You need a policy that is a good fit for your age, health situation, location, budget, and any pre-existing conditions you may have.

A broker can help you figure out which health insurance policy is the best fit for you. They can also help you through the application process.

If you find a good broker, they can also be an invaluable help with any future issue you may have with the insurance policy you chose together.

Plus in Panama the information you can find online can only take you so far. Website are not updated as often and as thoroughly as westerners are used to. It really helps to have the personal connection.

I mention 3 recommended insurance brokers. However, I would ask your local friends, and on forums and groups for recommendations as well.

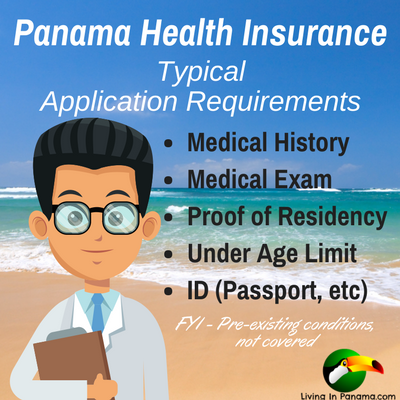

Before you apply, I recommend you review 9 important details about health insurance in Panama. You may also want to read my observations of health care in Panama

The process is generally pretty simple, especially if you use a broker.

Medical records and Spanish Translation. The most time consuming part will obtaining your past medical records. Those records will be examined for pre-existing conditions. You may need to get these records translated into Spanish. Your broker can help you with this. If they require a translation, you should find out if you need a Panama certified translator to translate the documents.

It is best if you turn in all the required documents at one time.

Typically the company's review process takes about 2 - 3 weeks. That is, once all the documents are submitted.

Make sure you fully understand your insurance before you start using it. You should feel confident that you know the following facts about your coverage.

Congratulations. If you followed all these steps, you now have health insurance in Panama.

If you like this post, please like or share it. Thanks.

More and more expats in Panama are choosing international health insurance. One reason is that the local policies have become more limited. More importantly, international health insurance covers you even when you are traveling, offers a wider network of doctors and hospitals, and offers a higher coverage amount.

Typical Limits - International Insurance Policy

Here are some International companies to check out.

Save Money Don't Have USA Coverage

The policies are less expensive if you exclude coverage in the USA. You can include coverage in the USA, but it tends to double or almost double the policy cost.

When traveling to the US, whether you are US citizen or not, you can simply buy travel insurance for the specific time you will be in the States. This works well if you will be in the States for under 3 months. Also, I have heard that the International insurance company, Cigna, allows you to add up to 3 months of coverage in the States for a reasonable price.

For the questions you should ask before you buy insurance, click here.

Hospital-based policies and local HMO-style insurance policies offer coverage only in Panama. If you don't plan on travel much outside of Panama, or are have insurance back "home", it can be a good option. It is generally cheaper. However, most will not accept new applicants after the age of 65.

Typical Limits - Domestic Insurance Policy

If you do decide to go outside the HMO group you are reimbursed for only 60% of what would have been paid to the preferred provider.

If you are over 65, you will have to look into an International insurance company that accepts new applications 66 years old and older.

Here are some International companies to check out.

Don't know if you need health insurance? Ask yourself these 3 health and financial questions to find out.

A Broker's Recommendation.

Cari Collins is an insurance broker I often see recommended on various Facebook groups and forums. I reached out to her and asked for her advice for expats looking for health insurance in Panama. We had a very friendly exchange. And, importantly, she responded to her email and my questions very quickly.

Cari Collins' Advice To Expats

The name of the company I represent is Global Health Insurance. I think the name is a good description of what we provide. Not only is health insurance available but also travel medical, property, auto and life insurance.

For medical, I can represent WEA, Cigna, IMG and VUMI, among others. The policy I feel is the best value is WEA.

The things I like about it that you may not find with other insurance plans here in Panama, are:

So many expats visit the U.S. though. If they exclude the U.S. to save money, they still need coverage for those visits back. In those cases, travel medical coverage is a great solution. You can purchase a policy to cover only the days you are visiting. No medical background is needed because no pre-existing conditions are covered. But it will cover any accident or illness incurred during your visit.

The WEA policy that excludes the U.S. combined with an IMG travel medical policy for visits is a great way to make sure your health care costs are covered and because medical costs are so much less in Panama insurance costs are also significantly less.

Cari Collins' contact information: email: [email protected]. website: www.globalhealthinsurance.com/cari-collins.

Find out how to apply for health insurance in Panama

If you like this post, please like or share it. Thanks.

Panama has had health insurance for over a 100 years. More recently, more insurance companies are offering coverage in Panama.

1) International Insurance. International coverage is a good choice, especially if you travel frequently. The right international policy is also a good stop gap to cover the 2 year wait period before a local policy will cover any pre-existing condition. However, more and more expat are choosing International medical insurance over any of the local insurance plans.

2) Domestic Insurance. These are local HMO-style policies that only cover medical care in Panama. Coverage varies widely, but generally it is between US$300,000 and US$500,000. You are limited to a select group of doctors, hospitals and labs. Go outside the group, and you will only be reimbursed for 60%o of what would have been paid to the preferred provider. When selecting one of these policies be sure to review the list above of factors to consider when selecting insurance.

Panama health insurance companies will not issue insurance until you are living in Panama. You’ll need to prove that you are renting in Panama or have bought a house. And they will have have restrictions about how long you can back in your home country to stay insured. So, you cannot buy insurance in Panama at the much lower price then move back to the United States full time.

3) Domestic hospital discount plan. This is not true insurance. It is a discount plan at a specific hospital. These membership plans give participants hefty discounts on procedures performed at that facility only.

I know people who with the preventative discount plan at the Chiriqui hospital who are very happy with it. However, it is not an insurance policy. It can not be used in a hospital in Panama City for instance. The usefulness of some of these plans may have deteriorated in recent years due to changes in coverage.

4) Tricare insurance. This is only available to US retired military. It is actually not insurance, but a military benefit. From what I hear, Tricare coverage in Panama used to fabulous. However, due to various factors including abuse by consumers, it is more costly and limited. At this time, I am not sure what it covers or where it can be used. Those who qualify to use Tricare can find out more by going to visiting the tricare.mil website

You also may be able to use your current (non-Panama) insurance in Panama, but you will have to check your policy. Some cover some costs at out-of-your network rates. I believe this is particularly true if you have Blue Cross or Blue Shield and go to an affiliated hospital or clinic in Panama.

If you don't want the headache of comparing policies, you may want to use an insurance broker or agent. They can help you select the plan that best suits your needs and budget. I have heard positive things from other expats about these 3 insurance brokers. I have not used them myself.

I recommend you also read my observations and tips about health care in Panama.

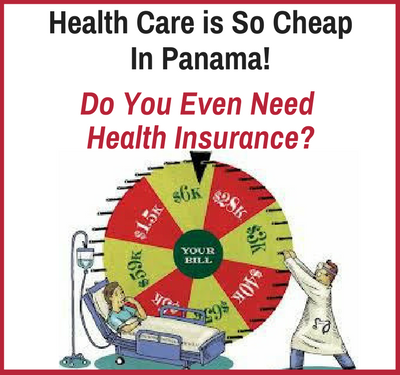

Given the cost of an accident or major surgery, it is smart to get medical insurance coverage. This is particularly true if you are in your early 70s. It becomes very difficult to get insurance once you are 74 years old. Keep in mind, pre-existing conditions are not covered. So you may want to get insurance now, so those conditions are covered if and when they crop up.

Because health care is so affordable in Panama, some people, especially when they are younger, opt not to get medical insurance. If that describes you, you may want to read the 3 things to consider before you decide not to buy health insurance in Panama.

For instance, a typical doctor visit is $10. Total. Although, in a private clinic like Mae Lewis in David, it can be more, 20-$65 per visit depending upon the doctor. If you go to a public hospital, it is only a $1.50 to see a doctor and $10 a day if you are hospitalized.

However, if you need an operation or need cancer treatment or anything major you are going to wish you had insurance. The cost of all those items will be cheaper here in Panama than in the USA (and many other locations), but it will still cost you a pretty penny.

Before you decide not to get health insurance, review these 3 age, health, and financial factors. It will help you decide whether you should get a Panama health insurance policy now, later, or maybe never.

1) Your Age. It is possible to get international health insurance to cover you anywhere in the world at any age, if you’re willing to pay for it. Affordable options, however, become limited to non-existent after age 65, and extremely difficult after age 74. In fact, a desirable policy might not be available at all once you are 75, especially if you want to a local insurance policy.

I am referring in all these instances to the age you are when you initially apply for insurance. Once you have insurance, you can retain it regardless of your age. Although the cost of the insurance will rise as you go from one age bracket to the next.

2) Pre-Existing Health Conditions. No local health insurance in Panama covers pre-existing conditions. International health insurance companies are more likely to cover pre-existing conditions, but not necessarily every type. This is also an age-related consideration. The older you are the more likely you are to develop various medical conditions. If that is likely for you, you may want to consider getting insurance before a medical condition develops. That way any medical condition will be covered immediately as it starts to emerge.

Otherwise, you will have to get insurance and wait 2 years. After 2 years of coverage, most Panama insurance plans will cover all conditions, whether they were pre-existing or not. Which is why some people keep their "home" insurance or get International insurance for 2 years while also paying for Panama insurance. In this way, you are covered for any unexpected and costly outlays for major medical issues due to “pre-existing conditions” or any other gaps in coverage.

3) Access To Cash. Do you have the cash to cover any unexpected major health issue? You can pay the cost of procedures by credit card, but you usually must pay the doctor's fee in cash. You are almost always required to pay a private hospital, in full, before they will perform any major or costly procedure.

If you plan on using Panama's public health care system, you will save money. As I said a doctor's visit is $1.50. In fact, you can visit most doctor's in Puerto Armuelles for only 5 or $10. We have visited to the emergency room in Puerto for only 50 cents. But most expats opt to use the private system, for at least part of their care. The public system tends to have long waits and is limited in what they offer. I did just that went I went to the Mae Lewis clinic about my ankle.

Find out about Panama's 3 Health Care Systems here

Ultimately, whether you decide to get health insurance or not will depend upon your current and expected health & your risk tolerance. If you choose to be without health insurance, you won't be alone. A number of people chose that option in Panama. It is a fine option as long as nothing goes wrong.

You may want to invest in preventive care. We have written up some tips for a healthy lifestyle in the tropics, and ways to both eat well and save money in Panama.

But if you do have a big medical need, you may be forced to return to "home" to use medicare or other health insurance. Or perhaps you will be forced to move from one of Panama's private hospitals to a public hospital if you cannot afford the higher cost of private health care.

However, as you get older and the specter of major health issues starts to raise its head, you may want to rethink your health insurance decision. This is especially true as you enter your 60s and 70s. It becomes harder to get health insurance after you are 65 and extremely difficult to secure health coverage once you are 74 years old. Of course, if you will keep your health insurance back home, that can be a plan B, at least for conditions you can plan your travel around.

Find out more about your health insurance options here.