We’ll discuss:

Note: No tourist visa is necessary to visit Panama for most tourists*. To enter Panama, you only need:

Wherever you enter Panama, the immigration official will put a stamp on your passport stating you can be in the country for 180 days.

NOTE:

You qualify for this type of visa if you receive at least $1,000 per month from a pension, retirement fund, or other types of reliable income source. Don’t receive that much? If you buy a property for at least $100,000, then you only need a monthly retirement or pension income of $750.

Since August 2021, this friendly and easy-to-get visa is not nearly as friendly or easy to obtain. To qualify, you must be a citizen from one of the 50 friendly nations* and must either buy a property in Panama for at least $200,000 or be employed by a Panama company professionally.

*Citizens from any of the 50 nations considered “friendly” to Panama can move here with their immediate family and acquire a permanent residency visa. Andorra, Argentina, Australia, Austria, Belgium, Brazil, Canada, Chile, Croatia, Cyprus, Czech Republic, Denmark, Estonia, Finland, France, Germany, Greece, Hong Kong, Hungary, Ireland, Israel, Japan, Latvia, Liechtenstein, Lithuania, Luxembourg, Malta, Monaco, Marino, Montenegro, Netherlands, New Zealand, Norway, Poland, Portugal, Serbia, Singapore, Slovakia, Spain, South Africa, South Korea, Sweden, Switzerland, Taiwan, United States of America, Uruguay, United Kingdom (Great Britain & Northern Ireland).

A fast and affordable visa to obtain, but only good for 18 months. However, if you are a remote worker, who earns at least $36,000 a year from that work, you should consider applying for a Panama Digital Nomad Visa.

All of the reforestation investments must be held for a period of 5 years, and they can be made in your personal name or in the name of a Panama entity, corporation, or foundation.

This has three options to qualify for this visa created to attract wealthy foreigners

If you're an Investor, you have 3 options to obtain expedited (30 days) permanent residency in Panama (leading to citizenship and a Panama passport after 5 years) with this program

If you have been offered a job in Panama, you will need to apply for a work visa that allows you to reside and work professionally within the country. It is important to check with your employer or a professional lawyer as to what other documents and information may be needed for the work visa application process.

Whether you want to stay in Panama for a short vacation or move here permanently, there is a visa that is right for you. If you have any questions about which type of visa you need, I would be more than happy to provide guidance.

It is the day, in 1903, that Panama gained independence from Columbia.

Normally, there are parades. People tend to spend the day at the beach BBQing, drinking, and having fun.

During Covid, there were no parades. And although people were allowed to gather at the beach, it is unlikely there was much in the way of gatherings. However, this may have been true even without Covid, typically, the rainy season is especially rainy during the month of November.

Also, Separation Day is a dry day. No alcohol is served or sold. You can drink 'em if you have 'em though.

Throughout the month, you will still see schools, cars, and shops decked out with the Panamanian flag as usual.

Below is the list of the other Independence-related holidays in Panama that will also be quieter and lacking in parades.

November 4 – Flag Day. The day after the announcement of the separation from Columbia, Maria de la Ossa de Amador secretly started to design the Panamanian Flag. Her design became the official flag of Panama in 1925.

Normally, on Flag Day there are numerous parades with many displays of national pride throughout Panama. But again, not this year, due to the coronavirus.

November 5 – Colon Day. This is to celebrate the independence fight from Columbia that occurred without a shot being fired. The US had something to do with it. Read about Panama's independence from Columbia here, to learn more.

November 10 – The Uprising of Los Santos. This holiday commemorates Panama's 1821 struggle to gain independence from Spain. The day is typically celebrated with colorful parades, traditional folk music, and dancing. Hopefully, all those forms of celebration will return next year.

November 28 – Independence Day from Spain. Officials in Panama City declared independence from Spain in 1821 but fearing retaliation, joined Gran Columbia, which is now present-day Columbia, Panama, Venezuela, and Ecuador. (NOTE: Unfortunately, for years Gran Columbia ignored the needs of its newest addition, Panama. There was an uprising, which failed. Then the US helped out, and Panama was quickly independent without a shot being fired.)

I read a recent interview with Marixa Lasso, a Panamanian historian and researcher, who wrote the award-winning book, Erased: The Untold Story of The Panama Canal. In the interview, Marixa Lasso was asked, "Which was more liberating: Panama's independence from Spain or its separation from Colombia?

Her reply (below) made me more fully realize the importance of Panama's independence from Spain.

“I'll change your question to this: Which of these movements changed the lives of Panamanians the most?

In that case, without a doubt, the answer is independence from Spain, because at that moment our whole way of understanding politics and social relations was changed. We went from being governed by a king to being governed by ‘the sovereign people’ through their representatives and a Constitution. We went from being a society with nobles and commoners, which had countless different laws and privileges for each social group, to one that aspired to a world in which all men were equal before the law. That was a huge change because it marked the beginning of the end of slavery. Or that illegitimate children had the same political rights as illegitimate children, and thus countless categories that divided society into different classes were eliminated. "

To get more detailed information about Panama's Holidays, go to my post on Panama's November holidays.

Most of the celebrations, especially parades, will not be happening in 2020, the year of the coronavirus.

However, government offices will still close and traffic and traffic flow restrictions in and out of Panama City will still be in effect. So keep that in mind.

You can vote in US Elections from Panama, or from anywhere overseas.

Votefromabroad.org makes requesting absentee ballots for US Citizens overseas easy. However, the deadline to request a ballot is different in every state. You can check your state's deadlines on the Vote From Abroad website, here. The Federal Voting Assistance program also provides information about getting an absentee ballot in your state, here.

Many states will send you an absentee ballot via email.

When I request an absentee ballot for Washington State, I use votefromabroad.org. The ballot request form is officially called the Voter Registration and Absentee Ballot Request Federal Post Card Application (FPCA).

The form asks you specific questions about your long-term plans. For instance, you are given the option to say, "my return is uncertain" or "I intend to return" to the US.

If you indicate, “My return is uncertain,” you will receive a federal ballot (i.e., President and Congress). Also, more than half of the states (31) will also send you a state ballot (i.e., governor, state legislature, etc.) for which you are registered.

If you indicate “I intend to return”, even if you have no fixed return date or firm plans to do so you will receive your state ballot for state offices as well as federal elections ballot.

Then, once you are back living in the U.S., you will need to update your residence address with your Local Election Official, just like you do whenever you move. However, you’ll already be a registered voter, so it will be relatively easy to simply update your address. Most states provide an online process to update your address.

You can still register to vote in a few states. But, keep in mind, most states require voters to register at least 45 days before an election.

The Federal Voting Assistance Program website (fvap.gov), allows you to discover your state's register to vote deadlines. The site also provides links for you to discover whether you are already registered to vote or not.

Important: Simply filling out the Federal Post Card Application (FPCA) on votefromabroad.org, does not mean you are registered to vote.

You must submit your completed FPCA to your US local election office. The VotefromAbroad.org website will tell you how to do this. You must do this because only your local election office has the authority to approve your FPCA, register you to vote, and send out your ballot! Depending upon your state, you can email FPCA to your local office, fax it or mail it.

Have you already requested an absentee ballot, but have not received it? You can fill out a Federal Write-In Absentee Ballot (FWAB). The FWAB is the US's back up plan for overseas voters.

Visit the Federal Voting Assistance Program website to fill out the FWAB.

There isn't much more time to return your ballot. When you get your ballot, be sure to fill it out and return it right away. Did I mention the election is only 6 days away!

Electronically

Thankfully, over half of the states also allow you to return your ballot electronically (email, fax, or online upload).

By Mail

All states allow you to return your ballot by mail. If you choose to mail in your ballot–or if your state requires you to do so, you can do so through mail services such as FedEx or DHL or use a courier service. To help ensure your ballot is received by the deadline, follow these steps:

However you send in your ballot, remember that you (the voter) must be the one who places it in the mail or courier service or gives it to an authorized agent for the US Embassy/Consulate. In some states, it is unlawful for any other person to handle your voted ballot, even if it is sealed.

If meeting the deadline is a concern, you can send in a Backup Ballot–that is, the Federal Write-in Absentee Ballot (or FWAB). (See above)

Your ballot will contain the instructions and deadlines specific to your voting state. Please be sure to read and follow the instructions completely!

If you have any questions, contact your local election office.

Confirm Your Vote Was Received

After you send in your voted ballot, be sure to verify that it was received and counted! Contact your local election office for confirmation. Many states also have websites to track your ballot.

For more information on voting overseas and sources for election information, please check out this post.

As I explain in my 5 tips to find a rental in Panama, many rentals are not advertised.

So if you'd like to line up a rental before you get to Puerto, Frank is a good option.

I know Frank well. He is conscientious and professional.

Please Whatsapp or email Frank to describe your ideal rental.

If you are also interested in Puerto Armuelles property for sale, please let me know.

This book is for you if you want to buy property in Panama, but don't because you are either uncertain or scared.

The book covers a wide range of topics in comprehensive detail, including:

After reading this guide, you will have the tools to buy your ideal property in Panama - with confidence & ease.

The book is titled:

Your Slice of Panama Paradise: How To Buy Panama Real Estate With Confidence & Ease (Even During Coronavirus)"

My intention in writing this guide was to provide comprehensive and detailed information on buying property in Panama. So that, armed with this knowledge, you will be able to overcome your uncertainty and go on to successfully buy Panama real estate.

I hope that you find the information in my Panama property buying guide helpful.

If you do find the information useful, I'd very much appreciate you giving me a review on Amazon.

Note: The book is available in 2 formats: Kindle and paperback. (The kindle version has color graphics, the paperback has black and white graphics.) Click here to see the book on Amazon.

Thank you!

February 14, 2020

In the case of Americans, forming a corporation can be a big disadvantage.

You do not need to form a corporation. There’s nothing to prevent you from buying a property in your own name.

Foreigners and locals alike can buy property in Panama - and in their own names.

Remember that the lawyers who insist you need to form a corporation will earn a fee when they help you create your corporation. And annually after that, they will continue to earn a fee (although smaller) to keep it active.

However, there are some good reasons to hold your Panama property in a corporation. I will describe those reasons further on in this post.

The way you choose to hold your Panama property depends upon the property, your needs, as well as other considerations particular to you. There are 3 ways to hold/buy your Panama real estate.

Putting your Panama property purchase in your own name is pretty straight forward. However, before you know whether to create a Panama corporation or foundation, you need to understand them better.

When choosing between holding your real estate in a corporation or foundation, your decision will depend upon how you will use the property.

If the property will generate income, it may be best to set up a corporation for tax purposes (except if you are an American, see below).

If you are going to live on the property, and will not be renting it out, you might consider a private interest foundation which can serve to hold your property, and also act as your living will.

The main difference between a private foundation and a corporation is that a private foundation cannot conduct income-producing business. However, a foundation can own investments such as real estate, other companies, stocks, bonds, etc.

Also, a Panama foundation is not the legal personification of a person or group of persons. There are no particular owners within a Panamanian foundation. That is, the assets of a private interest foundation in Panama represent a separate legal identity from the personal assets of its Founder, Protector, Council Members or Beneficiaries. Typically, a foundation has a specific mission that benefits a group of individuals.

There are 5 main reasons to have a corporation or foundation hold your property.

First the good news: there is no estate tax in Panama. The bad news is that you cannot avoid probate if a property is held under a person(s) name(s). Probate in Panama is conducted in court. This process is usually long and costly, requiring that you hire an attorney to represent you.

In a nutshell, having a will won’t save you from probate, unless your property is held in a corporation or a foundation.

No Right of Survivor-ship in Panama

Be aware that you cannot assume that the laws in Panama are similar to the laws of your home country. For instance, there is no ‘rights of survivor-ship’ in Panama.

That is, if a Panama property is registered under more than one person’s name, it just means that each party owns a share of the total. When one owner dies, the property does not automatically pass to the surviving co-owner(s). In some instances, especially when the co-owners are not married, the deceased partner’s share of the property may end up being passed on to his/her heirs.

This is true even if your co-owner has named you as his heir in his will. This is true even if the will was created in Panama, by a Panamanian lawyer.

However, all of this complexity disappears if the property is held in a corporation or foundation. In this case, it is a simple process to change ownership.

In conclusion, the specter of probate is a good reason to use a corporation or foundation to buy property in Panama. As long as the corporation or foundation’s shares are properly structured, you will avoid probate altogether.

You will often be told that if you want to avoid Panama’s transfer and capital gains tax when buying and selling land, you should use a corporation.

Yes, this is true; corporations don’t pay a title transfer or capital taxes. However, they do pay an equivalent amount in share transfer taxes.

Both the title transfer and capital gains taxes are paid by the seller. Between the 2 taxes, the seller pays a tax equivalent of 5% of the sales price.

However, while a corporation is exempt from those taxes, it must pay an equivalent share transfer tax of 5%.

Either way, you effectively pay the same amount of tax. However, if you sell via a corporation you lose out on getting a refund if it turns out that your capital gain is less than 3% of the sales price.

If privacy is your aim, you need to choose the right type of corporation and structure it appropriately.

To that end, there are 2 types of corporations in Panama, each with a different level of privacy.

International Business Corporation (IBC). An IBC requires at least 3 Directors and 1 or more shareholders who can enjoy participation privacy – for this reason, IBCs are also known as Anonymous Corporations. In an IBC the directors (president, secretary, and treasurer) are all listed in the Public Registry. These roles can be held by you, family members, partners, or by a nominee director service. If you use a nominee director service, you can have a higher level of privacy regarding your participation in the corporation. In addition, the names of the shareholders are kept private and are not publicly listed.

Keep in mind that you cannot maintain anonymity if you plan on getting a mortgage. When you apply for a mortgage, your loan documents will be publicly accessible. Plus the bank will require you to show up at the bank in person before they will approve your loan.

Limited Liability Corporations (LLC). Alternatively, you could choose to form an LLC. LLCs do not offer the same level of privacy as an IBC. If someone searches for a specific LLC in Public Registry records, they will easily discover the names of the managers and partners of that LLC. An LLC requires a minimum of 2 Managers and 2 or more Partners. You are not required to have an equal partner, one partner could only have a 1% share. The names of all the managers and partners must be publicly disclosed in all registration documents. The object here is to provide more transparency. Such transparency is typically a requirement of a partner’s country of origin, rather than a requirement of Panama.

IBCs and LLCs share similarities in that both are legal entities and they both limit a member’s responsibility to his participation as a shareholder or partner.

Highest Level of Privacy

If maximum privacy or anonymity is your goal, you should first create a foundation and then an IBC corporation. The key is to have the private foundation named onto the board of your IBC corporation, so you are not named specifically as a board member. That structure will give you maximum anonymity.

Another benefit of forming a corporation is that you can use your Panama corporation to establish residency under the Friendly Nations program. Creating a corporation is a fast and easy way to help qualify for the popular Friendly Nation visa.

After you receive your permanent residency status, you can terminate the Panama corporation. Maintaining your corporation means that you have to pay annual fees. If you are a US citizen you will also be required to report on the existence of your corporation as part of your tax return, even if your corporation holds zero assets.

Another important advantage of holding your assets under a corporate structure has to do with lawsuits. In the case of someone who attempts to sue you, they would not be able to go after your property since it is not owned by you. Instead, it is in the name of a Panamanian corporation or a private interest foundation.

Of course, there are negative considerations when deciding to create a corporation. I list 4 of them below, including why Americans, in particular, should think carefully before creating a corporation.

You must pay a lawyer to create a corporation or a foundation. After that, you need to pay an annual fee to keep the corporation or foundation active.

The typical cost for creating a corporation is from $1000 to $1500. The government then charges an annual fee of $300 for its right of existence. Additionally, the resident agent might charge his own fee to represent the corporation.

Note: if you feel your attorney is charging too much for this service, you could find an attorney with a more reasonable fee. It is a simple process to change your registered agent. You do not need to feel stuck with a lawyer as your registered agent just because you originally hired him or her to create the corporation.

Over time Panama corporations have grown more expensive and the paperwork associated with owning one has become more demanding.

In recent years, all Panamanian corporations and foundations, even those with no activity, are required to file annual financial statements with their registered agents. The goal of this new requirement is to increase transparency, something that has increased in importance in the aftermath of the Panama Papers.

Potential Paperwork - Esp for US Citizens

As you have probably heard, the IRS is very aggressive about collecting taxes from US citizens with overseas investments and income. Americans (US citizens and legal residents) that file taxes in the US are almost invariably required to file a form 5471 with the IRS. This is required if they are officers, directors, or shareholders in Panama corporations (or in certain corporations in other foreign countries as well). This is required even if the corporation has a net value of zero dollars.

Regardless of your citizenship, you should ask a tax specialist in your home country what reporting and tax requirements apply to owning a corporation in Panama.

If you own real estate that generates passive income (e.g., a rental property) and is registered under a Panama corporation, you could be in for a big tax headache as a US citizen or legal resident. This is true even if it is not passive income, for instance, if you run a business that is held by your corporation.

However, if it happens, if you earn money with a Corporation in Panama, you will be required to file even more forms with the IRS. Keep in mind, all US citizens have to declare as income on all money earned in a foreign country.

Very few Panama attorneys fully understand the tax issues this may cause Americans. And frankly, some don’t much care. They are more interested in the money they make selling you a Panamanian corporation than whether it is the best vehicle for you to hold income-generating property.

So keep all this in mind when your lawyer insists that you need to have a corporation. Remember, you do not need to hold your Panama property in a Panama corporation. And, I repeat, if you are an American, you may not want to hold income-generating Panama property in a Panama corporation.

Talk with your lawyer or tax accountant about other options. Perhaps an offshore corporation in another country, or some other solution that would give you the protection of a corporation, without the tax and reporting requirements.

Perhaps reading this information has prompted you to want to close your Panama corporation. The simplest way to close a corporation is to stop paying its annual registration fees. Eventually, the government will drop the corporation from its records. You can check the status of your corporation by searching via this link.

If you follow the guidelines established for closure by Law 32 of Public Limited Companies, it will still take more than 3 years to close the corporation. What follows is a summary of those guidelines. First, the board of directors of the corporation needs to vote on a dissolution agreement. If they vote in favor, then the shareholders need to vote on it. If they vote yes, then a certified copy of the agreement and the addresses of the directors and officers must be published in a local paper. After all that, the corporation is considered dissolved, but not closed. (Note: No corporation cannot be dissolved until all outstanding debts are made to the Ministry of Economy and Finance of Panama.) The government does not consider the corporation closed until 3 years after that notice is published in the newspaper. Not a fast method.

Given all that, the easiest way to close a corporation is to stop paying your annual corporation fees. Regardless of how you close it, you are not required to pay a lawyer to close your corporation.

The final decision to hold your property in your own name, the name of a Panama corporation, some other off-shore corporation, or a private interest foundation, will depend upon your individual circumstances. A style that is right for one expat in Panama, may not be beneficial to another.

Hopefully, this post has provided you with enough information so you can make the best use of the advice of your lawyer and/or tax accountants.

For some words of caution regarding buying and selling property from a corporation, see this post.

We soak up everything that Lonely Planet, Rosetta Stone and Wikipedia have to offer about our soon to be new home.

In our zeal, we are prone to misgauging our own proficiency.

We are pumped . . . and ready . . . and oh so naive.

Set for swindling.

A big thank you to Jerry of thecultureblend.com. This post is a reproduction of his article, "The Seven Lies of Living Cross Culturally". He expresses the expat situation so well, I wanted to share it with my readers.

There are seven great deceptions and most of us fall for at least five. I have personally tested them all. You know . . . for research.

I lay them out now NOT for the sake of those who are packing up their lives and getting ready to go. That would be like telling newlyweds that marriage is hard.

They just tilt their head and grin at you as if you’re the cute one . . . “yeah, we know it’s hard for everyone else but we’re sooooo in love . . . and it will never, ever be hard for us.” You’re sweet and I would never steal this time from you. Proceed.

But for those of you coming down from the honeymoon (and possibly even some of you veterans) . . . here are seven deceptions which you may or may not have noticed just yet.

It’s perfectly natural when we relocate from one country to another country to focus entirely on those two cultures. Give me a spreadsheet with TWO columns and tell me how our cultures are different.

WE like personal space — THEY don’t.

WE are direct — THEY are indirect.

WE use a fork — THEY use their fingers

BOOM! I got this.

There are tests and inventories and boatloads of brilliant research that can help you size up YOURS and THEIRS. Culture to culture, side by side.

I love that stuff. I could get lost in it but the big reality shocker comes when you realize that living cross-culturally is not simply TWO cultures but it requires MULTIPLE layers of cultural adjustment.

Here’s the kicker — often times the OTHER cultures are more consuming than the one of your host country.

This list goes on.

It’s never just two

Learning a new language is hard. Sure it’s easier for some people than others and no doubt there are gifted learners who seem to have flair for picking it up quickly. The rest of us are . . . what’s the English word?

NORMAL

Regardless, one of the most painful realizations is that a new language doesn’t just grow organically in your brain because you are surrounded by it.

Expats are survivalists first and foremost. We pick up the absolutely essential phrases, we seek out picture menus, we print taxi cards, we download apps and we are shameless masters of hand gestures and charades.

Never has there been a group of people who have worked harder to communicate without learning how to.

In many places, you can be (and you will not be alone) an expat for years upon years and never learn the language. Intentionally choosing the harder option is key.

It doesn’t just happen.

“Culture shock” is a deceptive phrase. The word “shock” insinuates some kind of unforeseen, instant jolt. As if you stuck your fork into an outlet and BAZZZAAAPPP!

“WHOA! Should have used chopsticks! Didn’t see that coming.”

Consequently, when we don’t have the quick sizzle, hair raising, eye-bulging zap followed by the easily distinguishable and obviously dysfunctional meltdown we assume (incorrectly) that we have beat the system. No culture shock for me.

“I am Transition Man! Your culture bolts are no match for my defences!”

But the transition from one system to another system is not a switch that we flip, it is a process that we go through. That process includes the stress of adjusting from the way you have always done it to the way it is now done.

It includes wrestling with knowing, without a doubt that your way is better . . . and then thinking that it probably is . . . and then wondering if it might be . . . and then acknowledging there may be two good ways . . . and then (sometimes) recognizing the new way is better.

For some people, the process is harder, deeper, darker, more dysfunctional. Some people thrive on the instability.

It’s not the same (by any means) for everyone but no one gets immunity.

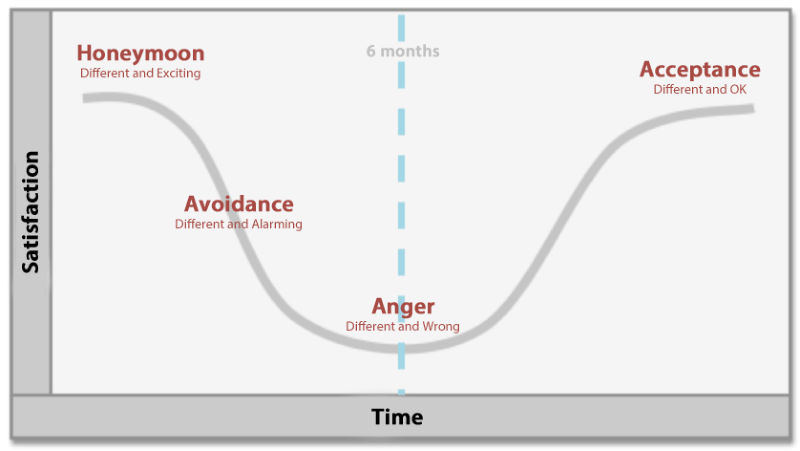

Maybe you’ve seen something like this:

Tools like this are especially helpful when cultural transition feels like puberty. “Why am I feeling like this?! Why am I acting like this?! GET OUT OF MY ROOM!!”

In the complicated, confusing moments of adjustment, charts like this serve as a sweet reminder of a simple yet solid truth.

“I’m normal??. Waaahh, that’s fabulous. But seriously, get out of my room.”

The problem with the standard culture shock continuum is NOT that it is inaccurate. It is that we think it was designed to be more accurate than it is.

“I feel like my transition had more dips than that.”

“I think my dip wasn’t so deep but it lasted longer than 6 months.”

“I don’t think I ever got a honeymoon phase.”

Yes. Yes. Yes. You are spot on. Your transition is yours. It is dramatically different than the next guys and his is different than everyone else. If you are expecting to fit exactly into the right schedule for adjustment you’re likely to slip back into feeling weird or abnormal or dysfunctional or superhuman.

There are too many variables for everyone to have the same transition.

This was mine.

In human years, expats move from 5 to 16 in about two months. Let me explain.

Expats are uber inquisitive on the front end. “What is that? How do you say this? What’s that smell? Why do they do that? What’s the history behind this? Who? What? When? Where? How? Why? Why? Why?”

Like a 5 year old. We embrace ignorance on a quest for answers.

BUT (and this is where it ALL falls apart): We think when we get an answer, we understand it (you should read that sentence again). Soon we “know” (finger quotes) everything.

Like a 16 year old.

When we have answers, we stop asking questions. This can be a fatal flaw for expats. There is ALWAYS more to it.

“Ignorance is not your problem unless you think that you’re not ignorant.”

-Albert Einstein – should have said this

Embrace ignorance and stay 5 for a while.

For contrast, imagine describing the climate of North America as frigid because you spent Christmas day in Northern Canada. Check out Guatemala in July before you share your expertise.

There is always more to it.

This one is doubly deceptive. It sneaks up on you and you never see it coming. There are no instant, clear cut signs, but one day . . . months from now . . . maybe even years, you realize you’ve been duped.

No one is more excited than the honeymooning newbies to engage local culture.

“We’re going to make lots of local friends and study language, learn their customs, and teach them ours. We’ll share cooking lessons and laugh about idioms. It’ll be great!”

Then . . . over time . . . and one interaction at a time, you take the least challenging option.

It’s frustrating to speak a language you don’t know. You don’t connect with these people on sports or politics or food or fun and it feels more like work than friendship.

That’s how the bubble is built.

For clarity let me just say . . . I love the bubble. Some of my best friends are in that bubble and I like hanging out there.

BUT I don’t want to be STUCK inside of it. To live cross culturally and never genuinely experience (deeply) your host culture is a BIG miss. To be surrounded by people who are SO different and could teach you SO much and never find a friend, is a sad thing.

The lie we believe is that it won’t happen to us. However, without tremendous and ongoing intentionality it almost always does.

This varies dramatically depending on who you are and where you are living. It is painfully easy to mistake cultural hospitality for respect and admiration. “These people treat me like a rock star.”

It’s easy to let that misguided reaction go to your head (much like a rock star would). The result is typically tragic.

This is where cultures get abused and foreigners leave a trail of mess behind them. In their arrogance, they assume that they have all of the pieces — “They smile when they see me, they laugh at my jokes, they want to spend time with me . . . they must love me.”

There is always more to it.

Or maybe they love you.

Point is, you can’t know until you stick around and build a real relationship. That’s where the good stuff is. The real stuff.

If you’ve been duped, welcome to the club. Actually you’ve been here for a while, but none of us wanted to say anything. Welcome back from your honeymoon.

This is where it gets good.

In Panama, most foreigners buy property with cash.

Of course, it isn’t usually a cold hard cash payment. Typically it is paid via a cashier’s check or a wire transfer from your bank account.

You don’t really want to pay with a suitcase full of cash, even if you could. It is always a good idea to have a paper trail of all payments made on a property.

There are two primary options for financing property in Panama.

I review those, and some less commonly used financing options, below

Some sellers (like us) offer to finance your purchase of their property. This way you can avoid dealing with a bank or mortgage company. It can be time-consuming for a foreigner to get a bank mortgage in Panama.

Seller financing is a good option for buyers who want to buy a home in Panama but need to sell their current home to pay for it.

In that case, a buyer may want to negotiate terms that include a small downpayment, payments until the house sells (say 3 years), and then a balloon payment at the end of the 3-year term. You can have your lawyer or agent help you with this if you would prefer.

This type of seller financing allows you to secure the property of your dreams and gives you plenty of time for the sale of your original home. If the original home sells earlier than expected, then you get to pay off the balance early. However, you need to ensure that the financing agreement includes a clause stating there is no penalty for early payoff.

For buyers, who have monthly income and some cash-on-hand, but not enough to pay for the property in full, they may ask to structure the financing to pay a larger downpayment of say 30 to 40%, then the remainder in monthly payments over 5 years or so.

Owner financing is a great option for potential buyers who know they want to purchase property in Panama but cannot pay for it fully upfront.

To discover our seller-financing terms, click here.

It is not an easy process to get a mortgage through a Panama bank. It is tedious. And it can take a long time, especially if you are an American.

If you plan to apply for a mortgage, allow for a good long wait before it is finalized and approved. You may get it quickly, although it isn’t likely. However, it will be a wonderful gift if it does happen fast.

The amount of documentation that is required will leave you flabbergasted. God forbid you forget to include a document when you submit your application. Your forgetfulness can bring the whole mortgage application process to a crawl.

Big Developments Can Be An Exception

The exception is if you are buying a property from a developer that already has a relationship with a bank.

These are usually large developments, especially the type that sell property in the pre-construction phase.

In those situations, your loan can be granted in a matter of days. But most property in Panama is not in that kind of development.

You do not have to be a resident to get a mortgage loan

But you do need to be under 75 years of age (see below for more).

In North America, qualifying for a loan is all about your credit history. However, in Panama the banks focus more on your ability to pay and the property’s loan to value ratio.

Because of this dual-focus, Panamanian banks require massive amounts of documentation.

Documents that:

Panama banks will only give loans on land that is:

The following are typical mortgage terms and requirements for foreigners.

I advise you ask multiple times about what documents are needed for your loan application. It is not unusual to submit your documents to the bank only to learn that they forgot to mention one or two other documents that you need to supply.

If you think you will be applying for a loan, you should bring some of these documents with you to Panama. Others you will gather in Panama. Most banks require them. Of course, every bank has slightly different requirements.

Plus Banks typically require all documents (like your bank statements) from other countries to be “authenticated” either through a Panamanian consulate or by “Apostille” which is a globally recognized type of a government certified authentication of public records.

Tip: Getting your documents apostilled is a better way to go than authenticated.

In addition, some banks require that you have a Panama bank account for at least 6 months before you can be given a mortgage.

If you are self-employed, you need to submit even more documents:

Once all the required documentation is in the bank’s hands, it goes to the bank’s credit committee.

The Committee has 14 days to analyze your loan application. Once approved, the buyer gets to review the terms.

If the buyer agrees to the loan, he signs it and returns it to the bank.

The bank then issues an irrevocable promissory letter for the approved loan amount.

The interest rates are generally in line with those offered in the USA. However, interest rates can vary depending upon:

Note, Interest rates are not credit-score driven. If approved for a loan, all non- residents qualify for the same interest rate.

Also, if you have a pensionado visa, you may be able to get a discount on your interest rate.

Panama has a law to help first time buyers, including foreigners, of new homes by subsidizing the mortgage interest rate. If you are looking to buy new titled construction priced between $35 to 120k (after the down payment), you might want to find out more about it.

Items to watch out for in the loan documents include:

How to Pay Less Interest

Here is a tip to help you pay less interest over the term of your loan.

Because of the difficulty in getting a traditional mortgage, many people, especially from the US, go an easier route. This can include developer financing, seller financing, paying cash, or borrowing against your retirement.

You can also get a loan directly with the developer of a property rather than the bank or mortgage company.

This is very common with pre-construction and during-construction developments.

It usually consists of small down payments, small monthly payments, and then a balloon payment once your property is complete.

If a bank is connected to the developer you are purchasing a property from, the loan can be pushed through within days, but only to buy that specific property.

In Central America, there are international banks that will provide mortgage financing for properties located in some other Central American countries.

If you plan to invest in Panama as well as in another Central American country, you may want to develop a relationship with one of these types of banks.

International banks such as Lloyds TSB International will often finance overseas properties in a range of countries. These larger banks will sometimes finance up to 70% of the value of the property.

Sometimes when you cannot get financing for a specific type of property from one sector of the banking community, another will find it more attractive.

List of Banks

Currently (in 2019), there are 67 banks (Regional, International & 2 State-owned) in Panama. Check out this list of Panama Banks maintained by Panamabank.info.

If you have an IRA at a traditional brokerage, you can roll it into a self-directed IRA. Self-directed or self-managed IRAs give you complete control over selecting and directing where to invest your IRA, including real estate.

This includes using your IRA to invest in overseas real estate.

However, this option is not for everyone. You need to be actively involved in managing your IRA and to learn the rules of the self-directed IRA. Also, depending upon how it is used, it may generate taxable income.

Want to learn more? Start by reading this 2019 Guide To Self-Directed IRAs by US News & World Report.

If you make your first investment a cash-flow property, you can use the proceeds to buy or finance future properties.

The CAP rate can be excellent. We know some people in Puerto Armuelles who pay rent of $500/month to an expat who had just bought the rental house for $50,000. You do the math. Even without looking at the CAP rate, the investor is making 12% a year plus appreciation.

Looking for more finance ideas? I brainstormed 18 ways to finance your Panama property. They might inspire even more ideas for your financial situation.

If you want to finance your Panama property, seller financing is the fastest and easiest to secure. However, as you read above, you have other options as well.

In this post, I suggest questions to ask before and during your property search.

First, take your time.

There are plenty of properties available. Don’t feel pressured to make a hasty decision.

Just as in the US or Canada, there are fast-talking, high-pressure salespeople in Panama. Although, in Panama, these salespeople are just as likely to be taxi drivers as realtors.

Before you take a deep dive into a property search, you need to know exactly what you are looking to buy. Take a good look at your needs and determine what you consider non-negotiable.

If you have a clear picture of your ideal property, your search will be faster, more fun, and ultimately more successful.

Specifically, before you buy a property you should determine your ideal property’s where, what, when, and how much.

Consider the following questions to help clarify your criteria for your perfect property.

Panama is a small country, but even so, before you start looking for a property you should narrow down where in Panama you would like to live. It will save you a lot of time and expense.

Here are some questions to help you narrow down your location options:

The point is to make sure the place you are exploring offers the types of activities you enjoy.

Once you narrow down which part(s) of Panama you’d like to consider calling home, you need to visit that area.

Online research is one thing however, exploring a place in person is the real test of whether you will be happy living there.

Keep in mind, it takes time to get a good sense of a place. You need to give yourself some time to explore and get to know an area. Think about what it would be like to live there. To help you do that, I suggest you consider doing the following during your visit

Now that you have a better idea of where you want to live in Panama, it is time to clarify what your ideal property looks like.

Again, you will more quickly find your perfect property if you are crystal clear about your most important property criteria.

Start by asking yourself these questions:

Once you are clear on your ideal property criteria, you can assess if the property you just fell in love with is really “the one”. You don’t want to buy a property only to find out that you were blind to the fact it did not meet a critical requirement on your list of non-negotiables.

Do you have a timeline for when you want to move to Panama?

Ideally, you should start well before that date. It can take time to find a place that resonates with you. And as you will see in the task list below, you need to do more than simply find your ideal property.

When creating your timeline, factor in these tasks.

These tasks don’t have to be done sequentially, you can have them overlap. And of course, some of them can happen after you purchase your property.

Keep in mind that these tasks may take longer than you think. Not only are they unfamiliar tasks, but everything in Panama takes longer than most North Americans anticipate.

Do you have a ball-park figure of what you can afford? Based on your finances, how much can you afford to spend on a property?

Do you need to sell your home or business before you can buy property in Panama? Do you want, or prefer, to take out a loan or use another financing tool?

Mortgages

People commonly think of taking out a mortgage to buy a home. However, obtaining a mortgage in Panama can be time-consuming and at times difficult to obtain. I write about how to get a mortgage here.

Seller Financing

An easier and common financing method that many foreigners use in Panama is seller-fiancing. That is when the seller of the property offers to finance the purchase. For an example, you can check out our seller-fiancing.

Looking for other ways to finance your purchase? A few years ago, I brainstormed 18 ways to finance your Panama property purchase. Not all of the ideas are ideal, however, perhaps they will get your own ideas flowing.

Conclusion

You need to do your homework. Be clear about where and what you are looking for. Then explore the community and property to make sure it is what you want.

Consider the wisdom of renting before you buy. This allows you to fully discover if the weather, the community, the lifestyle of your selected location is right for you.

Already know you want to live in Puerto Armuelles? Check out our beautiful properties for sale.