax system is similar to the United States.

The Foreign Earned Income Exclusion (FEIE) does not affect your U.S. tax bracket, nor does it reduce your adjusted gross income amount, which is used in calculating your capital gains rate.

For example, a husband and wife who qualify for a FEIE with individual salaries of $100,800 in 2015 will pay $0 U.S. Federal Income tax on their salaries. However, their adjusted gross income for determining capital gains rates will be $217,200. This means that their long term capital gains will be taxed at the blended 18.8% rate.

This also means that every dollar earned in excess of the FEIE is taxed at the 28% or 33% tax rate. Keep in mind, your tax rate does not start from zero after taking the FEIE consideration. Also FEIE does not apply to retirement or other investment income.

Note: to qualify for the FEIE you must either pass the IRS's physical presence test or the residence test. The physical requires that you are out of the United States for 330 out of any 365 day period. The residence test is more complicated, but in general it requires your intent to move to another country and that you are in the US for no more than 3 to 4 months a year.

The exception to the same tax rate rule above is offshore real estate held in an IRA. By purchasing offshore real estate in your retirement account, you can defer or eliminate US tax on both rental profits and capital gains.

If the country where your property is located doesn’t tax the sale, then you just might avoid the tax man all together. If the country taxes you at a relatively low rate, such as Panama at 10%, this might be the only tax you pay (ie. the IRA cut your total tax bill by half with this exception).

Let me explain: If you move your IRA or other type of retirement account away from your current custodian and into an Offshore LLC, you can invest that account in foreign real estate. The LLC is owned by your retirement account and holds investments on behalf of that account. You buy the rental property in the name of the LLC, pay operating expenses from the LLC, and profits flow back in to the LLC and into your retirement account.

This only applies to investment rental real estate and not property you personally occupy. If you later decide to live in the property, the funds must first be distributed out of the retirement account and any applicable taxes paid.

If you wish to purchase offshore real estate with funds from your IRA and a non-recourse loan, or you are in the active business of real estate, you can add a specially structured offshore corporation to eliminate US tax.

If you buy real estate with an IRA in the United States, you get the joy of paying tax on the gain attributed to the money you borrow (the mortgage). If 50% of the purchase price comes from your 401-K and 50% from a loan, half of the rental profits and half of the gain is taxable, with the other half flowing in to your retirement account.

Take this same transaction offshore and no US tax is due. Tax free leverage in a retirement account is one of the great offshore loopholes. This is often called using a self-directed IRA.

Owners of rental real estate in the United States can use accelerated depreciation to deduct the value of property over 27.5 years. However, if the property is offshore, a straight-line depreciation must be used over 40 years. The straight-line method gives you less bang for your depreciation buck.

This means that on a $100,000 rental property, your annual depreciation deduction would be about $3,636 for a US property vs. $2,500 for a foreign property. So you would pay a premium of $1,136 on the overseas property.

It may sound like an issue, but it isn't necessarily. A straight-line depreciation can also save you money. Accelerated depreciation is great if you plan to hold the property for about 20 years. However, if you plan on buying, improving and selling over a short period (a few years), then accelerated depreciation will cost you money, not save you money.

This is because depreciation is “recaptured” when you sell the property. Every dollar you were allowed to deduct over the years must now be paid back. It is added to your basis, and taxed at 25% rather than 20%. So, as a rough example, if you have a gain of $50,000 and took depreciation of $20,000, you owe tax at 20% of $50,000 for $10,000 plus 25% of $20,000 for $5,000. Therefore, you total tax due is $15,000.

The more depreciation you take, the more you must repay. If you hold a property for many years, taking a deduction today, and paying it back in the distant future, is a benefit. If you will sell the property in 3 or 5 years, taking the deduction now, and paying an additional 5% in tax later, is of little to no benefit.

People can be shocked at the size of their tax bills from the sale of a rental property. They had planned for a 15% rate (the previous long term rate), and ended up at 20% + recapture. In States like California, where values property values have gone down, it is possible to sell a rental at a loss and still have a big time tax bill from recapture.

This might lead some to think a good strategy is to not take depreciation, especially on property you plan to flip ASAP. Well, the IRS has a surprise for you: The tax law requires depreciation recapture to be calculated on depreciation that was “allowed or allowable” (Internal Revenue Code section 1250(b)(3)). This means you will pay tax on depreciation whether you take it or not.

All of this is to say that not being allowed accelerated depreciation on offshore real estate might be a good thing.

As I said to begin this article, all of the same US tax rules apply to offshore real estate that apply to onshore properties. This holds true for the primary residence exclusion. If you qualify, you can exclude up to $250,000 single or $500,000 married filing joint, from the sale of your primary residence.

To qualify, you must own and occupy the home as your principal residence for at least two years before you sell it. Your “home” can be a house, apartment, condominium, stock-cooperative, or mobile home fixed to land anywhere in the world.

Tax Tip: You can take the $250,000/$500,000 exclusion any number of times. But you may not use it more than once every two years.

Have you owned and been renting out a property in Panama for a few years? You might consider kicking out those renters, moving to Panama, and occupying the property for two years before you sell.

Did you convert a home from your primary residence to a rental property? The rule is that you must have lived in the property for 2 of the last 5 years to qualify for the exclusion. Therefore, you can live in it for two years, rent it out for up to 3 years, and then sell and get the full exclusion.

To get the $500,000 exclusion, both a husband and wife must live in the home as their primary residence. It is possible for one spouse to qualify while the other does not. For example, husband is living in the United States and visiting his wife and family in Panama. On a joint return, only the wife may take the exclusion for $250,000 when they sell the home in Panama.

You don’t need to spend every minute in your home for it to be your principal residence. Short absences are permitted—for example, you can take a two month vacation and count that time as use. However, long absences are not permitted. For example, a professor who is away from home for a whole year while on sabbatical cannot count that year as use for purposes of the exclusion.

You can only have one principal residence at a time. If you have a home in California and a condo in Panama, the property you use the majority of the time during the year will be your principal residence for that year. So, it would be possible for Panama to be your primary resident for one year and California to be your primary residence the next. Before you sell, make sure you have spent at least 2 of the last 5 years in the property.

Because you get the “benefit” of all US tax rules when it comes to offshore real estate, you can use like-kind exchanges (also called a Section 1031 exchange) to defer US tax. The only caveat is that you can’t exchange US property for foreign property – it must be a foreign property for foreign property transfer.

In a like-kind exchange, you defer paying taxes by swapping your property for a similar property owned by someone else. The property you receive is treated as if it were a continuation of the property you gave up. The benefit is that you defer paying taxes on any profit you would have received.

You may only exchange property for other similar property, called like-kind property by the IRS. Like-kind properties must have the same nature or character, even if they differ in grade or quality. All real estate owned for investment or business use in the United States is considered to be like kind with all other such real estate in the United States, no matter the type or location. For example, an apartment building in New York is like-kind to an office building in California.

All real estate owned for investment or business use outside of the United States is considered to be like kind with all other such real estate outside of the United States. Therefore, you can exchange an office building in Panama City, Panama for an apartment building in Medellin, Colombia. You may not exchange a property in Panama with a property in New York.

Combo Deal: Yes, you can combine a 1031 exchange with the $250,000 primary residence exclusion. To qualify for both, you must hold the property for more than five years and live in it for at least two of those five years. Then, you can use the exclusion to reduce or eliminate the capital gains, including tax carry-over from a like-kind exchange.

Rental income and expense from offshore real estate is reported on your personal return, Schedule E, just as a US rental property would be. You must keep rental records, including all expenses from management, improvements, repairs, and taxes paid. You must follow all US tax rules for these deductions and expenses, such as depreciating improvements and deducting repairs.

The IRS has a right to audit your offshore real estate, so be ready. It may be common to pay your bills in cash in Colombia, but you will have a tough time deducting any expenses without a receipt and proof of payment (such as a cancelled check).

An area of emphasis in an audit of offshore real estate is travel and other expenses associated with visiting the property. If you are flying to Panama five times a year, hanging out for a week, and then expensing these trips against your one rental unit on Schedule E, the deduction will not survive an audit. On the other hand, you most likely can expense one trip a year, more if you have a large portfolio overseas.

When reporting your rental property, remember to take depreciation. As stated above, the only difference in offshore real estate is the allowed depreciation method. You must utilize straight-line depreciation over 40 years.

Your offshore real estate may come with a number of new US tax forms to file. It is important you file them or you may face substantial penalties if you are caught. These penalties are aimed at Americans hiding money offshore, but they could ensnare you as well.

FBAR

The most critical offshore tax form is the Report of Foreign Bank and Financial Accounts, Form TD F 90-22.1, referred to as the FBAR. Anyone who is a signor or beneficial owner of a foreign bank or brokerage account (or combination of accounts) with a value of more than $10,000 must disclose their account(s) to the U.S. Treasury.

On your tax return you will be asked if you have such an account. The question is answered with a simple yes or no. But that is not the end of it.

You must also remember to send in the separate FBAR form. But you don't send it to the IRS, you send it to the US Treasury Department. Oddly it is due, or was due, on June 30th. No extensions.

New FBAR Due Dates

However, for calendar year 2016 and beyond, the due date is April 15th, with an automatic extension of 2 months for US citizens living abroad. Also an extension is now available, which moves the FBAR due date to October 15th.

I can see myself taking that extension. It is so much easier to do all the forms at once, and not have staggered due dates.

Other Required IRS Forms

Other tax forms may be required if you hold your property in a foreign corporation, LLC, Panamanian foundation, or international trust.

Offshore Real Estate Professional Benefits & Definition

If you are living and working abroad and in the business of real estate, you can realize some great tax benefits. The following section is for those who spend a significant amount of time and effort working their offshore properties, and not those with only one or two apartment units.

The typical investor in offshore real estate may only deduct his losses against other passive income. If you do not have any other passive income, losses are carried forward until you can use them.

An exception to this rule applies to a) active participants and b) material participants in the management of offshore real estate.

As an active participant in offshore real estate, you can deduct up to $25,000 of passive losses against other income (like wages, self-employment, interest, and dividends) on your US tax return. This allowance is phased out on a 50% ratio if your adjusted gross income is $100,000 or more.

If you are a material participant in offshore real estate, you are much more involved and in control than an active participant. As a material participant (sometimes referred to as a real estate professional), you are in the active business of real estate and may deduct your expenses against any and all of your other income, without limitation or AGI phase-out.

It is relatively easy to qualify as an active participant. It is far more challenging to be classified as a material participant in offshore real estate. If you can meet the criterion, you will find that there are major international tax breaks and loopholes available to the real estate professional.

NOTE: The major benefit of being offshore and material participant / real estate professional is that you may draw a salary from an offshore corporation and qualify for the Foreign Earned Income Exclusion. This tax break is only available to offshore professionals and not those living or working in the United States.

In order to materially participate in offshore real estate, you should be living and working abroad. It would be near impossible to qualify as materially involved in properties in Colombia while living Texas. Therefore, you should also plan to qualify for the Foreign Earned Income Exclusion (FEIE). When the FEIE is combined with an eligible offshore real estate business, you can take out up to $108,600 (in 2015) in salary from that enterprise free of Federal income tax and make use of a number of other tax mitigation strategies.

In other words, a qualified offshore real estate professional can deduct his or her expenses against all other income, regardless of source and without limitation based on his or her AGI, and draw out up to$108,600 in profits free of Federal income tax. If a husband and wife both qualify as material participants and for the FEIE, they can each take out a salary of$108,600, for a total of $217,200 of tax free money.

Again, to qualify for the FEIE, you must be out of the US for 330 out of 365 days or a resident of another country. If you are a resident of another country, preferably where your properties are located, then you can spend up to 4 months in the US each year.

If, after reading this, you realize you have not been filing the required FBAR, not done your taxes correctly (or at all); no worries. Just make sure you file before you are caught. The IRS has an amnesty program with no penalties if you voluntarily correct your past errors or omissions. But you have to do it before the IRS calls you out.

For most Americans, filing your US taxes while living overseas is no more difficult than it is if you live in the USA. However, there are some loopholes, exclusions, tax accounting, and tax forms you should be aware of as an American living abroad, especially when it comes to offshore real estate.

NOTE: I don't know the ins and outs of US taxes as well as this post makes it sound. While I did draw on some of my own knowledge, the vast bulk of this tax information comes directly from posts found on premieroffshore.com and greenbacktaxservices.com. And mostly from Christian Reeves, of premieroffshore.com, he really knows his stuff.

If you need any help setting up your business structure or with your US taxes I would give premieroffshore.com a shout. He offers a free and confidential consultation. (I am in no way affiliated with this company.)

.

Updated Dec 13, 2019

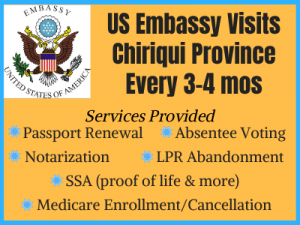

You can accomplish many tasks at one of these ACS travelling shows.

As I mentioned, the ACS visits David and/or Boquete every 3 to 4 months. If you are lucky, their visit will be in time to save you a trip to Panama City.

To find out when they will be in town, you can visit the embassy's website, email [email protected], or give them a call during their very limited phone-answering hours.

Unfortunately, the embassy doesn't set the date for ACS's visit to the Chiriqui province much in advance of it happening.

The ACS will only accept payment by local banker’s cashier check (known in Spanish as “Cheque Certificado”). That is, the check needs to be issued by a Panamanian bank. It must be made payable to “U.S. Embassy Panama” and have been issued within the past 5 months.

The ACS will NOT accept cash or credit card payments. The notarial fee is $50 per each signature of the Consular Officer.

Depending upon which ACS services you will be using, you will need to bring the following documents.

Passports: For adult passport renewals, in addition to the completed DS-82 application, provide one recent color photo with a white background that measures 5x5 cm (2X2 inches), your passport, and a photocopy of the photo page of your passport. The fee for an adult passport renewal is currently $110. If your previous passport was lost or stolen you will also need to bring a copy of the police report and the fee for the new passport is $135.

You will be happy to learn that you can complete adult passport renewals by mail (or Uno Express). You do not have to visit the embassy in person to renew.

For minor passport renewals, in addition to the completed DS-11 application, bring a copy of the photo page of the minor’s passport, a copy of both parents’ passports /cedulas, one recent color photo with a white background that measures 5x5 cm (2X2 inches) and a copy of the minor’s birth certificate, in addition to the original birth certificate and passport/ cedulas. The fee is currently $105.00 for a minor (under 16) passport renewal. The minor and both parents or guardians must appear in person. If only one parent is present in Panama, the “Statement of Consent from Absent Parent” Form DS-3053, notarized in the U.S., is required. Please note that the DS-3053 will not be accepted if notarized in Panama.

Notarizations: If you are requesting the notarization of your driver’s license, bring a photocopy of the front and back page of your license, as well as your license. If you are requesting notarization of benefits documents, bring the original and a copy of the document(s) showing the amount of benefits you receive monthly or annually. The notarial fee is $50.00 for each signature of the Consular Officer. Visit this US Embassy webpage to learn all the details regarding getting a document notarized there or at the visiting ACS unit.

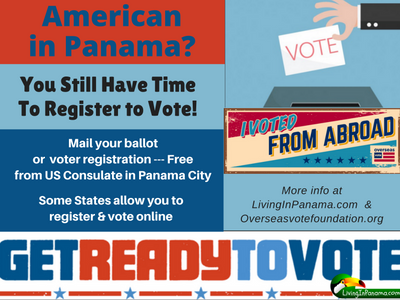

Voting: You can submit your completed absentee ballot, no postage required, at the travelling ACS unit (or at the US Embassy in Panama City).

If you haven’t yet registered to vote or requested an absentee ballot, you can find out how to do those things by visiting the Federal Voting Assistance program's website. I also explain how US citizens can register and vote from Panama in this post: How To Vote in US Elections While In Panama.

LPR Abandonment: Bring completed form I-407 and a photocopy of your Permanent Resident Card, as well as your Permanent Resident Card. (Filling out this form means you decided to voluntarily abandon your status as a lawful permanent resident of the United States.)

The Embassy stresses that all your copies of the required documents, noted below, need to be legible.

SSA Proof of Life: If you are required to comply with this requirement, please bring your cedula or passport.

Medicare Enrollment/Cancellation: To enroll in Medicare, you should complete and sign form CMS 40B. To find out more about Medicare eligibility and how to cancel your participation, this US government Medicare page is a good place to start.

Social Security Replacement Card: Bring a copy of your valid U.S. passport and completed form SS-5FS.

Social Security Card for child under 12: Bring a copy of the U.S. passport for one of the parents, the child’s “copia integra” birth certificate, and the child’s U.S. passport (as well as copies) as well as completed form SS-5FS.

Change of Address for Social Security: Bring your current passport or cedula.

International Direct Deposit Enrollment: You should bring the necessary form and whatever other documents the form instructions requests. Before the ACS visit, e-mail the SSA Federal Benefits Unit ([email protected]) to request the enrollment form.

You can get more information on getting your Social Security checks directly deposited into your bank account (in the US or in Panama) on this US Embassy webpage.

If you live in Panama and have questions regarding Social Security, you must contact the SSA Federal Benefits Unit (FBU) located in Costa Rica. For more information on their services and how to contact them, please visit their webpage.

For comprehensive information on SSA’s services abroad, please visit SSA’s Service Around the World.

Also, I wrote a post about how to continue to receive SSA benefits while in Panama.

There are several websites that will help you both register to vote and vote. In many cases you can do these online. Some states allow voting by email or fax.

For resources on how to vote as an American overseas go here.

The US Consulate in Panama City has special postage paid envelopes available.

You can also create your own with a blank envelope and a printer. You can get the necessary information to print your own envelope from one of the online voter assistance websites for Americans living abroad. For instance, the Federal Overseas Assistance website has all the information you need for your envelope at this link.

Are you in the Chiriqui Province? The US Embassy is visiting David & Boquete on October 12th. You can hand in your absentee ballot during their visit. Don't have your absentee ballot yet? go here.

The US consulate is open only from 8 a.m. until noon. You don't need an appointment.

Take your envelope to Window 14 at the consulate.

The US Consulate is in the American Embassy complex in Clayton. You can visit the US Consulate in Panama's current voting information, by clicking here.

The US Consulate does not offer overnight mail. You should count on it taking 2 weeks for your ballot to reach its destination.

For the US Presidential election on Nov. 8th, the Consulate recommends that you get your ballot to them no later than Wednesday, October 26.

If it is less than 2 weeks from election day, you should overnight mail it using FedEx, DHL, or other service.

You also might want to contact your state election office to discover if you can fax or email it.

One or more of these sources for overseas voting should help you find out more about your options.

Please comment below

The video also includes Google Earth and Map images. This should give you a good context on the lot's location.

There is a link below the video if you want more information about the property. And, of course, we are always happy to answer your questions by phone or email.

[leadplayer_vid id="57E847F53D84A"]

..

Go here to browse all our Puerto Armuelles real estate

In fact, soon after our announcement our very first student began receiving one-on-one English conversation practice.

He appears to be advancing in his English speaking and listening proficiency at a very rapid rate. This student is highly motivated and also spends several hours each day listening to podcasts in English, as part of his self-created “English Immersion” program.

Obviously, we are still in the formulation phase of our project. We have no fixed structure in place. While we are still uncertain about the details, we are certain that there is a need for such a program. The best way to learn English is by being exposed to native English speakers.

If you are interested in participating in any way, please contact us.

Perhaps you have skills that could be useful to the program, even beyond simply tutoring in English. We are especially interested in talking with someone who is skillful in coordinating communication among the students and volunteers in the program. We are looking for volunteers to:

I am positive that I am not capable of all of the emails, texts, etc…that may be required, as the program gains momentum. However, I am available to participate in developing the process and introduce new tutors and students to the program. As the program grows, as I am sure it will, I may even be able to provide a physical space in Puerto Armuelles for holding classes, or one-on-one tutoring sessions.

Over the next year or so, it would be wonderful if we could offer English conversation opportunities to a 1 - 2 dozen motivated young people in Puerto Armuelles.

Hopefully, this program will help increase the English language proficiency in Puerto Armuelles. Fluency in English will certainly give these young people access to many opportunities in fast-developing Panama.

In recent months, we have talked with more expats who have plans to move to Panama, and Puerto Armuelles. Some of them already have a desire to help the young people of Puerto Armuelles. Many have also said they'd be interested in volunteering in the English tutoring program. Added to the longer-term expats in the area, we should be seeing a growing pool of potential volunteers.

Tutoring a young person from Puerto Armuelles in English is a great way to get involved in the community, in positive way, without making too big a commitment.

Not a Permanent Commitment

If you want want to volunteer, but don't want to commit, that is perfectly fine. You can assess as you go along. You can see if you would like to increase your participation, or back out if you discover you don't enjoy it. No worries or judgements. But for some expats, retiree or otherwise, this could be just the sort of adventure that they have been looking for.

An Exchange Program

We have also gotten requests for Spanish language lessons from local expats, particularly from retirees. For this reason, the idea of a “language exchange” program has emerged.

An exchange, or “intercambio” is a great way for an expat to share their own English language skills with a local youth. In exchange, the youth would help you to learn Spanish. This kind of program has been successful in many places. There is no reason that it couldn’t work for us here in Puerto Armuelles.

Please let us know if you are interested in participating in an intercambio.

Please let us know if you are interested or have any comments or suggestions.

1) There is a lot of it. So there are many opportunities of buying the location you want at a price you can afford.

2) Vacant lots cost less. Somewhat surprisingly, even a lot with a structure that looks like it should be torn down, is priced higher than a similar lot with no structure. Check it out for yourself. There must be some psychological reason for this.

3) Investing in a vacant lot carries very low overhead costs---and there is usually very little maintenance required.

4) You get complete freedom to build & landscape the way you want. You decide where on the lot the house will be built, and what it will look like. You decide the look and feel of your property. If you have never gardened before, this is the place to get started. To cultivate many species, you simply get a cutting, stick it in the ground, and water. If you plant in the rainy season, you can skip the watering part. The term tropical paradise fits gardening perfectly here.

In Panama, you can buy a lot in the jungle with no infrastructure around --- not even a road --- or you might choose a lot in a sub-division, a place that has everything you need in place, ready and waiting for you to build your home.

More Remote = More Hidden Costs

Obviously, a lot that has everything ready to build your house will have no additional development costs. While a remote jungle lot could have very high development costs. Development costs are all the expenses necessary to get a site ready to start construction of a home.

Before you jump to the conclusion that an undeveloped lot is a screaming deal, you must factor in all the hidden costs. That is, how much will it really cost to get the property into “ready to build” condition.

The True Cost = Sales Price + 4 Hidden Cost Factors (described below)

You should calculate the true cost of a lot before you decide to buy. This is true even if you only plan to hold the property and sell it when it goes up in value. Most likely the person you eventually sell the property to will want to build on it. You need to make sure you are buying a lot that will be attractive and affordable to your future buyer.

Cost of the road or driveway will depend upon the lot’s

If you fall in love with a lot that is far from an access road, it will obviously cost a lot more to develop than if your lot is near, or on, an already established access road.

If the property is on a steep slope, that will open up whole new realm of hidden costs. Not only will the road cost a lot more and take more time, but you will have to deal with erosion and drainage issues. In a hilly area, you must take care to consider what to do with the water runoff so your new road won't be come a mud disaster. One key to a successful road is to put it in the dry season, not the wet season. After all the work of creating the road, you want it to stay usable for years to come not be washed out in the next big rain.

If you want to keep your road development costs down, or at zero, you should pick a lot that is

Google Earth - A Real Estate Tool

With Google Earth you can discover topographically challenging lots from the comfort of your computer. And you can use it to get a feel for the property before you visit it. Google Earth is free and can be used with both Apple and PC computers. To use it, you need to download the software and then search for your property by using its address or coordinates.

Now comes the fun part. You can zoom in using your mouse/curser and the command (control for PCs) and shift keys on your keyboard. Using the same controls, you can tilt the earth so you can see precisely where all the hills and valleys are on the lot and in the surrounding area. If you don’t know the lot's coordinates or address, you can usually find them using Google Maps (if you can locate the lot by sight), or by asking the seller for them.

Now that you can access the lot, you need to get it ready for constructing a house.

Ideally, your site is already level. Or it could simply mean removing some trees (just make sure to get a permit to do that) or adding a moderate amount of fill to level out the site.

If you are building on a slope, it will be more complicated. You may need a major earth building project including retaining walls and or drainage system.

Make sure you get a good ideas of the cost of these steps or it may come as an unwelcome surprise.

If you want to keep your site development costs down, or at zero, you should pick a lot that is

We have many affordable and beautiful lots. Almost all of our lots are ready to be built upon. No site or road development is needed. Many already have full utilities, or we offer to do that work at no extra charge. All are in the Puerto Armuelles area.

You can explore our properties by clicking here or using the property search tool at the top of the page.

Now on to getting utilities to your building site.

Generally, there is electricity available along all of the main roadways and neighborhood streets in Panama.

In Remote Areas

If you are buying a farm, or other remote property, you will be responsible for bringing in electrical power from the nearest road, where you will access it via overhead power lines. You will need to install your own power poles, or underground conduit, to access this power. And of course, you will need a licensed electrician to obtain an electrical permit, even if you are going to do your own electrical installation.

Alternatively, you can always decide to be completely off-grid. Just be sure to factor in the full cost of setting up and maintaining your own electrical system. Of course, if your lot is extremely remote you will have to go off-grid.

In Developed Areas (e.g., Puerto Armuelles)

In Puerto Armuelles, we generally have good access to power lines by our electrical utility provider (Union Fenosa). This makes electrical installation simple.

Once you start to build your house, you can connect the meter to the house in 2 ways. You can either hang an overhead line, which enters through the roof of your home, or you can install underground conduit, with the supply wires running inside. These wires connect the breaker panel to the electrical meter at the property line. From the breaker panel, you can do your own rough in wiring, or hire an electrician.

You can live without electricity, but not water. How will you get water to your lot and future house.

In Remote Areas

Before you buy a property in a remote area, make sure you know how you will get water to the site. It is likely that you are going to have to dig a well. If it is a well, check with an engineer to verify that you can actually build a well. Find out how deep a well you will need to dig. Then calculate the cost. If you are told there is a well there already, I suggest you check this out and test the water.

About Digging Wells

The good news about well digging in the rural areas around and as well as in Puerto Armuelles, is that it is very cheap. In most cases, wells are dug by hand, using a shovel. Our soil is silty/sandy, and it has no aggregates. (This is why it is not the most stable building substrate, and building footings should be deep and use plenty of steel reinforcement).

In short, a laborer digs your well, and then you line it with concrete pipe sections which are available in 4 foot lengths, and in many diameters from 10" to 2 or 3 meters.

Please be aware, hand digging is dangerous for the laborer. You should check with the municipal engineer to find out the details for doing this safely and if the person doing the work is covered by insurance. You can make it safer by having the hole supported, or "cribbed" during the excavation.

The pipe sections used to line the well are very heavy. You will need to schedule a back hoe to have them installed. You might just opt to use a back hoe for the entire well digging process, however the result will be quite sloppy. Back hoes cut a very wide hole. All that dirt will need to be stored on site until it is back filled. The dirt excavated for the actual well hole will need to be stored or used permanently either on site, or off site.

And, of course, you can also employ a well drilling company. There are some located in David. Just look them up on the Internet. I have not used a well drilling company yet. Obviously, this is the most expensive well digging option.

In Developed Areas (e.g., Puerto Armuelles)

In Puerto Armuelles (and other developed areas), most locations have access to the municipal water supply.

Hooking Up Water

To gain access to the municipal water supply, you simply cut in a connecting hub, or collar, into the ABS water line that runs alongside the street nearest your lot. In Puerto Armuelles, this ABS pipe is likely to be 3" in diameter.

You can buy a connection collar at most of the local building supply stores in Puerto Armuelles. You will need a permit both for the water supply line hook up and for any necessary street cut for the new pipe. You will only need a street cut permit if the city water line happens to be located on the opposite side of the street from your property. This street cut is performed by MOP (Ministry of Public Works).

I am fairly certain that you can apply for your own permit. However, for the $20 that my plumber charges to do all the legwork of obtaining permits, I never get my own permits. At all costs, I try to avoid waiting in lines at all of the various municipal offices. I don't have the patience.

Service & Expense

Generally our water service is good. The water is abundant and cheap. Our bill is under $5.00/month for unlimited use.

Interruptions in Supply

Many locations in Panama, including Puerto Armuelles, still experience occasional water shortages. In our area, these are not actual shortages, but rather interruptions to service. Water service is temporally shutoff due to a highway building project, or occasionally, storm related damage to a water supply pipe during heavy rains. Such interruptions are becoming less and less frequent. This is certainly not a chronic problem anymore, not the way it was 10 years ago. In addition, the water to our neighborhood is shut off in the afternoon everyday. I have never been clear about exactly why this is done. But it is the reason almost every house in our neighborhood has its own water tank.

Install A Water Tank

It is never convenient to be without fresh water, even for a few hours. The easiest way to overcome this is to have your own water storage tank located on your property. That way, you won't even notice when the municipal water supply is shut down for an hour, or even an entire day. You will have your own backup supply on your property.

At our house in the Las Palmas neighborhood we have a 140 gallon emergency tank. It is raised up on a platform about 12 feet above ground. It fills whenever there is city water pressure. When the municipal water fails due to road work, which has been pretty common with the new highway construction, or due to the new water and sewer system being installed in Puerto, we are covered. We also use it everyday as the source of our water after the city water is mysteriously turned off for the day. We have a gravity feed from this elevated tank directly to the house---we don’t use a pump. It has been years, since we were absolutely “out of water”.

Water Drinkability

Generally, water is drinkable in Panama. Bocas del Toro is the only blanket exception to this rule. In addition, at times, Panama City has issues with its water quality.

But again, overall, Panama's water is perfectly drinkable. Much more so than some areas of the US (not even including Flint, Michigan). My daughter still reminds me of how truly horrible the water is in the elegant neighborhood of Washington D.C. where her grandparents live. My parents happily drink that water. They are used to it. My children considered it to be unfit for human consumption.

Although the water in our town is drinkable, most expats and many Panamanians filter or buy bottled water. Many people (like us) get bottled water delivered to their home. Some people are concerned about water quality, but many people do it for aesthetic reasons. In the rainiest times of the rainy season, the water from the tap can look cloudy. That is what prompted us to start drinking bottled water. We always use tap water for cooking, but for drinking we use bottled water. At least we do at home, when we go out we happily drink the tap water.

You must include the cost of taking care of all the outflow from your home as well. How you take care of this depends upon where your lot is located.

Out of Town & Remote Areas

Sewer service is only available right in town, or along the main roads. If you are not in town, or on a main road, you will need to invest in a septic tank.

You are supposed to get a permit for most plumbing projects, including a septic tank. This application must be submitted by a licensed plumber, even if this plumber is not going to do the work. Talk to your neighbors to learn more about how this septic tank permit & installation process is usually done in your area.

Installation of Septic Tanks

There are a variety of methods for installing a septic system. The very poorest people in Puerto Armuelles simply dig a deep well, line it with old car tires, and run their pvc waste line into it (or put an outhouse on top).

Most locals who can afford it, build 2 separate septic tanks out of concrete block.

The 1st one, in line from the house, captures the solids and lets the liquid flow off the top toward a secondary tank. This 2nd tank is filled with large round drainage rock. (This rock is available from local rivers. It can be delivered to your building site by local truck operators.)

This 2nd tank provides a drainage “field” which leaches out into the surrounding soil, and hopefully, filters out all dangerous bacteria, before flowing to a nearby stream, or the ocean.

You can also purchase black plastic (ABS) molded tanks from local building materials suppliers, or from suppliers in David. Most suppliers in David offer delivery services to Puerto.

In Town - Sewer Connection

If your lot is in town, or off a major road, you can hook up to the municipal sewer system. To connect to the municipal sewer pipe on your street, again, you must apply for a permit. Again, this application must be filed for by a licensed plumber, even if this plumber is not going to do the work.

The connection is a simple matter of cutting in a connecting hub to the municipal sewer line, usually 6” pvc pipe. Generally, homeowners connect their own 4” pvc pipe to this 6” pvc pipe. It is a simple procedure. Pipes are not buried very deeply. Generally not over 3 or 4 feet. Given that our soil is silty/sandy, this kind of work can usually done with a couple of laborers with hand shovels in half a day.

The entire connection process, including plumbing and backfill, shouldn’t take more than a day. That is, after you have the permit in hand.

Before you buy a lot, you should estimate the cost of permits, materials, and labor to get utilities to your building site.

Obviously, if all your utilities are already delivered to your lot, you will be saving both money and headaches. If your lot is in a remote area, your "get your site ready" development costs will be a significant part of the true cost of your lot. Also, don't forget to factor in the amount of time it will take to get all that infrastructure into place.

The bottom line: Is the lot worth the price?

To know that, you first need to know the true cost of the lot. True price = Sales Price + 4 Hidden Cost Factors

Which Is The Better Buy?

Calculating the true price eliminates many unexpected expenses. It also allows you to knowledgeably compare seemingly diverse properties. For example, knowing the true cost of properties allows you to know which of these similarly sized and located lots is a better buy:

Hopefully, you now have a better understanding of what it means to buy an empty lot. As we explained, depending upon the lots location, getting an empty lot ready to build upon can be very easy or very challenging process.

“When I grow up,” Paul proclaimed, “I am going to build myself a house out of trash”.

(FYI - He never did build a house of trash. He teaches painting at Penn State)

I certainly wasn’t interested in living in a house made out of trash. It sounded kind of, well, trashy.

That was in 1979.

Fast forward 30 years, and nobody calls it “trash” any more.

Today we use the terms “recycled material” or “Post Consumer” material. We’re all building out of recycled materials, whether we realize it or not.

The fact is that many parts of our homes are made out of “trash” today. Thank goodness for recycling.

With 7 billion people living on the earth, and with the continued promotion of the “American Dream” (ie, a high consumption, high environmental cost, standard of living) there is going to be an ever greater need to get creative about using recyclables in home construction.

In Seattle, where our family is from, many creative remodelers and builders visit the Boeing Aviation Surplus Store to find such crazy building products as aluminum honeycomb fusilage, or solid aluminum bar stock “I-Beams”, and you name it. It’s pretty high tech stuff, but it appeals to a certain type of designer builder.

For instance, on an loft apartment/art studio project in which I participated, our crew used aluminum honeycomb panel fuselage material as the floor in a sleeping loft. Aside from being super cool to look at, since the hexagonal cells of the honeycomb were visible on the exterior sheet surface, the material was so rigid that it required no structural supports, other than the perimeter walls. Obviously this material calls for a different approach to building (ie, practically no framing support). This results in a very clean, ultra modern look. It wasn’t a look that I particularly liked for a human dwelling. It wasn’t traditional, cozy, or “homey”. Rather, it was “defiant”, “impervious”, “edgy”. It certainly challenged the viewer’s normal sense of what constitutes a home.

Of course, you can also find much more traditional recycled building materials in Seattle. There are many, many recycled building supply centers in Seattle, as there are in most metropolitan areas of North America. You can find old fir warehouse beams, recycled bowling ally floors, stained glass from old churches, antique bar mirrors and surrounds from 120 year old hotels.

When one comes to Panama, one doesn’t think about recycling. Most buildings are pretty new and made of cement.

However, Puerto Armuelles is unique here. What we have is a company town, former home of Chiquita Banana Company. “The Company” as it was known, imported most of the materials used to build the town of Puerto Armuelles, literally from the ground up.

If you have ever get the chance to explore inside an old Chiquita Banana house, up on stilts, you will surely discover lumber stamps from Portland, Oregon where this gorgeous, old-growth red cedar was milled well over half a century ago.

If you know anything about lumber, then you also know that the quality of the 2”x4”, 2”x6, 2”x8” framing material, as well as the 8”x8” and 8”x 10” support posts and beams is of such standard that has not been available as building material in North America for decades.

If one purchased it in the states today, the wood in the old Chiquita Banana Houses would be considered “furniture grade” and probably cost in the $15-$25 range per board foot—prohibitive for home building. I wouldn’t be surprised if our own house in Las Palmas contained over $50k worth of clear, old growth cedar.

If you look at the tightness of the growth rings, you will see that none of these trees could have been younger than 1000 years old. I love this beautiful old wood. Still, I’d much rather see the wood in the forest than in my house.

In addition to clear, old growth cedar, some of the more recent vintage Chiquita Banana Houses are built using the identical plan as the original Chiquita houses.

However, the newer models, dating from 25, 35, even forty years ago, are built from other exquisite woods. That is, these houses are built of dimensional lumber logged directly from the jungles (now, former jungles) of our own Punta Burica.

Just as the original Chiquita houses were built of ancient Cedar trees, so the newer generations of Chiquita houses are built of local, but equally ancient forest trees. Species such as Teak, Sangrio, Espave, Kirra, etc. A couple of these woods, particularly teak have very good resistance to termites. Sangrio and Kirra are gorgeous furniture quality hardwoods that are really too hard to be good framing material. They require pre-drilling, prior to sinking a nail.

As for the logic of cutting down a 10 foot diameter ancient rain forest tree in our local jungle just to make an 8”x8” structural post or beam in a Banana Company house, some of us have different views. I suppose back in the days of Chiquita Banana in Puerto Armuelles, nobody ever thought that the world would ever run out of wood. If you are from Canada, it might seem that there is still an endless supply of old growth trees.

I am not suggesting that one purchase Chiquita Banana houses and begin disassembling them and loading them into containers for export. But, rather, I am saying that there is a huge quantity of amazing building material available for those who are on a tight budget, but who have creative energy to burn.

Many of the original Chiquita Banana houses have fallen into disrepair. Since the local builders have a strong preference for building with concrete, many of these Chiquita houses just get scrapped, or used as concrete form boards.

A thorough search in the various neighborhoods of Puerto Armuelles would surely turn up some excellent salvage. I am guessing that one could purchase adequate salvage material from old Chiquita Banana houses to build an amazing beach house, for a couple to 5 thousand dollars.

This includes studs, joists, cedar siding, and super heavy duty galvanized roofing. There are still even a few old Chiquita hand washing sinks and toilets floating around in town.

I do not want to contradict what I said earlier about wood not being a desirable building material in our coastal/tropical climate. I stand by that opinion, if you are building a conventional house, using conventional methods and utilizing the labor force available in Puerto Armuelles at the present time.

Find out more, by reading why you shouldn't build with wood in Panama and why remodeling a wood home is not the best idea.

However, if you are artistic, high energy, and want to build something super inexpensive, something that is truly unique, and truly yours, building with Chiquita salvage could be ideal.

I think you might be able to come to Puerto Armuelles, buy a bargain priced lot for under $5k, and put up a completed structure, made primarily of recycled Chiquita Banana surplus.

The final product would be limited only by your own skill and imagination. This entire home could be built for well under $5k (total price for house and land under $10k).

Obviously, this sort of a challenge, and this kind of lifestyle, is not for everyone. However, if this sort of thing sounds like a fun adventure to you, you have come to the right place. Puerto Armuelles is a great place to experience this sort of an “alternative” eco- building lifestyle.

I have only mentioned Chiquita wood salvage so far, but Chiquita Banana imported other great materials as well. For instance, you will notice shortly after arriving in Puerto Armuelles, that many of the local fence posts are made from railroad rail, salvaged (stolen?) from the narrow gauge Chiquita Banana railroad tracks.

These tracks ran from the banana fields all the way to the shipping pier in downtown Puerto Armuelles. The train also ran to David. Some folks have reused this rail to build house posts, beams, storage buildings, hoists, racks, etc…

Imagine a practically unlimited supply of railroad rail. If this starts your mind thinking of possible projects, then you are the person I was hoping to communicate with in this article.

In addition to railroad rail, Chiquita imported miles of steel plumbing pipe, as well as some super thick walled steel tube section, both round and square.

Some of this material is still being sold just for its scrap iron weight. However, the salvage market is certainly getting more competitive, as materials prices go up. However, it depends on how good a scavenger you are.

If I could show some of this Chiquita Banana salvage to my friends from architecture school, they would probably have heart attacks. All this salvage, and very few people who have the design skill to take advantage of it.

If you have any questions about recycled Chiquita Banana building products, or about alternative building methods, in general, please contact us. We are always happy to share with you what we know, and we are eager to learn anything that you might be willing to share

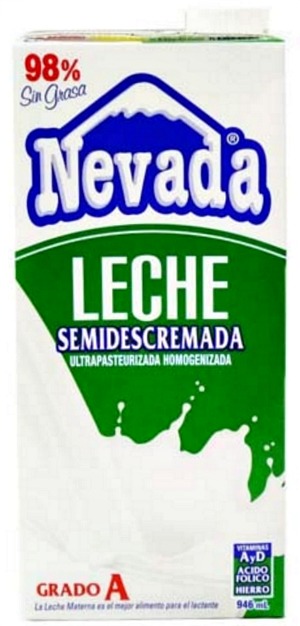

(Scroll down for how milk is made to have a long shelf life.)

You can also easily buy refrigerated milk in Panama. But I found the taste was not consistent. Sometimes it would taste fine, and sometimes it was a little off. Not off as in going bad, just different.

I have learned to love the boxed milk. Now I prefer it. I really don't like running out of milk for my coffee. In the States, I keep a few cans of evaporated milk as a back up. In Panama, a case of boxed milk.

Boxed milk means I don't have to run to the store nearly as often.

The Chiriqui Province, where we live, annually produces over half of the Grade A & B milk in Panama. The Azuero region produces the rest, focusing more on Grade C milk.

Panama’s milk brands include Bonlac, Estrella Azul, Nevada and La Chiricana.

Dos Pinos is also sold in Panama, but it is a Costa Rican brand. Although I hear that Dos Pinos bought both the Nevada and La Chiricana milk companies.

La Chiricana

Locals have come up to me in Romeros (supermarket) to let me know the best milk to buy is La Chiricana.

It is the most popular milk in Panama.

I do like the milk. It is what we usually buy. I haven't tried it's newer low-fat milk which is called, Fit.

Dripping Issue

The issue I have with La Chiricana is that it is impossible to pour milk from the carton without dripping. Frustrating. Which means I not only have to clean up the drips off the counter, but the carton always leaves a tiny milk puddle on my refrigerator shelf.

Life's little trials.

Nevada

If dripping cartons are unacceptable, try our 2nd favorite milk, Nevada. Nevada comes with a pour spout. No more drips!

We used to regularly buy Nevada milk, pictured, when we drank low-fat milk. That was before La Chiricana came out with its low-fat option (Fit).

Nevada offers whole, low-fat, non-fat, and lactose-free milk options. They even have a 2 milks with oatmeal (avena) added (in graphic above)

Bonlac

I have tried Bonlac and I don't like it. I did not like the taste.

Bonlac also offers flavored milks in small child-sized boxes. Very sweet milk. It's strawberry (fresa) and vanilla flavored milks are in the graphic above.

Estrella Azul

This is the milk to buy if you are buying refrigerated milk. I think it tastes the best.

However, we have found that the taste of refrigerated milk can vary, and not usually for the better. It doesn't taste like it is going off, just strange. It is the main reason I gave up on refrigerated milk and started buying boxed milk.

You can get some specialty milk in Panama, such as

In some parts of Panama, you can go to the dairy and buy raw milk.

In the past I have bought milk from right from a farmer, still warm from the cow's udder. I don't do that anymore. The kids were not crazy about the taste, which also was inconsistent. Also I felt compelled to pasteurize it myself on the stove. This was a pain in the neck.

When I was growing up we had raw milk delivered to our house. But it was raw certified milk, meaning it had been tested to make sure it was safe.

I found it interesting that the milk I bought from the farm had very little cream. Much less than I had experienced when drinking raw milk in the States. I am not sure if the farmer skimmed it off before giving it to me, or if it came from a low-fat producing breed of cow, or..

In our area, Finca Santa Marta offers organic goat's milk for sale, as well as a wide range of organic produce, chickens, and more. You can even order online at this link.

Dos Pinos does sell a bag of heavy milk that I have successfully used to replace heavy cream in recipes. Particularly a hot fudge sauce recipe my family loves. I wouldn't use this heavy cream in my coffee though. It has a unique after taste. Unfortunately, at least in my town, this heavy cream is not always available.

Caution: Dos Pinos also sells sour cream in an identical looking bag. The bag is small, cream colored and about 5 x 2 inches. Sorry, I don't have a photo of it.

Researching what they do to make milk able to sit on the shelf for 6 months was eye-opening.

But not in the way you think.

I didn't know I had been drinking the milk, even in the States, without realizing it.

Most refrigerated milk, esp. Organic, sold in the States goes through the same Ultra High Temperature (UHT) Pasteurization as non-refrigerated milk.

See the chart for details.

The only difference between UHT pasteurized milk that is refrigerated vs. non-refrigerated is the container. The non-refrigerated milk goes into a sterile box which is made of layers of various materials.

They refrigerated UHT milk in the States because Americans distrusted the warm boxed milk. So they gave us the same milk that is in the boxes, but sold it in the refrigerated section and in familiar-looking cartons. But they didn't tell us. I had no idea.

Popular in Europe & South America

Non-refrigerated milk is very common in Europe and throughout Mexico and South America. I do not know if it is common in Canada or not.

I'd be interested in hearing from someone who does know. Have Canadians embraced boxed milk? (I have heard you can buy milk in bags in Canada. Is that so?). Please comment below.

UPDATE: Sarah and Roger graciously left a comment saying that boxed milk is the norm in Canada. And that buying milk in bags is also very common. See the comment section below for more.

In Panama, a gallon of milk is $4.34 - $5.25.

In Panama, boxed milk ranges from about $1.34 to $1.70 a quart. (It only comes in the quart size.) So in order to buy a gallon of milk, you'd have to buy 4 boxes, costing from $5.36 to $6.80.

For comparison, a gallon of non-Organic milk in Seattle costs from ~$2.69 - $3.49.

I don't know why milk is so expensive here. Maybe it is because Panama does not produce enough milk for its needs so it has to import a significant quantity of milk.

Well, that is about all I can think to say about milk in Panama.

If you have anything to add or any questions, please share them in the comments below.

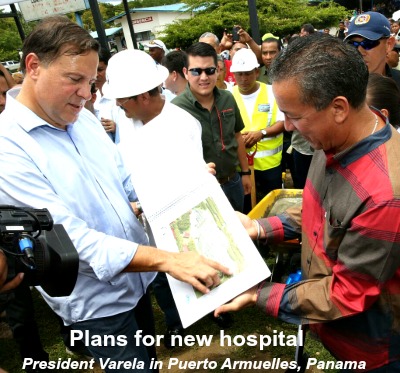

Thurs, September 8, 2016

A crowd of Portenos had assembled to hear him speak.

Puerto Armuelles will have an all new hospital. The new facility will include:

It will happen in 3 phases.

But while the new hospital project is a positive backdrop for President Varela’s visit, the crowd gathered were more interested in knowing:

“What are you going to do to boost our local economy here in Puerto Armuelles?”

Residents of Puerto Armuelles are somewhat skeptical of the promises of President Varela, as they were of previous presidents. After Chiquita Banana left Puerto Armuelles, now about 15 years ago, presidential administrations have all promised projects to bring economic vitality to Puerto Armuelles.

Today, President Varela explained that he is fulfilling his promises to Puerto Armuelles residents.

First of all, the current negotiations with Del Monte to take over the Chiquita Banana plantations are almost complete. (These negotiations have been in process for over a year.) The President has signed the final executive approval for Del Monte to begin work. All that remains is the final approval by the legislature. (Find out more about the Del Monte banana deal here).

President Varela anticipates that the deal will be passed by the legislature in the near future. He predicts that Del Monte will start operations in early 2017.

The Panama government has negotiated with a few other banana companies (including Chiquita) since Chiquita left Puerto. But none, have gotten as far into the process as Del Monte.

Del Monte will employ up to 3,000 workers in Puerto Armuelles.

I'm sure Del Monte taking over the banana plantations will contribute to the current upswing in prosperity in Puerto Armuelles. The renaissance of the “Green Gold” can only be good for Puerto. (Green Gold was the a name used for bananas during Chiquita's reign of Puerto Armuelles.)

In addition to President Varela’s announcement about the imminent arrival of Del Monte, the president also touched on the continued investment in the new, 4 lane highway into Puerto Armuelles.

Road out to Limones

Varela stated that he had approved the funds to continue this new highway all the way out to the fishing community of Limones. Limones is 12 kilometers past Puerto Armuelles, on the Punta Burica Peninsula.

Over the last decade, the road to Limones has been upgraded several times. But the work has always fallen short of a long lasting and paved road. All past work on the road, has been partial at best and it has always fallen into disrepair very quickly.

This time, President Varela said, the work is going to be done right.

The President stated that, with these and other positive investments, the Puerto Armuelles community will continue to reap the benefits of the higher quality of life so much of Panama is enjoying.